The Best and Worst U.S. Cities to Retire (Perhaps)

Bankrate's intriguing list leaves out one key measurement

The popular personal finance site Bankrate.com is out with its first-ever list of The Best (and Worst) Cities to Retire. But whether you’ll agree with its choices depends on how you expect to retire.

Bankrate ranked the best states to retire in March. Now it’s back with a list comparing 172 U.S. cities, big and small. (In some cases, Bankrate lumped together nearby cities as one location because the data was so similar, which might rankle, say, the residents of Rochester, N.Y., who are now effectively Buffalonians.)

“When you do a state ranking, the weakness is that a state’s urban and rural areas are taken together,” says Chris Kahn, Bankrate’s research and statistics analyst, who’s based in Brooklyn, N.Y. “It’s like saying the retirement experience in Manhattan is the same as in the Finger Lakes in upstate New York. This time, I wanted to drill down further with a cities list, which is much more challenging to do.”

Top 10 Cities to Retire

Bankrate’s 10 Best Cities are mostly in the South, with a heavy Arizona presence (see a slideshow at the end of this blog post for details about them):

1. Phoenix, Ariz. (including Mesa and Scottsdale)

2. Arlington/Alexandria, Va.

3. Prescott, Ariz.

4. Tucson, Ariz.

5. Des Moines, Iowa

6. Denver, Colo.

7. Austin, Texas

8. Cape Coral, Fla. (including Ft. Myers)

9. Colorado Springs, Colo.

10. Franklin, Tenn.

“Arizona cities dominated the list for a few reasons,” said Kahn. “They have really nice weather, especially in the winter; they’re in one of the lower-taxing states in the country and residents of Phoenix, Prescott and Tucson gave their cities good well-being scores.”

Arlington and Alexandria, Va., made the Top 10 for completely different reasons. “The state has very good health care and the area got high marks for walkability and a low crime rate,” said Kahn. “The knock on Arlington and Alexandria is the high cost of living.”

Des Moines was “the biggest surprise,” said Kahn. “The cost of living is extremely low and there’s a really good health care system. Des Moines also had high well-being scores.”

10 Worst Cities to Retire

The 10 Worst Cities to retire, according to Bankrate, are mostly in the Northeast:

172. New York, N.Y.

171. Little Rock, Ark.

170. New Haven, Conn. (including Stamford, Norwalk, Bridgeport and Milford)

169. Buffalo, N.Y. (including Rochester and Niagara Falls)

168. Newark, N.J.

167. Albany, N.Y. (including Troy and Schenectady)

166. Hartford, Conn.

165. Oakland, Calif.

164. Indianapolis, Ind.

163. Cleveland, Ohio

“New York City was at the bottom of the list for the same reasons New York State was in our other ranking,” said Kahn. “Although it’s a great place for a lot of things — it has great museums and is the most walkable city in the country and the crime rate is low — it has a high cost of living and high tax rates.”

Plus, he added, there’s the winter weather, which also hurt scores for New Haven, Buffalo, Newark, Albany and Hartford.

Little Rock came in next to last because of its “below-average health care system, high taxes, high crime rate and weather,” said Kahn.

How the Ranking Was Done

Bankrate ranked the cities on criteria in seven categories, each weighted equally:

- Weather (the more moderate the temperatures and fewer the snow and rain storms, the better)

- Health care quality (state scores from the U.S. Agency for Healthcare Research and Quality on roughly 160 health-related issues)

- Cost of living

- Tax rate

- Crime rate (the FBI’s property and violent crime statistics)

- Well-being (using data from Healthways, a wellness company, on what people 65 and older say about community satisfaction, pride and happiness)

- Walkability (WalkScore.com’s measurement of how easy it is to get around without a car)

What Wasn't Included

What surprised me was that Bankrate didn’t factor in the job market and the local economy.

After all, 67 percent of workers plan to work for pay in retirement, according to the 2015 Retirement Confidence Survey of the Employee Benefit Research Institute. And other best-places-to-retire surveys, such as ones from Forbes and the Milken Institute, include an area’s economic strength in their rankings. (Milken calls its list The Best Cities for Successful Aging, so it’s not technically a list of best places to retire.)

“Retirement to us meant not working,” said Kahn. “Maybe we will include the local job market and the economy the next time.”

Best States vs. Best Cities

Another oddity: the striking differences between the areas showing up in Bankrate’s Best States to Retire and its Best Cities to Retire. Six of the Top 10 Best States weren’t represented in Bankrate’s Top 10 Best Cities list. So although Wyoming, Utah, Idaho, Montana, South Dakota and Nebraska are among the nation’s best states to retire in Bankrate's eyes, none of their cities took top honors in the site's new list.

That’s because Bankrate used different data sources for the two lists and because some cities score better or worse than the states they’re in on the same criteria.

If you are considering relocating for retirement, it’s worth noting that only two of Forbes’s 25 Best Cities to Retire (Colorado Springs and Tucson) and only one in the Milken Institute’s Best Cities for Successful Aging (Des Moines) are in Bankrate’s Top 10.

To me, this goes to show that different criteria and weightings can produce vastly different lists. It also speaks to the importance of not moving anywhere for retirement based wholly on any one list you see. Here's a slideshow of Bankrate's Top 10:

1 of 10

10. Franklin, Tenn.

Only 20 miles south of Nashville, Franklin is experiencing a revitalization. It’s also a relatively affordable place to live, ranked 52nd out of 308 metro areas for cost of living by The Center for Regional Economic Competitiveness. Tennessee also has no state income tax and has the sixth lowest tax rate in the nation, according to the Tax Foundation. FBI data show that in 2013, there wasn't one murder in the entire city of Franklin.

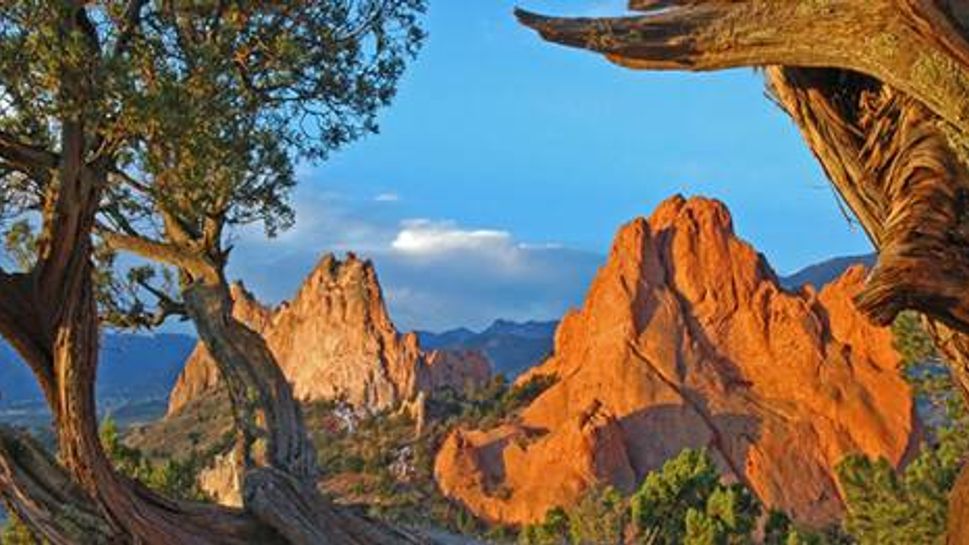

9. Colorado Springs, Colo.

For retirees who love the outdoors, Colorado Springs has a lot to choose from, especially in the nearby Garden of the Gods Park and Pikes Peak. The federal Agency for Healthcare Research and Quality says Colorado enjoys above-average health care and Colorado Springs residents age 65 and older have expressed a strong sense of well-being and enthusiasm for their surroundings according to the Gallup-Healthways Well-Being Index.

8. Cape Coral, Fla. (including Fort Myers)

Located on Florida’s west coast, Cape Coral bills itself as a "Waterfront Wonderland," with more than 400 miles of navigable waterways. With so much to do, it's easy to see why residents 65 and older gave the Cape Coral-Fort Myers area the fifth highest well-being score, according to the Gallup-Healthways Well-Being Index. Despite a fair amount of rain and the occasional hurricane, its relatively warm year-round temperatures make it a welcome destination for retirees from the Northeast. Cape Coral’s crime rate also is well below the national average.

7. Austin, Texas

Breakfast burritos, brisket and queso — the capital of Texas has all the fixins if you want to eat your way through your golden years. Summers can be muggy, but the city makes up for that with plenty of outdoor escapes, including miles of trails, bike paths and parks. Texas residents also benefit from the absence of a state personal income tax and the overall state and local tax burden is the fourth lowest in the country, according to the Tax Foundation. The Gallup-Healthways Well-Being Index also gives the area high well-being scores for people 65 and older. Monthly rent runs around $1,037, more than the national average of $919 but cheaper than Houston’s $1,427.

6. Denver, Colo.

Residents love the community in the shadow of the Rocky Mountains. Many locals spend their weekends hiking or skiing; Vail is only a two-hour drive away. The cost of living is a little high compared with the national average, but Denver’s crime rate, walkability and weather rank favorably. The Tax Foundation says Colorado places a lower tax burden on residents than the national average and the state has the 13th best health care system in the country, according to the Agency for Healthcare Research and Quality.

5. Des Moines, Iowa

This just might be the best place you never thought of for retirement. Not only is it home to an increasingly vibrant downtown, Des Moines also is a great jumping-off point for the outdoors, with more than 600 miles of trails. Iowa has America's sixth best health care system, according to the Agency for Healthcare Research and Quality. And like much of the Midwest, the cost of living is relatively low.

4. Tucson, Ariz.

If it's the outdoors you love, consider Tucson, which is surrounded by five mountain ranges, flowering deserts, hundreds of miles of trails and the southernmost ski area in the U.S. Southern Arizona is slightly cooler than Phoenix to the north, and you'll rarely need to stay inside because of a rainy day. The Gallup-Healthways Well-Being Index ranks the area in its top 20 of 105 metro areas for senior well-being. The cost of living is relatively modest, too; the average home price is around $250,000, below the $305,838 national average. Plus, Arizona places a below-average tax burden on residents, according to the Tax Foundation.

3. Prescott, Ariz.

Welcome to everybody's hometown. That's the motto of this quaint city, located about two hours north of Phoenix and where Phoenix residents visit to escape the sizzling summer heat. Prescott is also more laid-back, with less traffic and a "know-your-neighbor" vibe. The Gallup-Healthways Well-Being Index gives Prescott high marks for well-being; residents 65 and older are generally happy with their surroundings. Prescott gets a fair amount of rain, but winters are mild and the average August temperature is around 72 degrees.

2. Arlington/Alexandria, Va.

Typically associated with America's most famous cemetery, retirees have more to do in Arlington than visit Civil War tombstones. There are more than 100 miles of trails, bike lanes and routes, so it's not surprising that residents embrace a healthy lifestyle and rank the area high on The Gallup-Healthways Well-Being Index. Arlington has a low crime rate, and Arlington/Alexandria locals can get by without a car due to ample public transportation. Virginia also has one of the better health care systems in the country. And its tax rate is more favorable than the national average, according to The Tax Foundation.

1. Phoenix, Ariz (includes Mesa and Scottsdale)

Mild winters and dry climate aren't the only reasons why the Phoenix area topped the Bankrate.com list. According to The Gallup-Healthways Well-Being Index, it ranks among the nation's best in terms of overall well-being for people 65 and older. The cost of living is relatively low, too, and The Tax Foundation says Arizona has one of the lower overall tax burdens in the country. Also, the Phoenix/Mesa/Scottsdale area is home to many cultural attractions, parks and golf courses. Phoenix struggles with crime, however, like many other big cities.