Why Older Adults Are So Susceptible to Financial Fraud

Research suggests that changes in our brains as we age may be a key factor

Innovations in technology, medicine and public health have resulted in longer life spans for Americans. In 1950, the average American could only expect to live to age 68; the average has since jumped to 78. Longer life spans have led to a burgeoning older adult population, in sheer numbers as well as in percentage of the population. In this regard, we can count aging as a true success story.

Yet the significance of the older adult generation lies not only in its size but also in its economic power. Older boomers are wealthier than the generations before them, with a median net worth of $241,333, a 34 percent increase over that of the War Babies generation (born 1936 -1945) and a 39 percent increase over Depression Babies (born 1926-1935). Older adults also represent greater purchasing power. Nielsen reported that the 50+ population consists of nearly 100 million consumers who are responsible for $230 billion worth of sales in packaged goods, a whopping 49 percent of total sales. As AARP spokesman Jody Holtzman commented, “You’d have to be an idiot to turn your back on this humongous market.”

Pitfalls of Prosperity: Financial Fraud Scams

Con artists, scammers, and other perpetrators of financial fraud and abuse are clearly not idiots, however. In 2010, one fifth of Americans over age 65 reported in a telephone survey that they had been subject to some sort of financial fraud or abuse. And it is not only wealthy seniors who have attracted scammers’ eyes. Most studies show no link between income and prevalence of financial abuse. As Cindy Hounsell of the Women’s Institute for a Secure Retirement (WISER) explained “[older women] feel badly they have nothing to leave [their relatives], then someone calls up and says, ‘You just won!’ They all say the same thing – that’s why [these women] fall for it.”

Trust, Vulnerability and the Aging Brain

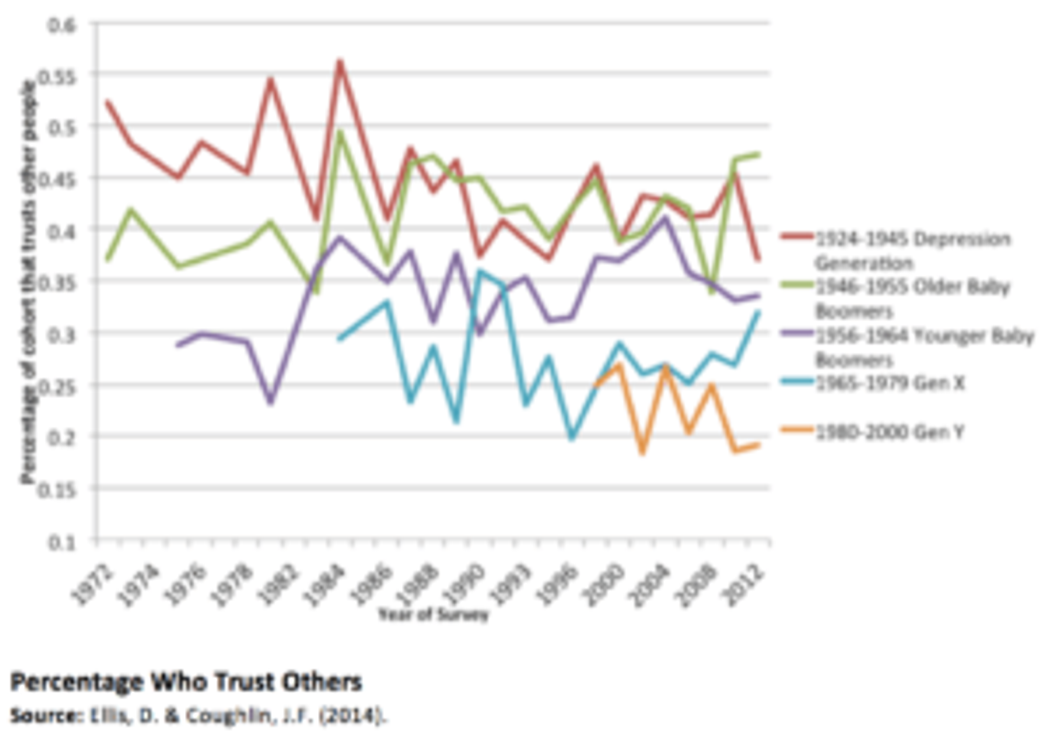

Why do older adults seem to be particularly vulnerable to financial abuse and scams? Part of the answer may be that they seem more trusting than other age groups, in general. When asked in a MIT study, “Do you feel that most people can be trusted?” boomers gave the highest percentage of “Yes” answers.

Higher levels of trust among older adults may have something to do with actual changes in the brain.

In a UCLA study, participants were shown faces that had cues as to their trustworthiness or untrustworthiness. Older participants perceived the untrustworthy faces as significantly more trustworthy and approachable than younger participants did.

Interestingly, when viewing these untrustworthy faces, older participants also showed less activation of the anterior insula, a part of the brain known to support interoceptive awareness, or what is commonly called a “gut feeling.” These gut feelings warn of potential risks or dangers, such as an untrustworthy person. Decreased activity in the anterior insula portion of the brain in older adults may suggest that their awareness or assessment of risk is not as strong as that of their younger counterparts, which in turn may contribute to a greater vulnerability to fraud and scams.

This phenomenon may also be related to what researcher Laura Carstensen calls the “positivity bias,” or the tendency to devote more attention and memory to positive information in general. This is another common occurrence among older adults.

Ignoring Warning Signs

Also related to changes in the brain, this bias seems to exist to help keep older adults’ moods and morale high. Yet despite these potential benefits, this bias can have perilous consequences for their financial security, leading them to ignore warning signs such as the aggressiveness or insistence of a telemarketer and to focus instead only on the potential rewards or profits they promise.

Another possible explanation for older adults’ increased vulnerability to fraud may be that financial capacity itself seems to decline with age. Some research has found that older adults are significantly worse at financial decision-making than their younger counterparts, with one study even suggesting that financial literacy scores decrease by 1 percent each year after age 60.

Another study found that although financial capacity seemed to decline with age, financial confidence did not: essentially, individuals still had faith in their own financial abilities even while they were eroding. This lack of awareness of their changing financial capacities could also put older adults at higher risk for financial fraud or abuse.

Further, if they are unaware of their own shortcomings, they might see no reason to be more cautious about money, to monitor themselves or to question their own decisions to ensure that they are financially sound.

It is easy to see how all these factors could combine, resulting in an individual who is both overly trusting of others and overly confident in his or her own declining financial capacity: a perfect target for scams and financial abuse.

Solutions and Next Steps

It is important for older adults and their families to put into place early comprehensive financial plans that incorporate decisions about health care, future housing options, asset management, and contingencies to account for any possible financial incapacity (such as power of attorney arrangements, living trusts, or financial advocates). Doing so can help avoid any uncertainty or confusion that might expose older adults to a greater risk of exploitation or fraud.

There are also a few useful technological weapons for combating fraud that have surfaced in recent years. Services such as these may be suitable for some older adults and their families:

Financial advisers, older adults, and families should assess services such as these to determine if they are a good fit for their individual situations.

Yet even as these solutions to combat elder fraud continue to grow and improve, so will the tricks and contrivances of people who would seek to defraud and steal from older adults. That’s why older adults, family members and financial advisers must work together to keep seniors informed about ways to keep their money and financial futures safe.

The MIT AgeLab Website has more tips and resources to help prevent seniors from falling victim to financial abuse.