The Wrenching Financial Costs of Addiction

A new study shows how cash outlays for substance abuse can gut savings

If you’ve seen the recent movies Beautiful Boy or Ben Is Back, you’ve learned about the pain parents experience when their grown child becomes an addict. But what the films don’t talk much about, and what’s rarely discussed, is the devastation addiction can do to the finances of the people with substance abuse disorders — and their loved ones.

A new, dramatic study from the True Link financial services firm lays it out starkly. True Link — best known for helping families manage finances of parents with cognitive problems — surveyed 149 friends and family members of people with a substance abuse disorder. The researchers asked about the financial challenges as well as experiences associated with recovery.

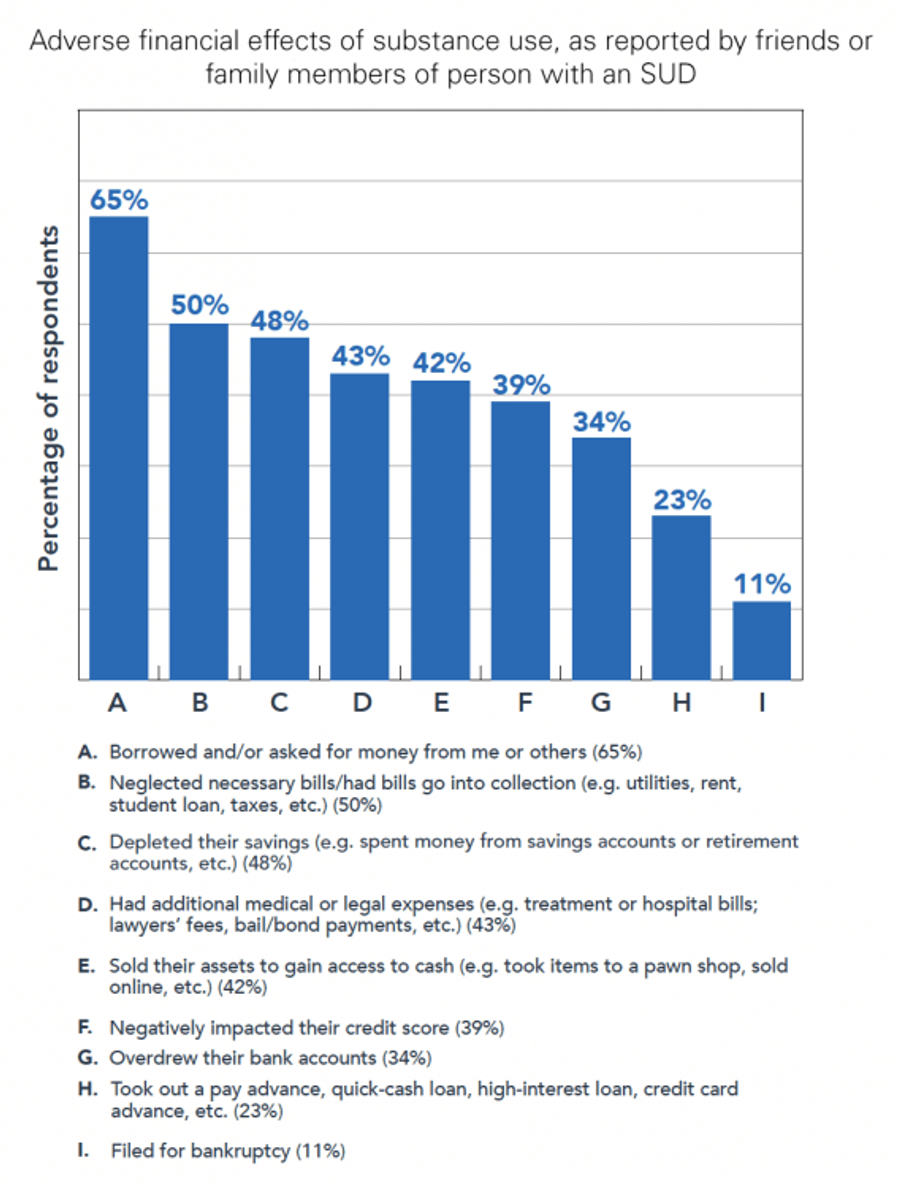

That the vast majority (82 percent) said their loved one experienced adverse financial effects due to their substance abuse disorder may not surprise you. But these specifics may: 65 percent said the person borrowed and/or asked for money from them; 48 percent said he or she depleted their savings and 11 percent cited a filing for bankruptcy. A person addicted to cocaine or heroin can spend over $10,000 a year to support the habit; rehab facilities can cost $30,000 a month.

Financial Problems During Addiction Recovery

And if you think that financial problems end when an addict is in recovery, you’re mistaken: 72 percent of the survey respondents said no matter how well someone manages money during their addiction, managing money during recovery is even harder.

“Treatment is extraordinarily expensive, and it often takes a couple of tries,” said Kai Stinchcombe, True Link’s founder. Stinchcombe has a family member who has dealt with substance abuse issues. “It was emotionally fraught for us,” he said.

Few can speak more eloquently about the financial costs of substance abuse than Eric Dresdale, 35. After being diagnosed with psoriatic arthritis, Dresdale was prescribed a painkiller. “That’s when the light switch went off. It numbed me and any feelings of depression, anxiety or stress got wiped away,” he told me.

But his addiction led to career setbacks, which led to his borrowing money from, and lying to, his family. “I got clean for about two months,” he said, “and then I was right back where I started. My bank account was at zero.”

Racking Up $7,000 in Debt

After a four-month stint at a care facility in Florida, Dresdale said, “I realized I could take out money and in about a week I spent $500 on silly things to fill an emotional void.” He then went to a recovery residence (once known as a “halfway house”) where he racked up $7,000 in debt.

Thankfully, Dresdale not only managed to turn his life around, in 2012, he helped devise the NextStep prepaid debit card with spending parameters, specifically for people with substance abuse and mental health disorders and their families. (the NextStep Visa card is now offered by True Link as the True Link Card for Recovery; the cost is $10 a month). Dresdale has since become co-founder and chief strategy officer for KNWN Technologies, a biometric identity and payment platform.

Dealing With Substance Abuse and Elder Financial Abuse

If you’re wondering why a company specializing in preventing elder financial abuse would venture into substance abuse, Stinchcombe said there’s a pretty strong connection. “We help families with special needs. It’s a multiple party financial management thing,” he noted. Both services send alerts to a family when a loved one is trying to spend money in a questionable, potentially dangerous way.

Sadly, aside from trying cards like True Link’s, families can rarely find help from the financial services world when dealing with the costs of addiction. In the True Link survey, 87 percent of respondents said banks or credit card companies do not offer much help to people with substance abuse disorders as they try to regain control of their financial lives.

“There have got to be a lot of bank executives who have a much bigger reach than our company,” said Stinchcombe. “It reminds me of the recruitment poster that said: ‘Dad, What did you do about the great war?’ Gosh, what are we doing about the opioid crisis?"

The Financial Struggles for Parents of Addicts

So many parents with a child who is an addict or in recovery struggle to figure out where to draw the line in trying to provide financial assistance. They often worry that the cash they provide ostensibly to help their son or daughter pay for groceries or rent might wind up paying for drugs or alcohol.

As Dresdale says: “I’ve worked with families and there’s a fine line between helping and hurting. You might think you are saving or protecting someone by giving financial support, but you could be making the problem worse. I believe in providing financial help with boundaries.”

David Sheff, the father of the real-life Beautiful Boy Nic Sheff, once said he stopped giving his addicted son money after “someone told me that sending money to a drug addict is like giving a loaded gun to someone who is suicidal.” (For a gritty look at the financial issues parents of addicts face, read the recent excellent Money magazine story by Kristen Bahler: “Parents Are Cutting Off Their Opioid-Addicted Kids — and It’s the Toughest Decision of Their Lives.”)

I also recommend parents dealing with this conundrum read The Financial Planning Association article, “Counseling a Client with Addiction: Tough Love Is Not the Answer,” by Catherine Seeber, a Certified Financial Planner at CAPTRUST in Wilmington, Del. Seeber writes that many financial planners are increasingly finding their clients and loved ones struggling with addiction — “with white elephants crowding the room.”

Seeber notes that the Affordable Care Act’s essential health benefits include substance abuse disorders, which means all health insurance sold on the exchanges must include services for them.

Warning Signs and Advice

Seeber says erratic and unusual withdrawals from portfolio accounts can be a warning sign of addiction. Another: cash advances and payday loans.

She also recommends clients with addicted love ones review inheritances such as Individual Retirement Account designations and set up wills that spring into what are called “special needs trusts.” With those, a trustee is appointed to distribute trust assets until the beneficiary is free from a substance abuse problem.

Fred Leamnson, a Reston, Va. financial adviser who has written very personally about dealing with addiction and its financial consequences (see his Moneywithapurpose.com blog), has written: “Under no circumstances should you ever touch your retirement accounts to bail your addict out of trouble.”

Stinchcombe’s advice for families: “Talk to a financial counselor or someone who is an expert in addiction. Come up with a plan that acknowledges the situation. It’s so nuanced. It’s tough. “