6 Tips for Enrolling in Medicare

It's Open Enrollment time, so here's how to navigate the Medicare maze

The annual Medicare Open Enrollment season opened Sunday, Oct. 15 and runs through Thursday, Dec. 7. Unfortunately, Medicare is a maze with more twists and turns than an Agatha Christie novel.

So what follows is below are my six tips for finding your way through it this year or in the future once you’re 65 or older. With a deliberate, careful approach, you can master the program’s terminology and the rules and get all the Medicare benefits to which you’re entitled.

Two essentials to know:

1. Everyone signs up for Medicare through the Social Security Administration, and that agency will be your contact point for questions as well as your actual registration.

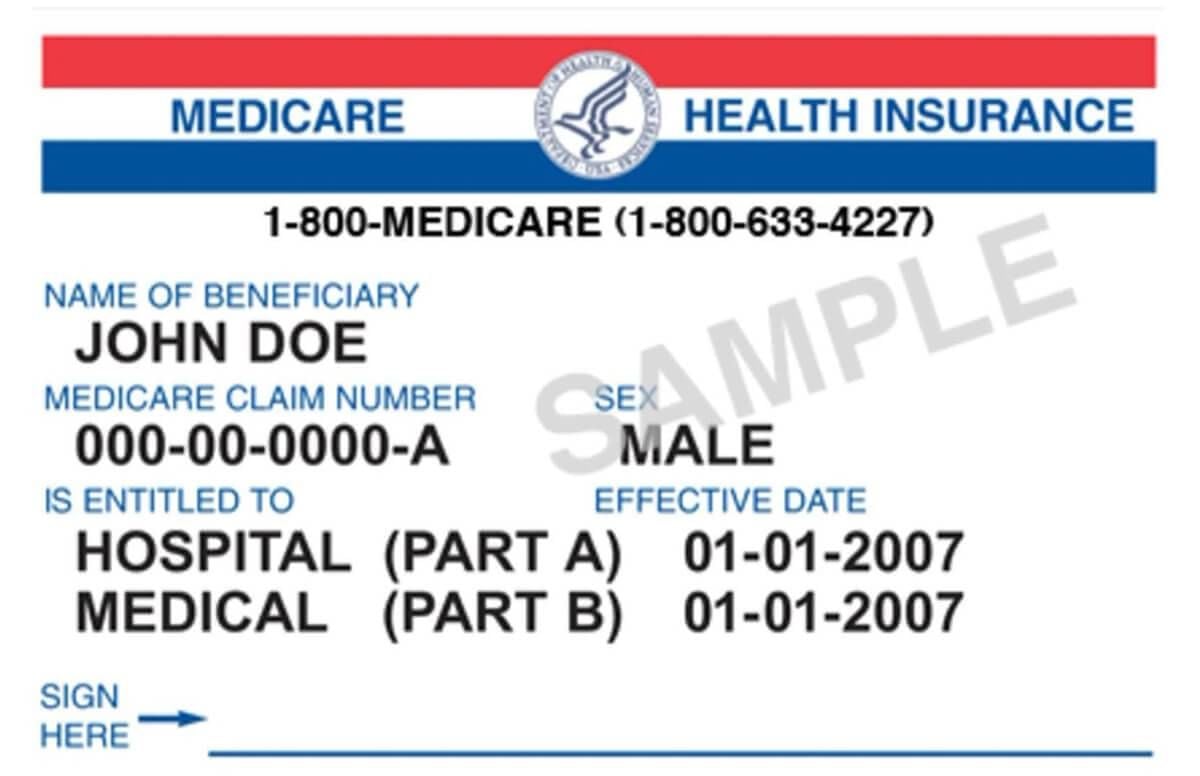

2. If you are already receiving retirement benefits from Social Security before you turn 65, you won’t have to do anything — you’ll be automatically registered for Medicare Part A (covering clinics, hospitals and other medical facilities) and Part B (covering physicians and other service providers) starting on the first day of the month of your 65 birthday. But if you aren’t getting Social Security benefits yet and are 65 or older, you’ll have to take the initiative yourself and sign up on your own.

Now, my six tips:

1. Start early and don’t procrastinate. You can begin the process of applying for Medicare up to three months before you turn 65. At that point, you can contact Social Security by phone, visit your local Social Security office or sign up for benefits online, depending on your preference.

But it’s a good idea to begin educating yourself about Medicare at least three or four months before you apply. That way, when the time comes, there will be no confusion and you’ll be ready to select the Medicare plan or set of plans you really want.

2. Study each type of Medicare plan and try to gain a clear understanding of all of them. The plans you’ll need to research include:

- Plan A (covering medical facilities)

- Plan B (covering medical providers)

- Plan C (Medicare Advantage plans, which mimic private insurance plans and function as an alternative to a Plan A/Plan B package)

- Plan D (prescription drug plans, used to supplement coverage gaps)

Familiarize yourself with the terminology they use, so you’ll have clear ideas about what you’re signing up for and why some choices are better than others.

The government’s Medicare site is a good place to start looking for information, but don’t limit yourself to just once source. Seek out a user-friendly site that takes an “everything you’ve always wanted to know about Medicare” approach to the subject. (Personal plug: My company’s site, Medicare on Video, is one.)

3. Find someone to assist you with your research (if you think that would help). A trusted family member or friend might be a valuable aide, especially if he or she is someone who’s already had dealings with Medicare and health insurance issues. A person like this could be a good resource if you feel confused or intimidated by Medicare’s labyrinth of coded lingo and convoluted regulations.

4. Call Social Security with any specific Medicare questions before you sign up for Medicare. If there is something you don’t understand or you are unsure how the rules would affect you, phone Social Security and ask. Stay on the line until all your questions have been answered and all your doubts erased. The phone number is 800-772-1213.

5. Pick the right time to call so you can avoid long delays. The busiest times for Social Security (and the hardest times to get through) are on Mondays, Fridays, early in the morning and on, or near, the first of the month.

The best time to call for information or to let Social Security know about your Medicare plans is from Tuesday through Thursday, preferably between 10 a.m. and 3 p.m. ET. If you do get put on hold during those times, it shouldn’t be for long.

6. Above all, don’t get stressed. Applying for Medicare coverage and benefits is not as scary or difficult as you think. Beneath all the bureaucracy and confusing terminology there is a logical, rational system that can be understood once you break through the initial walls of obfuscation.