7 Ways to Keep Your Parents' Assets From the Taxman

These steps could save them and you serious money

When I was named executor after my father’s death in 2004, one of the first logical steps seemed to be closing his Individual Retirement Account (IRA). Fortunately, my sister Michele told me about a way to continue to allow that money to grow tax-free for decades with something called an IRA-BDA (Beneficiary Distribution Account).

This underutilized product gives you the ability to withdraw these IRA funds over an extended period time, maximizing your tax-deferred growth of this money. The result of that one piece of advice: this $16,000 account now has a value of $44,000, and I continue to get a distribution of approximately $1,000 per year.

It’s just one example proving that there are many ways to reduce tax liabilities or defer payment, especially when it comes to death taxes.

At Executor.org, we help those charged with managing a person’s final financial matters after a death, helping them understand and manage the 100+ steps in the process. But when it comes to minimizing your family’s tax burden, the work is best started while your mother or father are still alive. Since many of us will serve as executors for our parents’ estates, this means talking to them now about their estate planning and money management.

7 Tax-Saving Strategies

Here are seven strategies that can save your parents money in their later years and limit the taxes owed by the estate after their death. Some are steps they can do; some are ones you can do. You or they may need a financial professional to help navigate a few of them:

1. They can sell stocks that have losses. Your parent may be able to take a tax deduction for his or her stock losses while alive. If your dad bought a share of stock for $500, say, and it’s currently worth only $300, if he sells it, he can likely deduct the difference at tax time. If he doesn’t sell it, upon his death, what he originally paid no longer matters; any loss is no longer tax-deductible. This is due to the “stepped-up basis” rule, which says that the value of the asset for tax purposes will be its value on the date of death, not its purchase price.

There is an exception that can be made by an executor of a large estate subject to estate taxes, though: He or she can choose to set the “basis” (value) of the asset at six months after the owner died, rather than the date of the death. Keep in mind that there is a limit of losses that can be taken in a given year and losses carried forward go away upon death for income tax purposes.

2. They can keep stocks that have gains. If your parent holds stocks that have risen in value, the stepped-up basis rule can be a tax saver when he or she dies. For example, say your mom bought a share of stock for $100 several years prior to her death and on the date she died it was worth $1,000. Using the stepped-up basis rule, there will be no income tax due on the $900 gain if the stock is not sold until after her death.

3. They can manage IRAs strategically to minimize taxes. If IRA investments are sold while a person is alive, any taxes owed will be taxed at his or her individual tax rate. After death, the beneficiary can take a lump sum distribution or choose to let the IRA continue to grow, with taxes deferred through that IRA-BDA I mentioned.

With an IRA-BDA, the beneficiary receives payments annually over his or her expected lifetime, with any undistributed amounts released to his or her estate at death.

You’ll want to manage your parent’s IRAs to be taxed at the lowest rates possible, so talking to a financial advisor can be wise. With an IRA-BDA, the tax deferment is of great value in most cases because money you would have paid in taxes can earn interest for you for many years.

4. You can claim your parents as dependents if they qualify. This strategy will be a benefit to you, not your parents, but it is an effective way to minimize taxes as your parents age. Any dependent must meet certain criteria, however, so this is not an option for everyone.

The most important consideration is whether you provide more than half of the financial support for your parent. Social Security payments are included in this calculation. If a parent lives with you, include the fair-market room rental, food and other support costs in this calculation. IRS Publication 501 can provide more details.

5. Have your parent file for the elderly or disabled tax credit, if permitted. This credit lets certain people claim a small credit to offset their ordinary income tax liability. To be eligible, your parent must be 65 before the end of the tax year or permanently and totally disabled and have an income of less than $17,500 ($25,000 for a couple). IRS Publication 524 can provide further details.

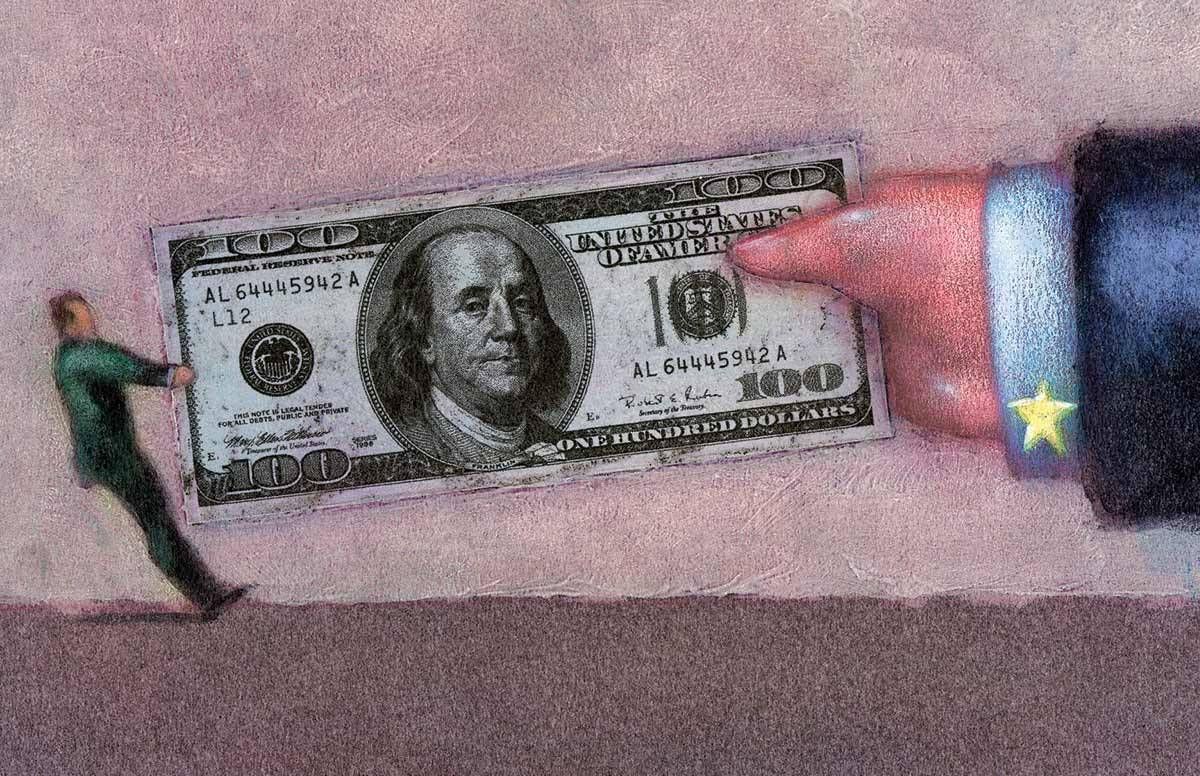

6. If your parents will have a large estate, they can gift money to potential beneficiaries while they’re alive. Currently, estates above $5.45 million are taxed at a top rate of 40 percent. If your parents are fortunate enough to have an estate large enough to be subject to the estate tax, they can help minimize the tax liability of their eventual estate by giving money to beneficiaries while they are alive.

Just remember they check if there are limits to the amount of money that can be gifted without tax consequences. That amount is $14,000 per person for 2016, just as it was in 2015.

7. They can put money into trusts. If your parents have significant assets, setting up trusts can make life a lot easier for beneficiaries (and avoid those assets having to go through probate court). However, trusts can be complex. There are annual filing requirements, including the filing of a tax return for each trust. Plus you’ll need to find, and possibly pay, a trustee to manage each trust and the investments within it. Some trusts also include complex requirements on how the money can be spent by beneficiaries.