The Dicey Retirement Gamble Americans Are Making

Unsettling findings in the mother of all retirement surveys

It’s appropriate that the Employee Benefit Research Institute’s (EBRI) 2016 Retirement Confidence Survey was just released during the American Society on Aging’s annual Aging in America conference I’m attending in Washington, D.C. Unfortunately, from my reading of the survey, workers are far more confident about their prospects for aging into retirement than they have a right to be.

The 39-page EBRI report — viewed by journalists as the mother of all retirement surveys because of its depth and rigor — is laden with fascinating, revealing data about how workers feel about retirement and what they’re doing (or not doing) to prepare, as well as how retirees say retirement is going for them. For its 26th annual survey, EBRI interviewed 1,000 workers and 505 retirees in January 2016.

Rising Confidence About a Comfortable Retirement

A key finding: The percentage of workers who are “very confident” about having enough money for a comfortable retirement has ratcheted up from 13 percent in 2013 to 21 percent this year, essentially plateauing from 22 percent in 2015, after sinking to record lows between 2009 and 2013. Similarly, those saying they’re “somewhat confident” have risen to 42 percent from 36 percent in 2015. Altogether, 63 percent are now confident they’ll have enough for a comfortable retirement.

But Jack VanDerhei, EBRI’s research director and co-author of the study, told me many workers who haven't been saving enough are making a “particularly risky gamble.” Essentially, they’re deluding themselves into believing that, as Bob Marley sang, Every little thing gonna be alright.

Start with the fact that plenty of workers are not saving very much — if they’re saving at all. The percentage saving for retirement actually peaked in 2009. Currently, just 63 percent of workers and/or their spouses are saving for retirement. (It's the “cholesterol” syndrome: Remember when Americans were manic about lowering their cholesterol in the '90s? That craze has cooled, as has the fervor for boosting retirement savings.)

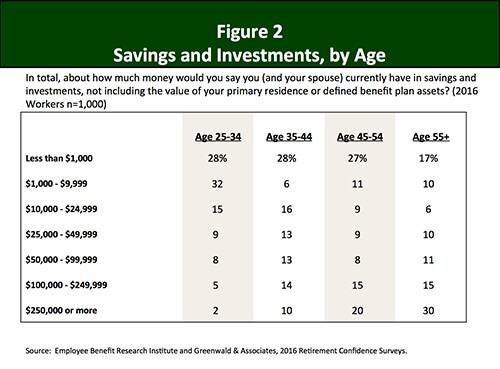

42 Percent With Less Than $10,000 Saved

In this year's EBRI survey, roughly four in 10 workers —42 percent — said they and their spouses have less than $10,000 in savings and investments; 27 percent of those age 55+ (in fairness, however, another 26 percent have saved $100,000 or more). Of those without retirement plans, a stunning 83 percent have saved under $10,000, which makes a pretty strong case for requiring all employers to offer all employees retirement plans, either through a federal or state program.

Now add to all this the report’s finding that “many workers acknowledge their savings shortfalls for retirement, stating they need to save a sizable, perhaps unmanageable [italics mine], share of their total household income in order to live comfortably in retirement.”

Specifically, 39 percent say they need to save at least a fifth of their income to retire comfortably. And how do the workers who say they’re putting away less than necessary plan to right their retirement ship? Well, 20 percent say they’ll need to save more later; 15 percent say they’ll need to work in retirement; 14 percent say they’ll need to retire later and 13 percent “don’t know what the impact will be.”

VanDerhei’s translation: “Better than one in four either have no idea what they’ll do or they’re just hoping they can, in essence, defer the pain.”

That echoed what Carla Dearing, CEO of the new financial planning service for women SUM180 told me she has been learning interviewing women about retirement. “They say: ‘There’s the weekly groceries and I have to take care of the kids and my aging parents, so this awful thing — retirement — is something I’m just not going to pay attention to,’” said Dearing.

Mismatch on Working in Retirement

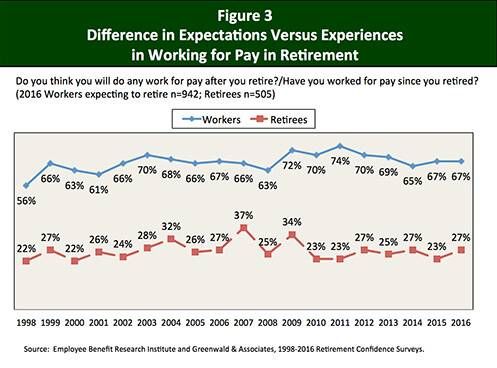

VanDerhei was particularly concerned that so many workers believe working part-time in retirement will be their financial salvation.

“Given that every year we find that 50 percent of retirees had to retire earlier than they wanted, usually because of their health or their spouse’s health, I view that as a particularly risky gamble,” he said.

In the EBRI survey, roughly two-thirds of workers (67 percent) said they expect to work for pay after they retire. But just 27 percent of retirees actually do. Similarly, 37 percent of workers said they expect to retire after 65 (up from 11 percent in 1991), but only 15 percent of retirees actually did.

It’s possible, however, that more Americans truly will work past 65 in the future, because they’ll stay healthier than today's retirees did and they'll be more emphatic about holding part-time jobs. “As we go more from blue-collar to white-collar jobs, people will have an easier time physically continuing to work beyond 55,” said VanDerhei. “It comes down to whether they’ll have the necessary job skills.”

Reality Check on Retirement Expenses

Another risky gamble of workers, according to the survey: underestimating their future retirement expenses.

Just ask current retirees about this: 38 percent of them told EBRI their expenses in the early years of retirement were higher than they’d expected. A recent Ameriprise survey backed that up, with retirees noting they underestimated the costs of food, taxes and health care.

And that leads to one more gamble some workers are making: an increasing confidence about their ability to pay for medical and long-term care expenses in retirement.

This year, 22 percent of respondents in the EBRI survey felt "very confident" about being able to pay for medical expenses in retirement, up from 12 percent in 2011; 16 percent felt that way about long-term care expenses, nearly double the 9 percent statistic in 2011. “I think far too many people still believe Medicare will cover long-term care,” said VanDerhei.

But when EBRI asked retirees if they thought they'd be able to shoulder these costs, just 42 percent felt very confident about having enough money to cover medical expenses and only 26 percent felt that way about long-term care expenses.

Women's Retirement Fears

Women may be more realistic than men — and more frightened — about long-term care and medical costs in retirement, according to another new survey, done by Nationwide.

When Nationwide surveyed women 50 and older, 78 percent were concerned about having enough money to cover long-term care expenses. Yet 62 percent of the women interviewed said they hadn’t talked to anyone about long-term care costs.

“They don’t discuss it with their family because they don’t want to worry their family,” said Shawn Britt, director of long-term care initiatives, advance consulting group at Nationwide. “They should talk with their spouses and their children about what they want and how to make that plan happen.”

Also, 64 percent of the women told Nationwide they were “terrified” of what health care costs may do to their retirement plans. “A lot of them don’t understand how all the health programs work,” said Britt. “Seventy percent of women told us they wish they understood Medicare coverage better.”

Not Confident About Retirement Planning

EBRI found many workers wish they understood how to plan for retirement better, too. Only 30 percent of workers said they’re very confident in their ability to do a good job planning for retirement. By contrast, 63 percent said they’re very confident in their ability to prepare a budget.

“Workers are so paranoid about all the things they have to consider for retirement planning — how much to contribute, where to invest, when to retire, whether to annuitize, what’s the best withdrawal strategy,” said VanDerhei. “The list just goes on and on.”

Yes it does. Retirement planning isn’t easy and it can’t be done well quickly. That’s why it’s a good idea for workers to hire sharp Certified Financial Planners. “Making the right decisions with them will more than pay for their services,” said VanDerhei. I agree.

Failing that, at the very least, you should spend some time using free online retirement-planning tools to see if you’re on track. Sadly, EBRI found, only 48 percent of workers and/or their spouses have ever tried to calculate how much money they’ll need to have saved to live comfortably in retirement. (For some excellent retirement calculators, check out the ones recommended by Walter Updegrave on his RealDealRetirement.com site.)

One new online tool, if you dare: Riskcalculator.org, from professors Mark R. Rank and Thomas A. Hirschl, authors of Chasing the Retirement Dream: Understanding What Shapes Our Fortunes. It lets you see your chances of experiencing poverty in the next five, 10 or 15 years.

My advice based on the 2016 EBRI Retirement Confidence survey: Don’t gamble away your retirement. The stakes are too high.