The 3 Big Financial Pain Points of Americans

Unemployment's low, but there's still plenty of stress about money

(Editor’s Note: This story is part of a partnership between Next Avenue and Chasing the Dream, a public media initiative on poverty and opportunity.)

If you look only at the nation’s low, 3.7% unemployment rate, it would be easy to assume that the economy’s humming and that Americans are feeling great about their finances. But after reviewing five recent notable surveys, I believe many people are actually feeling three big financial pain points now.

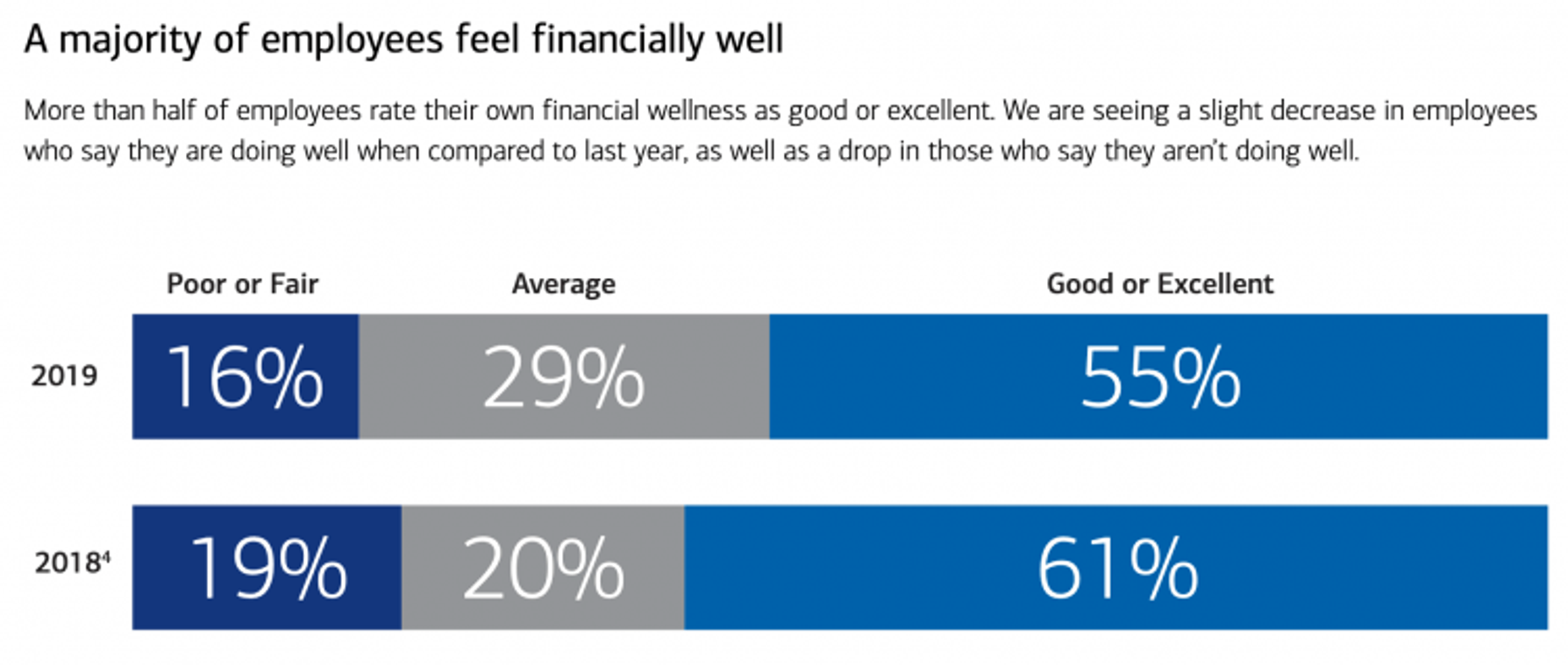

Overall, according to the Bank of America Workplace Benefits Report of 996 retirement-plan participants, just 55% of employees rate their financial wellness as good or excellent, down from 61% a year ago. “That’s something to keep a close eye on,” says Lisa Margeson, head of Retirement Client Experience and Communications at Bank of America.

Here’s more about what the surveys show about today’s financial pain points, and ways Americans and employers can relieve some of the stress:

Pain Point No. 1: Caregiving and Family Assistance

The financial — and sometimes emotional — stress faced by family caregivers and by parents assisting their grown children came up repeatedly in the Bank of America survey, as well as the new Wells Fargo/Gallup Investor and Retirement Optimism Index survey and the 2019 American Family Survey from Brigham Young University’s Center for the Study of Elections and Democracy.

The Wells Fargo/Gallup survey of 2,091 U.S. investors found that 45% have provided financial assistance to a parent or parent-in-law, an adult child, an adult sibling, a grandchild or another relative and 21% have provided personal assistance or care to them.

In the past year, they’ve spent $10,000 on average financially supporting adult family members (not including college expenses for an adult child). “It’s amazing to us that number is as large as it is,” says Mary Sumners, regional president for the Northern Region at Wells Fargo Advisors. And, she adds, “many felt [providing financial assistance to family members] would have an impact on their ability to save for retirement.”

Nearly half of employees Bank of America surveyed (45%) said they perform caregiving duties for a family member. And 65% of caregivers for people other than their children said they spend 10 or more hours a month doing so. They they shell out a not insignificant $3,263 out-of-pocket annually, on average, on caregiving costs.

BofA researchers say the percentage of workers who are also caregivers is significantly underestimated by employers.

One reason employers are in the dark, says Kevin Crain, managing director and head of workplace solutions for Bank of America, is the stigmatization of caregiving. That means, Crain says, “whether you step up and tell your employer” that you have a parent who needs your help from time to time.

“I think this will become an increasingly growing topic,” says Crain. “We need to get more employees to feel comfortable about stepping forward.”

That starts with creating a workplace culture where employees are encouraged to talk about their caregiving responsibilities. Says Margeson: “Part of it is the employer’s responsibility to drive the conversation down to the manager level, not an HR department off somewhere else.”

The top benefits caregiving employees want, according to the survey: leave of absence or sick days to give care to family members; flexible scheduling to accommodate caregiving needs and the ability to work from home when needed.

In The American Family Survey of 3,000 people, 10% of respondents said they wanted to take family leave but were unable to do so.

One suggestion for family caregivers from Sumners at Wells Fargo: “Get together as a family and have a conversation” about the parents’ caregiving and financial needs.

Pain Point No. 2: Health Costs

Three of the surveys I reviewed cited health costs as a serious stressor for millions of Americans. That comes as no surprise, since the cost of health care is often one of the top issues for voters in the 2020 election.

As Democratic presidential hopeful Elizabeth Warren said in the most recent debate: “Families pay every time an insurance company says, ‘Sorry, you can’t see that specialist.’ Every time an insurance company says, ‘Sorry, that doctor is out of network. Sorry, we are not covering that prescription. Families are paying every time they don’t get a prescription filled because they can’t pay for it. They don’t have a lump checked out because they can’t afford the co-pay.”

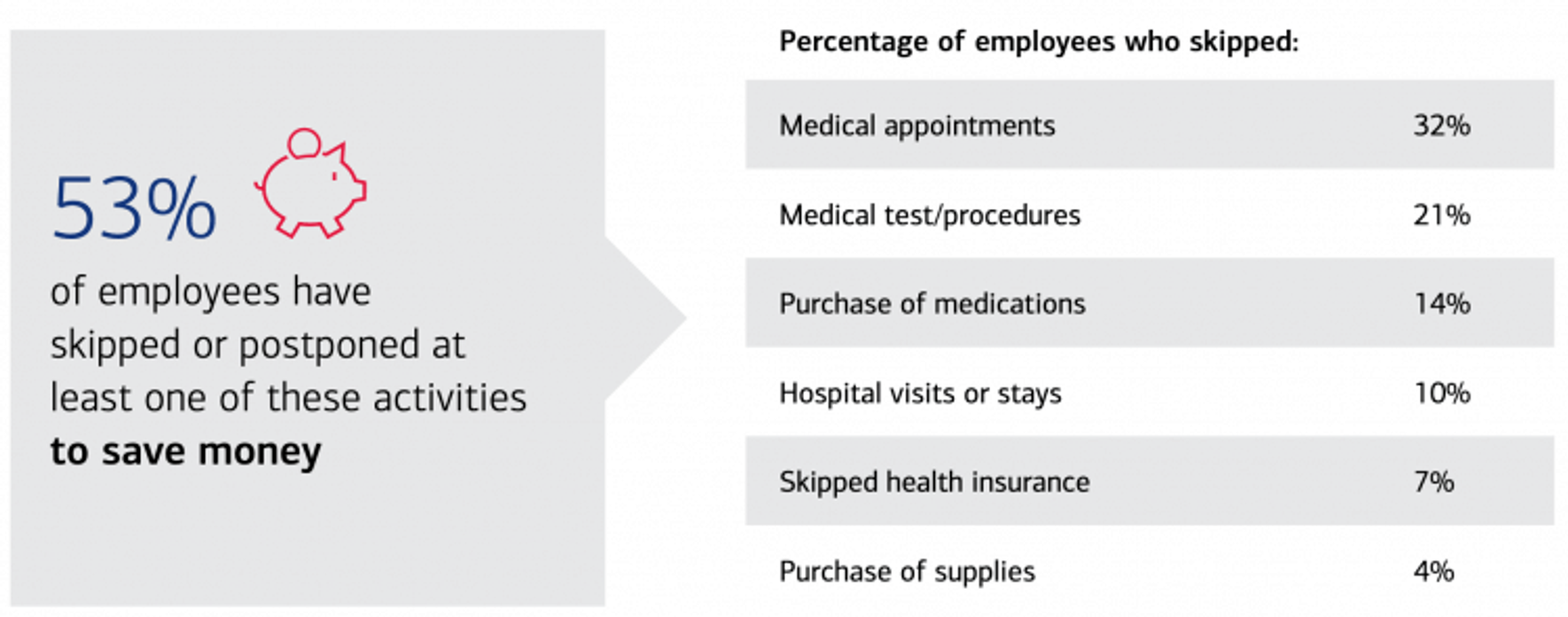

Bank of America found that employees pay an average of $7,685 annually for out-of-pocket health expenses and health insurance premiums. And, this survey said, 53% of employees have skipped or postponed medical appointments, procedures, hospital visits or the purchase of medications, health supplies or health insurance. “That’s really scary,” says Margeson.

In The American Family Survey, 14% of respondents said that in the past 12 months, someone in their household needed to see a doctor or go to the hospital but couldn’t because of the cost; 11% said there was someone in their household who needed a medication and couldn’t get it because of the cost.

“Even in economic good times, a meaningful percentage of Americans are not going to the doctor or getting their needed medications,” says Chris Karpowitz, principal investigator of The American Family Survey and co-director of Center for the Study of Elections and Democracy at Brigham Young University. “In the past, we called these ‘measures of economic crisis.’”

One problem, according to the surveys: Some employees don’t understand or take advantage of their employer-sponsored health benefits, particularly Health Savings Accounts (HSAs) with high-deductible health plans. HSAs are tax-advantaged accounts to help pay for health costs.

Bank of America’s survey found that only 11% of respondents correctly identified the basic attributes of HSAs. (Get this: just 7% of benefits decision makers at employers surveyed identified them correctly.)

One way to help reduce this pain point would be if more people saved for future health care expenses. According to the HSA Bank Health & Wealth Index, a survey of 2,000 adults, 40% of consumers never save for future health care expenses.

Pain Point No. 3: Not Enough Savings, Too Much Debt

It hardly seems worth repeating how little many Americans have in emergency savings and retirement savings. But here’s one distressing stat from the recent Clever debt survey of 1,000 adults: 31% of boomers and 32% of Gen Xers have no emergency savings funds.

As for retirement savings, Bank of America’s survey showed that women have median retirement savings of $30,000 and men have $100,000. The disparity helps explain why just 43% of women BofA surveyed said they felt financially well. By contrast, 65% of men did.

The financial wellness result for women “was a concerning statistic, but not unexpected,” Margeson said. “Women have a fundamentally different financial journey then men — they’re more likely to spend time out of the workforce for caregiving responsibilities, they live five years longer than men, on average, and retire two years earlier.”

On the flip side of savings, crushing debt loads remain a problem for many people.

The new Northwestern Mutual 2019 Planning & Progress Study of 2,003 adults found that of those with debt, 45% feel anxious about it monthly or more often. Gen X, according to the survey, has the highest debt level: $36,000, on average. Boomers are right behind, with $28,600

Also, the survey said, 15% of Americans expect to be in debt for the rest of their lives.

And 31% of respondents are paying interest rates on credit cards higher than 15%. Boomers are more likely than other generations to hold four or more credit cards, according to Northwestern Mutual; 23% do.

Put all these pain points together, and the financial picture for the public isn’t so rosy, after all. “The main message from our survey is that many of our investors don’t feel in control of their financial future,” says Wells Fargo’s Sumners.

If you’re feeling one or more of these pain points, you may want to meet with a financial adviser to discuss ways to address them. In fact, you may even want to do it with your parents or your millennial kids along with you, so the adviser and your family can better understand the whole picture and offer suggestions to help all of you.

This story is part of our partnership with Chasing the Dream: Poverty and Opportunity in America, a public media initiative. Major funding is provided by The JPB Foundation.