How to Invest for Income in a Low-Yield World

With puny, fixed returns on CDs and Treasuries, it's time to look at dividend stocks

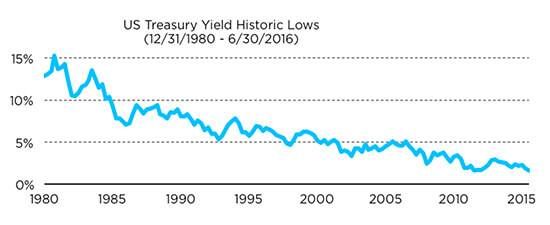

The current low-interest rate environment poses a challenge for boomers and retirees. A 10-year Treasury bond only yields about 1.6 percent, a 5-year bank CD pays a paltry 0.60 percent and bonds will lose value when the Fed raises rates. My suggestion if you’re looking for safe, reliable income: dividend-growing stocks.

The S&P 500’s dividend yield is currently hovering around 2.06 percent —higher than that 10-year Treasury bond. On top of having the potential for dividend yield growth, dividend investors also benefit from the potential for stock price growth.

Stocks With Tempting Yields

To best capture yield, investors are often directed towards companies whose stocks are paying the highest dividends. As of now, that would be the telecommunication services and utilities sectors, with dividends around 4.3 percent and 3.3 percent, respectively.

But that’s not what we recommend at my company, Reality Shares, which specializes in dividend growth investing. We feel the best companies to invest in for dividend income are the ones that are most likely to increase their dividends in the next 12 months.

Dividend investors often pick stocks by looking at past dividend yields and historical dividend performance. They assume that stocks that have consistently grown their dividend will continue to do so in the future. While this might seem smart on the surface, it has many pitfalls in practice.

The S&P 500 Dividend Aristocrats Index tracks stocks that have increased their dividends every year for the past 25 years. Yet, in the past 10 years, 40 stocks that were Dividend Aristocrats actually cut their dividend payout, causing them to be removed from the index. Also worth noting: the prices of stocks that cut their dividends typically fall. What’s more, dividend cuts are generally a signal of low overall corporate health.

How to Choose Dividend Stocks

So how can you better select stocks for dividend income?

At Reality Shares, we created DIVCON®, a dividend health rating system. It uses a forward-looking focus on future dividend growth, rather than a rear-view mirror looking at historical dividend changes. DIVCON forecasts and ranks a company’s ability to increase dividends by evaluating seven quantitative factors. The healthiest companies earn the highest DIVCON scores (DIVCON 5), indicating a strong likelihood they will increase their dividends in the next 12 months. The least financially stable companies are rated DIVCON 1, indicating a likelihood they could cut their dividends in the near future.

While past performance does not indicate future results, in a back-test analysis of our methodology from 2001 through 2015, companies rated in the highest tier of the DIVCON index system increased their dividends 97 percent of the time.

We believe stocks demonstrating dividend growth should do better than the overall equity market, making them strong potential investment candidates.

5 Dividend-Paying Stocks Worth a Look

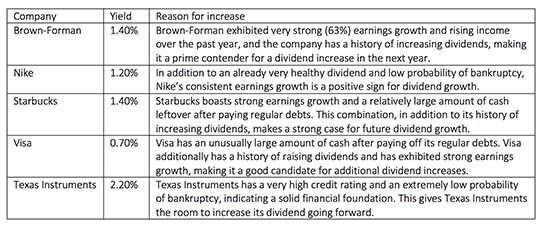

The following stocks are DIVCON 5-rated companies that we believe have a strong likelihood of increasing their dividends before the end of 2016.