The Truth About Social Security's Solvency and You

What's ahead, what the candidates say, and a forecast for Medicare

Social Security’s recently released 2016 Annual Report of the Board of Trustees on the system’s financial condition is 272 pages long and a doorstop. The report is dense, full of detailed tables and conservative projections — a policy wonk's dream. The dry recitation of numbers in its opening sentences are a powerful reminder, however, of just how critical Social Security's combined Old Age and Disability program is to Americans. Last year, the program paid benefits to some 60 million people, comprised of 43 million retired workers and their dependents, 6 million survivors of deceased workers and 11 million disabled workers and their dependents.

And here's why you should care: The bottom-line message from the 2016 Trustees report for current and future Social Security beneficiaries: Social Security isn’t running out of money. (That will be good news to the 68 percent of future retirees who worry Social Security will run out of money in their lifetime; that figure is based on a recent Nationwide Retirement Institute survey.)

It's Not Going Bankrupt

Social Security isn’t bankrupt. Social Security will be there when it’s time for younger boomers, Gen X'ers, Millennials and younger generations to file for benefits.

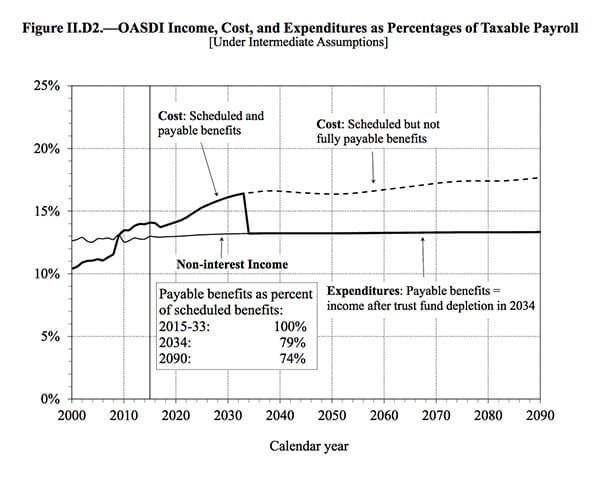

To be sure, the report said, the combined Old Age and Disability program will first face a shortfall in 2034 (see the cliff chart below), a projection that's unchanged from last year's report. Even if the trust fund becomes depleted (a huge "if" that presupposes Congress doesn't take steps to shore it up), annual revenues from the dedicated payroll tax and taxation of Social Security benefits will be enough to fund 74 percent of scheduled benefits through 2090.

That isn’t a desirable outcome, of course. But it’s a far cry from the all-too-common refrain that Social Security is hurtling toward insolvency.

Put somewhat differently, over the 75-year projection by the bipartisan Trustees, the combined program has a financial imbalance equal to 0.95 percent of the U.S. Gross Domestic Product. That's a smaller economic burden than the cost of the wars in Iraq and Afghanistan.

It’s important to remember that the Trustees actually make three projections, involving different demographic, economic, and program-specific assumptions. Common practice is to use the intermediate assumptions, the set that leads to the shortfall in 2034. This projection assumes U.S. productivity grows at a 1.68 percent average annual rate and that unemployment averages 5.5 percent.

But under the optimistic set of assumptions— including productivity growth of 1.98 percent and unemployment at 4.5 percent — there never is a shortfall. The fiscal situation deteriorates more rapidly with the pessimistic scenario, of course, including productivity growth of 1.38 percent and unemployment of 6.5 percent.

The different scenarios are a good reminder that a vibrant economy where the average worker shares in the bounty matters a lot when it comes to the future of Social Security.

A Call to Address the Looming Shortfall

The report's authors also included their annual plea for Washington legislators to take steps to avoid the looming 2034 problem. “The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them,” they wrote.

They’re right. Sadly, nothing has been done to shore up Social Security in polarized Washington, even though legislators of both parties know what's ahead.

This coming year just might break the logjam, though, largely thanks to the dynamics of the Presidential election.

How the Election May Turn the Tide

Social Security has been a backburner issue in the race to the White House so far. But that’s changing. The signal moment came earlier this month when President Obama urged legislators to make Social Security more generous. That was something of a reversal. Several times in his first term, Obama flirted with the idea of striking of grand fiscal bargain with Republicans that would have included some kind of reduction in Social Security benefits. No more.

"We can't afford to weaken Social Security, we should be strengthening Social Security,” he just said in a speech in Elkhart, Ind. “And not only do we need to strengthen its long term health, it's time we finally made Social Security more generous and increased its benefits so today's retirees and future generations get the dignified retirement that they have earned."

Hillary Clinton, the presumptive Democratic nominee for the presidency and her rival Bernie Sanders, agree on boosting Social Security benefits. Clinton takes a more targeted approach, specifically helping out vulnerable groups, like low-income women. Sanders has called for an across-the-board benefit increase.

“I like the enthusiasm,” says Alicia Munnell, director of the Center for Retirement Research at Boston College. “I also like that recognition that many people have nothing else for their retirement but Social Security.”

How to pay for improved benefits? The culprit for almost 40 percent of the projected shortfall is attributable to the upward redistribution of income over the last four decades, calculates Dean Baker, co-director of the Center for Economic and Policy Research in Washington, D.C. That's why both Clinton and Sanders are keen on raising the current $118,500 limit on earnings subject to Social Security payroll taxes.

Clinton has been open to that idea and Sanders has explicitly advocated lifting the cap so everyone “who makes over $250,000 a year pays the same percentage of their income into Social Security as the middle class and working families,” according to his campaign web site.

If the cap is raised (or perhaps eliminated), odds are the day of a shortfall reckoning will be delayed.

Another option is increasing the payroll tax itself. The Trustees note that the Social Security system would be fully solvent over the 75-year time horizon of the report if the payroll tax went up by 2.58 percent to 14.98 percent.

“I’m of the view that the real question is first, what level of benefits we want and second how do we pay for it?” says Nancy Altman, founding co-director of Social Security Works.

Trump and the Republicans

The mystery lies with the Republicans' answer to Altman’s question.

Republican orthodoxy has been to describe Social Security as unaffordable, a catastrophic burden. The conservative rule book with entitlement spending — including Social Security — is to promote privatizing or partially privatizing Social Security, means-testing the program, raising retirement age from age 67 for those born in 1960 or later, reducing the annual cost of living adjustment (which the report forecasts to be a paltry 0.2 percent in 2017) or some combination of these ideas.

Except Donald Trump, the presumptive Republican candidate for the presidency, doesn’t buy into the conservative canon. He likes Social Security (and Medicare) as they are just fine. “We should not touch Social Security,” he writes in Crippled America: How to Make America Great Again. “It’s off the table.”

Those lines echo what Trump said during the March primary debate in Miami. “I will do everything within my power not to touch Social Security, to leave it the way it is,” he said. “And it’s my absolute intention to leave Social Security the way it is. Not increase the age and to leave it as is.” This stance was a key part of his appeal to the conservative base during the Republican primary.

Medicare's Outlook

And what about Medicare? The Social Security Trustees also made a forecast for the health insurance program that covers more than 55 million Americans (mostly 65 and older). Here, the report paints a mixed picture, and a bit darker than last year's report.

The Trustees now predict Medicare will exhaust its reserves by 2028, two years sooner than last year’s estimate. The reason: the actuaries expect higher use of inpatient hospital services, lower projected improvements in productivity and lower payroll tax revenue due to slower wage growth.

Here, too, changes could be made to stave off the forecasted doomday.

Republican Speaker of the House Paul Ryan wants to gradually increase the Medicare eligibility age from 65 to 67 for people born after 1960 (matching Social Security). He also proposes providing beneficiaries with a fixed dollar subsidy to buy their Medicare coverage, a policy shift that moves the risk of rising health care costs from taxpayers overall to older Americans in particular.

Whether either of those will happen will, of course, depend largely on what happens in November 2016.