How to Close America's Wealth Gap

Policy proposals and programs discussed at the CFED conference

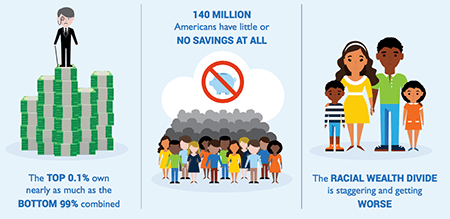

Wealth inequality and income inequality in America are leading concerns in the 2016 presidential campaign, appropriately so. Consider these wealth gap statistics from CFED (the national nonprofit previously known as the Corporation for Enterprise Development that's dedicated to expanding economic opportunity for low-income families and communities in the United States):

- The top 0.1 percent of Americans now own about as much wealth as the bottom 99 percent combined

- One in five Americans has zero or negative net worth

- Nearly half of households lack a basic personal safety net to prepare for emergencies

- It would take black families 228 years to amass the same amount of wealth white families have today, if average black family wealth continues to grow at the same pace it has over the past three decades. For the average Latino family, it would take 84 years to catch up.

Ezra Levin, CFED’s associate director of government affairs told me: “It’s worth noting, this is for averages. If you look at median household wealth in the black community and the white community, the gap will never close. Trends are heading in the wrong direction. Without reform, the gap will never close. It will not.”

What kinds of reforms could close the wealth gap and address the financial insecurity of so many Americans?

Last week, experts gathered at CFED’s Assets Learning Conference 2016 to offer policy prescriptions and discuss some current programs that are helping. CFED simultaneously released its Federal Policy Blueprint with recommendations for the new administration and Congress.

Below are highlights from the conference:

Closing the Savings Gap

Finding ways to boost savings, including retirement savings, for low- and moderate income Americans was a prime topic. According to CFED’s study, 140 million Americans have little or no savings at all. Numerous speakers noted, as Next Avenue has, the Federal Reserve survey showing that 46 percent of Americans said they’d struggle to meet an emergency expense of $400.

The Obama administration’s fledgling myRA (a Roth-IRA like starter retirement-savings program for the 55 million Americans without employer-sponsored savings plans), its proposed Auto-IRA and the recently enacted Secure Choice Program in California (which mandates private employers to offer retirement plans) received a good deal of attention. California’s plan is similar to legislation that has passed in Connecticut, Illinois, Maryland and Oregon.

Richard Cordray, director of the federal Consumer Financial Protection Bureau (CFPB), told the CFED audience: “We know three things. First, saving is hard. Second, saving is important. Third, saving is possible.”

Cordray also described the agency’s Project Catalyst initiative with American Express, aimed at promoting savings, especially among the low-income and economically vulnerable. Their pilot program tested strategies to encourage saving using prepaid cards.

Jamie Kalamarides, who heads Prudential Retirement’s Full Service Solutions division, focused on the 5.6 million small businesses that don’t offer retirement plans. They “account for 55 million workers, and of those 55 million workers, 35 million are women, and 22 million are people of color.” Added Kalamarides: “This is a public policy issue nationwide.”

Levin, the primary author of CFED’s federal policy blueprint, said he thought “the myRA solves a serious problem out there” and noted that CFED hoped the next administration “will expand the program to increase retirement savings among lower-income Americans.”

He was less enthusiastic about the current version of the federal Saver’s Credit (maximum amount: $1,000; $2,000 for couples), targeted to low-income workers to incentivize retirement savings. This tax credit is “a great step in the right direction, but there are several problems with it that make it less impactful,” said Levin. “The biggest of which is that the Saver’s Credit currently does not help those with no income tax liability.”

Closing The Racial Wealth Gap

Levin had pointed opinions about the fact that America's racial wealth divide is getting worse, not better.

“That says a couple of things to me,” he noted. “It says that historically there have been policies that have led to this racial wealth divide we have today, and also there are current policies at the state, federal and local level for retirement and savings that exacerbate that wealth divide and make things worse.”

What’s more, Levin maintained, “there are big policies out there that are either purposely, or usually thoughtlessly, constructed to expand the racial wealth divide.”

Optimistic About the Future

But Levin was optimistic about prospects for closing the racial wealth gap. “If we can reform those [policies], it means we can make huge improvements. We know what needs to be changed. We just need to build up the political will to do it.”

He was optimistic about chances for reforms to attack the wealth and income gaps in general, and boost retirement savings, too. “It’s an election year. We have a brand new Congress and a new president coming in next year, and that changes what is politically possible,” said Levin.

“One way to increase retirement savings, possibly counterintuitively, is to increase emergency savings,” he added. And one way to do that would be through The Refund to Rainy Day Savings Act, a bipartisan proposal in Congress “to support people who want to save at tax time and have a little bit of emergency savings.”

The legislation, introduced in 2016 by Sen. Cory Booker (D-N.J.) and Sen. Jerry Moran (R-Kansas), would let workers defer up to 20 percent of their federal tax refund. The savings would accumulate interest in a Treasury-held account before being transferred to the person’s direct deposit account six months later.

Levin believes the Rainy Day legislation might be enacted next year “if there’s a larger bill around tax issues.”

Similarly, he thinks Republicans may be open to the Democrats’ proposal to make the Saver’s Credit a refundable tax credit, so Americans with no tax liability could claim it.

In addition, Levin said he foresees possible movement next year on federal rules that penalize low- and middle-income Americans from receiving public benefits after they put money into savings accounts, raising their asset levels.

The Impact of the 2016 Election

“A lot depends on what happens during the election, but we are hopeful that the ideas laid out [in CFED’s blueprint] are not just pie in the sky ideas,” said Levin. “These are actionable, and could be done in the event that Congress and the new administration come together and decide, ‘Yes we want to do something on taxes, or we want to do something on welfare reform or anything that touches financial insecurity.’”

It will be interesting to see where things stand a year from now.