Bank Run Rerun

The failure of a California bank reminded some people of the bad old days of the Great Depression, but depositors have much more protection now

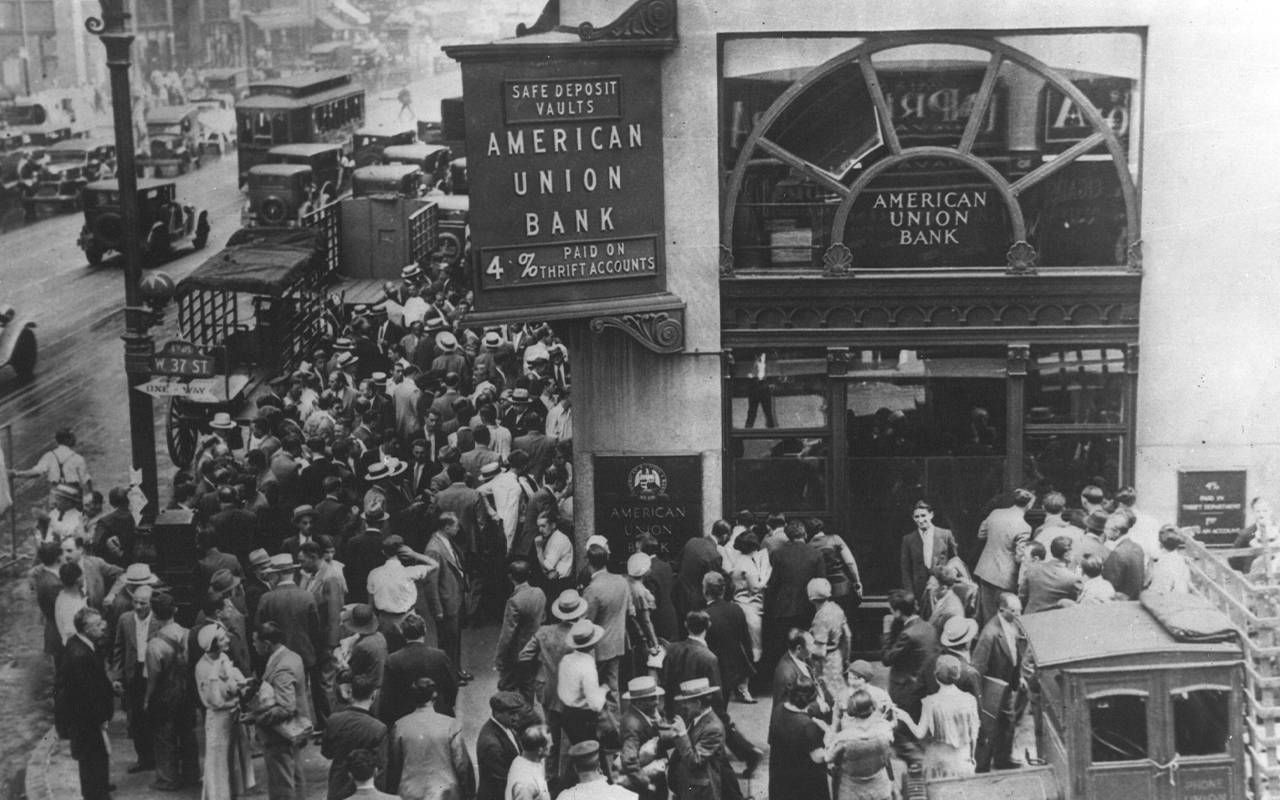

Many people thought of bank runs as a Depression-era issue or a memorable scene from the holiday movie "It's A Wonderful Life." That was until March 10, when the Federal Deposit Insurance Corporation announced it had taken over Silicon Valley Bank to stop a surge of withdrawals by jittery depositors.

Days before the FDIC stepped in, the bank announced it had lost $2 billion selling assets to satisfy depositors' demands to withdraw their money. The collapse of the 40-year-old bank is the second-largest bank failure in U.S. history, and the largest since the financial crisis of 2008.

Silicon Valley Bank's woes attracted global attention and contributed to runs on other banks as far away as Switzerland, making the global banking system look shaky. In fact, only a handful of banks go out of business each year.

Unless you have first-hand experience with a bank failure, the FDIC is barely noticeable in daily life.

The Bad Old Days

But some people still recall that about 7,000 banks failed in the three years after the 1929 stock market crash, leading Congress to found the FDIC in 1933 to insure deposits and reassure depositors.

Unless you have first-hand experience with a bank failure, the FDIC is barely noticeable in daily life. I received a crash course in FDIC insurance in the late 1980s. At the end of December, a regional bank in Boston went belly up. My issue? The company I worked for held all of its money at that bank and had issued me a monthly payroll check. The check bounced.

This left me with a host of overdrafts as I had paid my monthly rent, utilities and other bills before obliviously leaving for a New Year's ski trip. The FDIC insured the bank and made whole my employer, which refunded me for the overdrafts and reissued the paycheck from its new bank.

Safety in Banks

The value of having an FDIC-insured bank saved my day and my pocketbook. Not to mention my job as the company stayed in business.

The FDIC now oversees and insures more than 5,000 banks. Receivership like Silicon Valley Bank are rare. No banks failed in 2021 and 2022, according to the FDIC, but failures increase in troubled financial times, such as the Great Recession from 2007 to 2009.

The size of the Silicon Valley Bank bust has caught everyone's attention and reminded us to think about where we hold our cash.

The FDIC goes beyond giving bank depositors peace of mind by examining and supervising banks to keep them solvent. When necessary, the FDIC also takes receivership of failed banks. It also offers consumer-education programs such as Money Smart.

The Magic Number

FDIC insures each account holder for up to $250,000. Depositors are covered automatically when they use an FDIC-insured bank. Checking accounts, savings accounts and certificates of deposits are insured up to $250,000 per person, not per account. If you have a joint account, each person is covered for $250,000, a total of $500,000. Your individual account could still be covered for $250,000, as it all depends on how you title the account.

There are two ways that one account holder may receive additional insurance by including beneficiaries on the account. The first way is establishing a bank account titled in the name of your revocable trust account which designates beneficiaries of all your assets. This is best done as part of your estate plan and with a lawyer to be sure your wishes are followed.

Checking accounts, savings accounts and certificates of deposits are insured up to $250,000 per person, not per account.

The second way is to use the Payable on Death (POD) option provided by all banks for the funds held. For an account, you name the beneficiary or beneficiaries of the funds after your death.

In either of these cases, up to five beneficiaries receive the $250,000 of insurance for a total of $1.25 million.

A client of mine routinely kept more than $500,000 in her savings account to feel comfortable. She directed the bank to add POD designation to her account so that the cash would go to her three children equally at her death.

Retirement accounts in banks are also insured up to $250,000 if they are in cash accounts, not investment accounts with a bank affiliate.

Talk to your banker to learn more as they are knowledgeable about what is covered and how you and your money can receive better coverage.

Other Insurance Programs

Money deposited in a credit union may be insured by the National Credit Union Administration, which Congress established in 1970 to oversee member credit unions and insure deposit accounts up to $250,000.

Late that same year, the federal government founded the Securities Investor Protection Corporation, which insures up to $500,000, including as much as $250,000 in cash, for each customer of member investment firms. SIPC does not regulate those firms nor does it insure investors against market losses.

If you like to keep cash in savings accounts, increase your protection by having two banks or a bank and credit union.

For example, if you keep your retirement savings or investment account at an SIPC member firm and the firm went out of business, SIPC would reimburse you for up to $500,000.

However, if you lose money in a market slump, you bear any resulting losses. A former client of mine learned that the hard way when he moved his safety reserves from a low interest, federally guaranteed local bank savings account to a money market mutual fund offering a higher return.

When markets went topsy turvy in 2008, the value of the money market mutual fund fell below its original price — an unimaginable event in some investors' minds.

Protecting Yourself

When he called me to ask what happened, I reminded him that higher returns on investments means higher risks for investors. His bank account paid less because it was insured; the money-market mutual fund took more risk and was not insured. Happily, he recouped his loss by the end of the 2008 fiscal crisis, but he learned a lesson about adding needless stress to his life.

Banks want you to do all of your banking and financial transactions through them. Yet, diversifying is not just an investment motto. If you like to keep cash in savings accounts, increase your protection by having two banks or a bank and credit union. Therefore, if one of your financial institutions fails, you will still have access to the other cash account.

Just remember the "magic" number of $250,000 to keep all of it safe in an insured institution.

C.D. Moriarty, CFP, is a Vermont-based financial speaker, writer and coach. She can be found at MoneyPeace.com. Read More