How to Choose the Right Medicare Plans

Many beneficiaries make costly mistakes, says this author

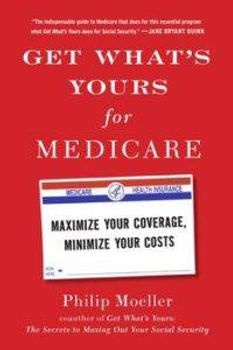

You think Social Security’s rules for claiming benefits are complicated? They’re nothing compared to Medicare, says Philip Moeller, author of the massively helpful new book, Get What’s Yours for Medicare.

“I think Medicare is easily as hard as Social Security and perhaps harder, to the extent that once you make your Social Security benefit choice, you’re by and large done,” said Moeller. “But once you’ve picked your Medicare plans, you’re not done at all. Not only do you need to learn how to use them, but you should evaluate them on a regular basis to ensure you have the best coverage year in and year out.”

With Medicare Open Enrollment starting Oct. 15 (and lasting through Dec. 7), this is an especially opportune time to get wise about Medicare. That’s true whether you’re 65 and about to enroll for the first time; you’re a current Medicare beneficiary and want to make smart decisions for 2017; you’re in your late 50s or early 60s and need to begin learning how Medicare works or you want to help your parents make the best decisions for their Medicare coverage. All of these types of people would find Moeller's book extremely useful, I think.

I recently interviewed Moeller, who is also co-author of the bestseller, Get What’s Yours: The Secrets to Maxing Out Your Social Security, a writer for Money and the PBS NewsHour site, Making Sen$e, and a research fellow at the Center on Aging & Work at Boston College.

Highlights from our conversation:

Next Avenue: How would you rate Medicare in terms of what it offers people 65 and older?

Philip Moeller: I would probably give Medicare a B. Medicare offers a wide range of health insurance options for older and disabled people, but you have to know how to use them. And it doesn’t do such a good job on that.

Also, there are some big holes in Medicare. It does not cover long-term care; many people mistakenly think it does. It does not cover most dental, hearing or vision needs. Almost all people on Medicare need that kind of care and the need for it will only grow as they get older. So in terms of comprehensive care, it has some holes, but compared with other insurance, it’s pretty good.

Do you think most people on Medicare have made the right choices about which type of plans to get?

Wow. I haven’t seen good research on that. I have seen research on whether people take advantage of the open enrollment period to change their coverage, and that indicates only about one in eight actually change plans every year. It’s hard to know whether the other seven-eighths are sticking with the best deal possible.

But research indicates that many Medicare beneficiaries could improve their coverage if they changed it, which makes me believe many don’t know whether they have the best coverage they could get.

You say some people are unpleasantly surprised after they sign up for Medicare Advantage plans — the ones from private insurers that Medicare beneficiaries can sign up for rather than Original Medicare (Medicare Part A and B). Why?

Medicare Advantage plans are pretty inexpensive, but often, they have coverage limits. They’re limited to a particular network of care providers and are only in the geographic area where the plan does business. Original Medicare doesn’t have those limitations for Part A [hospital insurance] and Part B [doctor’s bills]. Switching sometimes go way up for people with Medicare Advantage who then want to get Original Medicare.

Where do you think people make the other biggest mistakes signing up for Medicare?

People make the mistake by assuming someone will look out for them. You’re really on your own with Medicare. There are plenty of resources, but you have to seek assistance yourself.

You don’t recommend asking friends which Medicare plans they have to make your choices. Why not?

People often ask their friends, ‘What’s the best plan?’ I understand that, but your friend’s health needs might not be the same as yours, and your friend’s financial profile might not be the same for you.

Should both spouses of a married couple get the same Medicare plans?

Not necessarily. People are used to getting family coverage at work. There is no family coverage for Medicare. You and your spouse need to get separate plans and you need to realize that the two of you don’t have identical health profiles. So you could both do much better financially and get better coverage if you got different Medicare plans.

You say just choosing when to enroll in Medicare can lead to mistakes, right?

Yes. Medicare enrollment periods can be confusing. They can differ depending on when you retire and by different types of Medicare. You really need to understand the signup windows so you’re not pressured to make a decision at the point of a gun, figuratively speaking.

The classic eligibility period is when you’re retired and enroll at 65. You actually can do it three months before you turn 65 and up to three months after you do. If you keep working past 65 and retire later, you have eight months to enroll once you do retire. Then there are separate enrollment periods for Medicare Part D prescription drug plans, for Medigap supplemental insurance plans and for Medicare Advantage plans.

If you lose your employer health care and then get COBRA [employer-based group health insurance you can keep for 18 months after losing a job] and turn 65, the Medicare enrollment window clock starts ticking at age 65.

You say that many people on Medicare pay more money for coverage that may be inferior to what’s available at a lower cost. Why does that happen?

Because during the course of the year, a health plan can change its terms. If you don’t pay attention, you can wind up paying too much.

For example, if you have a Medicare Advantage plan and it reduces the participants in its provider network and you don’t know it, you could wind up re-enrolling and paying out-of-network costs for some doctors. Even if your plan stays the same, your health needs may change.

Can you switch Medicare plans anytime if your plan changes?

That can be a gray area. If the plan makes a really substantial change in its provider network, it’s supposed to alert you and give you an opportunity to make accommodations. In limited cases, Medicare has ordered plans to open enrollment during the year and let people change. But it hasn’t happened much.

Every year, by the end of September, private plans are supposed to send out an annual notice of change and explanation of benefits. That should be an early warning system about whether you should do something during open enrollment.

Many people are confused about whether to sign up for Original Medicare, a Medigap plan and a Part D prescription drug plan or to instead sign up for a private Medicare Advantage plan with a Part D prescription drug plan. What’s your advice?

There are several issues. One is money. Original Medicare is going to be more expensive. Medicare Advantage is going to be less expensive and it often covers things that Original Medicare does not; some of these plans have vision, dental and hearing coverage. Some have zero premiums for people of modest means.

But you also need to look at your health care needs and lifestyle preferences to make a decision. If you travel a lot or you’re a snowbird, Medicare Advantage plans often won’t cover you when you’re out of your geographic area.

Medigap is a different animal than the rest of private insurance policies: It’s regulated by the states and has a six-month window that guarantees you access and you can’t be charged more due to a pre-existing condition. Once you’re through that initial window, those protections can go away in some states.

Is there much danger that a doctor won’t accept Medicare?

Anecdotally, all I hear is how unhappy doctors are with Medicare and with medicine. The implication is they are leaving, or will leave, Medicare. But that really hasn’t happened. Medicare is still accepted by almost all practicing physicians.

Medicare.gov has a tool on its site on which physicians accept it in your ZIP code.

You write that there are more than 2,000 Medicare Advantage plans and the average consumer has 19 to choose from. How should someone do it?

I like to send people to Medicare’s Plan Finder site. You can look at plans in your area and see what the premiums and co-pays are to get an idea what your out-of-pocket expenses are going to be.

I urge people to do this with Part D prescription drug plans, too.

What do you think of the star ratings for Part D and Medicare Advantage plans?

I urge people to look for 4- and 5-star plans. That can be helpful in terms of making a difficult decision easier. We’re seeing fewer and fewer low-rated plans; Medicare doesn’t like them. And a 5-star plan can enroll new members 51 weeks of the year. If you have a 4- or 5-star plan, you can usually assume it will have that rating next year.

Who can people talk to for help understanding Medicare?

Your State Health Insurance Assistance Program, or SHIP. These programs have 15,000 trained volunteers who can walk you through the general steps. They’re not supposed to tell you if a Humana plan is better than an Aetna plan for you. But they can explain what Medicare covers and can help you if you have a problem with Medicare.

You say that some Medicare beneficiaries could see their Part B premiums jump by about 20 percent next year. Who are they and why so much?

This wouldn’t affect 70 percent of Part B beneficiaries. But some higher-income people and people who haven’t filed for Social Security but receive Medicare might see those premiums go up a lot due to a quirk in the law related to Social Security Cost of Living increases. Last year, the people affected saw their premiums go up by 16 percent. This year, it depends whether Congress will step in at the 11 hour.

You feel strongly about Medicare and end-of-life care issues. Why?

Yes, I urge people to think about the kind of health care they want at the end of their life and the kind of medical treatment they want in terms of whether they’ll want heroic efforts to save their lives. These decisions need to be made well in advance of a health care emergency.

Medicare has a great hospice program. And it has started paying physicians to have end-of-life discussions with beneficiaries. We absolutely need to do this.