4 Ways to Bounce Back From a Financial Setback

These financial resilience strategies can help you rebound faster and stronger

(Editor’s Note: This story is part of a partnership between Chasing the Dream and Next Avenue.)

Money is the last thing you want to think about when a traumatic event upends your life.

If you or your spouse has been laid off, your home was damaged by a deadly storm, you’ve had a major unexpected money emergency or were socked by another financial setback, your energy is consumed by grief and shock. Just getting through the next hour, day and week is hard enough. You don’t want to count the cash in your savings account or deal with bills or contemplate whether you can afford to maintain your lifestyle going forward.

That you will need to consider all those money matters, though, is almost inevitable.

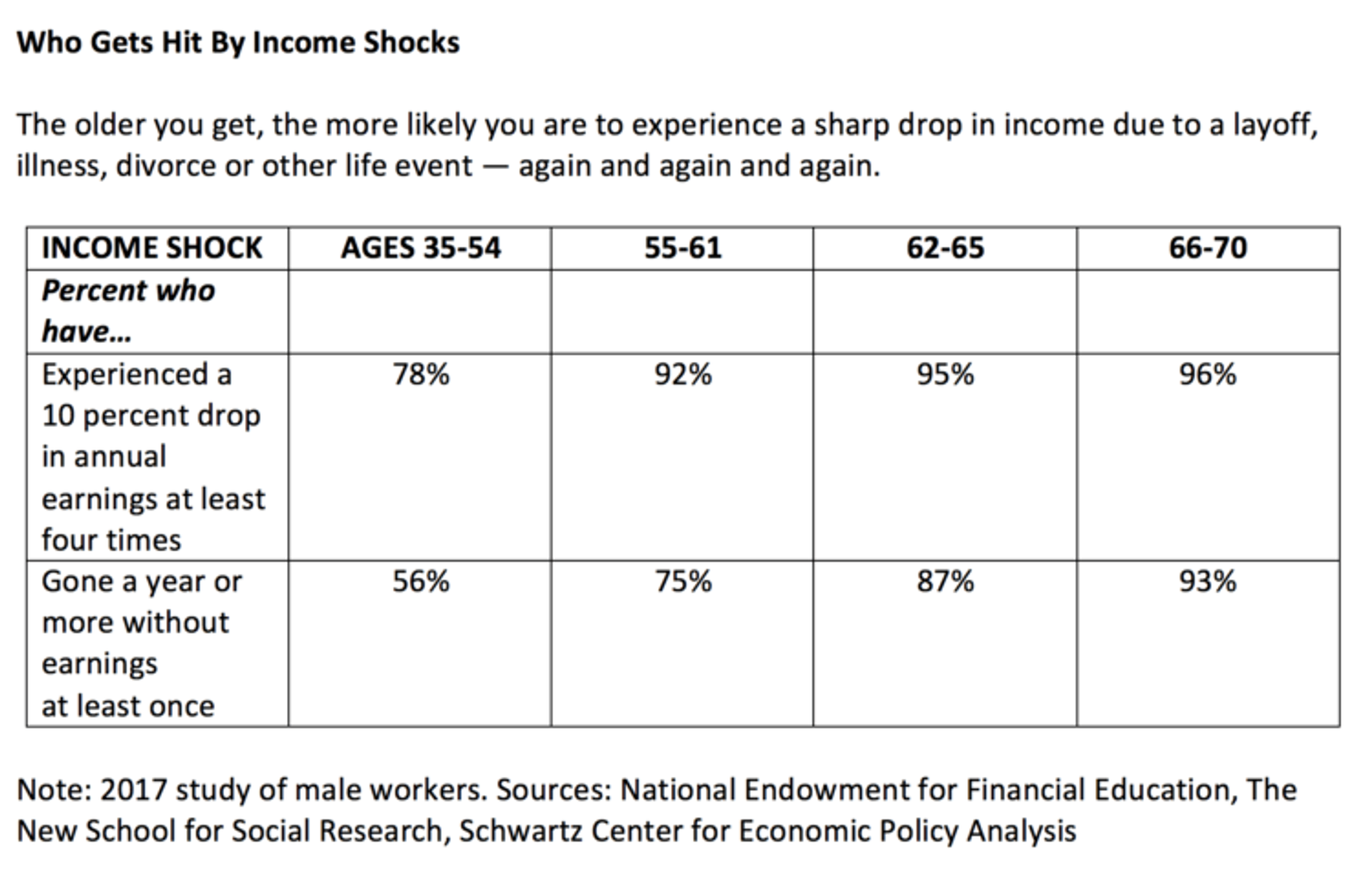

According to a 2017 study commissioned by the National Endowment for Financial Education, by age 70, 96 percent of American men experience four or more major life events — such as a layoff, illness or divorce — that cause their incomes to drop 10 percent or more. Six in 10 male workers go a full year or more without earnings at least once.

That’s why financial resilience — the speed and strength with which you bounce back — is so important. Resilience has become a hot topic lately, in books like Option B by Facebook COO Sheryl Sandberg and Wharton professor Adam Grant, along with a growing body of academic research. But these experts have focused on the emotional aspects of recovery, not your finances.

Of course, the financial part of recovery from a setback and the emotional journey are inextricably intertwined. It’s tough to rebound emotionally if you’re totally stressed out about money.

How can you apply the insights of the emotional resilience movement to the challenges you’ll commonly face after a financial shock? These four strategies can help:

1. Contain the Pain

In the immediate aftermath of a life shock, it’s natural to worry about, say, how you will manage the rest of your life without your spouse’s income or whether you’ll ever find another job comparable to the one you lost. Natural, but not helpful.

Those thoughts are big and probably unanswerable soon after a major life upset. You’re already overwhelmed emotionally; don’t pile on.

Instead, identify the steps to ensure that you can pay your bills and get by for the next few weeks and months. Tackle only those urgent tasks and put everything else on hold.

If you’re a new widow or widower, for example, you may need to contact Social Security, your former spouse’s employer and his or her life insurer to begin the process of claiming retirement and survivor benefits. If you’ve been laid off, filing for unemployment will be a priority.

“Ask yourself, ‘What are the consequences of postponing this task?’” says Barbara O’Neill, a specialist in financial resource management with Rutgers Cooperative Extension at Rutgers University. “Anything needed to generate income can’t wait; most of the rest can.”

Create a checklist of the key action steps or find ready-made versions online (such as this list for new widows and widowers from Vanguard or this one from the financial education nonprofit Take Charge America, about steps to take after a natural disaster).

Doing this keeps you organized, on task and fosters a sense of control, which studies show helps build resilience. Adds O’Neill: “Just crossing items off a to-do list is empowering.”

2. Cut Yourself Some Slack

It’s common to feel that the financial fallout of a negative event is somehow your fault, says Rachel Schneider, co-author of The Financial Diaries: How American Families Cope in a World of Uncertainty and a senior vice president at the Center for Financial Services Innovation.

“People often feel ashamed and alone and that they should be able to manage money problems on their own,” says Schneider. “The sooner you realize you’re probably not at fault and financial setbacks are just part of life, the better off you’ll be.” As the NEFE study noted, financial shocks happen a lot, and not just to you.

And don’t beat yourself up thinking you’d have been okay if only you’d saved more for that inevitable rainy day.

While an emergency fund helps (see my column on how to prep for shocks before they happen here), it’s not a cure-all: A Pew study found that half of families with a savings cushion still found it hard to make ends meet after a financial shock.

And many shock victims continue to struggle a year after the event, Schneider notes. “Embrace that it takes a while to recover, so you don’t blame yourself when you don’t bounce back quickly,” says Schneider.

One more don’t: Don’t let pride stop you from asking for help.

Lenders will often work with you to extend payment schedules on your mortgage and credit cards if you reach out, says Schneider. She note that one in five cardholders at a major company have recently been granted hardship plans as a result of the Hurricanes Harvey and Irma.

“Give lenders that chance to be your partner,” she says. “Often the person at the other end of the phone at the call center has been through something major, too.”

3. Enter the Decision-Free Zone

Big life events are often accompanied by a payout — an insurance benefit, a divorce settlement, a severance package — that can help cushion the financial blow, if deployed wisely. But what’s the smart move when you get one? Should you pay off your mortgage? Start a business? Invest the money in the stock market?

The best answer: None of the above.

Instead, park the cash (minus whatever amount you may need for immediate living expenses) in a money market account or bank CD where it will be safe. Postpone making big decisions with the money until you’ve had a chance to acclimate, emotionally and practically, to your new circumstances.

In her book Sudden Money, Palm Beach Gardens, Fla. financial planner Susan Bradley calls this period a Decision-Free Zone and says it commonly lasts a year, sometimes longer.

The low interest you’ll earn on the payout, Bradley notes, is not as important as protecting yourself at a vulnerable time from making a bad investment that could worsen your financial situation in the long run.

Studies show that dealing with stress diminishes your ability to make smart money decisions. You only have so much mental bandwidth, as researchers term it, and in the immediate aftermath of a tragedy, grief and shock take up much of the room in your brain.

Beware, too, of well-meaning family and friends with advice about how to proceed as well as cold calls from financial pros looking for your business (they come out of the proverbial woodwork at times like these). Suggests O’Neill: “Just say, ‘Thanks very much for the info, but I’m not at a point where I’m ready to make a decision yet.’”

4. Reclaim What Brings You Joy

“The biggest key to long-term recovery after a financial shock is to resize your spending to your new reality,” says Schneider. But while you’re looking for areas to cut back, also pay attention to what you can’t eliminate without a serious deterioration in your emotional well-being.

During the course of a year studying the money behavior of 235 families for her Financial Diaries project, Schneider found that occasional splurges actually helped those struggling after setbacks to maintain an otherwise tight budget and pay down debt.

“Allowing yourself a pocket where you lack discipline apparently makes it easier to be disciplined everywhere else,” says Schneider.

Sure, you may have to find a less expensive version of the thing that gave you joy or replace a big splurge with a smaller one, but don’t think you need to cut pleasure spending entirely. And while the pain of whatever adversity you’re going through will still be with you, you may find yourself enjoying these new pleasures more than some of those in your old life.

“No one would wish for tragic events to happen but, after hardship, people are stronger and often more in touch with what really matters to them,” says Schneider. Though your life and finances may still be challenging, she adds, “in some ways, you may end up richer because of the experience.”

This story is part of our partnership with Chasing the Dream: Poverty and Opportunity in America, a public media initiative created to stimulate a deeper understanding of the impact of poverty. Major funding is provided by The JPB Foundation. Additional funding is provided by Ford Foundation.