How Much Should You Withdraw From Retirement Savings Annually?

The 'Friends Talk Money' podcast hosts weigh in on 'the 4% rule'

We hear a lot — a lot! — about how much we should save for retirement.

But people nearing retirement, and in retirement, are often perplexed about how much of their retirement savings they can afford to withdraw each year without running the risk of outliving their money.

So, my "Friends Talk Money" podcast co-hosts and I just released an episode to help offer guidance.

"Our clients ask us this question every day," David Frisch, a fiduciary adviser, CPA and president of Frisch Financial Group in New York City, said in the podcast.

(You can listen to the "Friends Talk Money" episode anywhere you get your podcasts or at the end of this article.)

The Big Retirement Worry

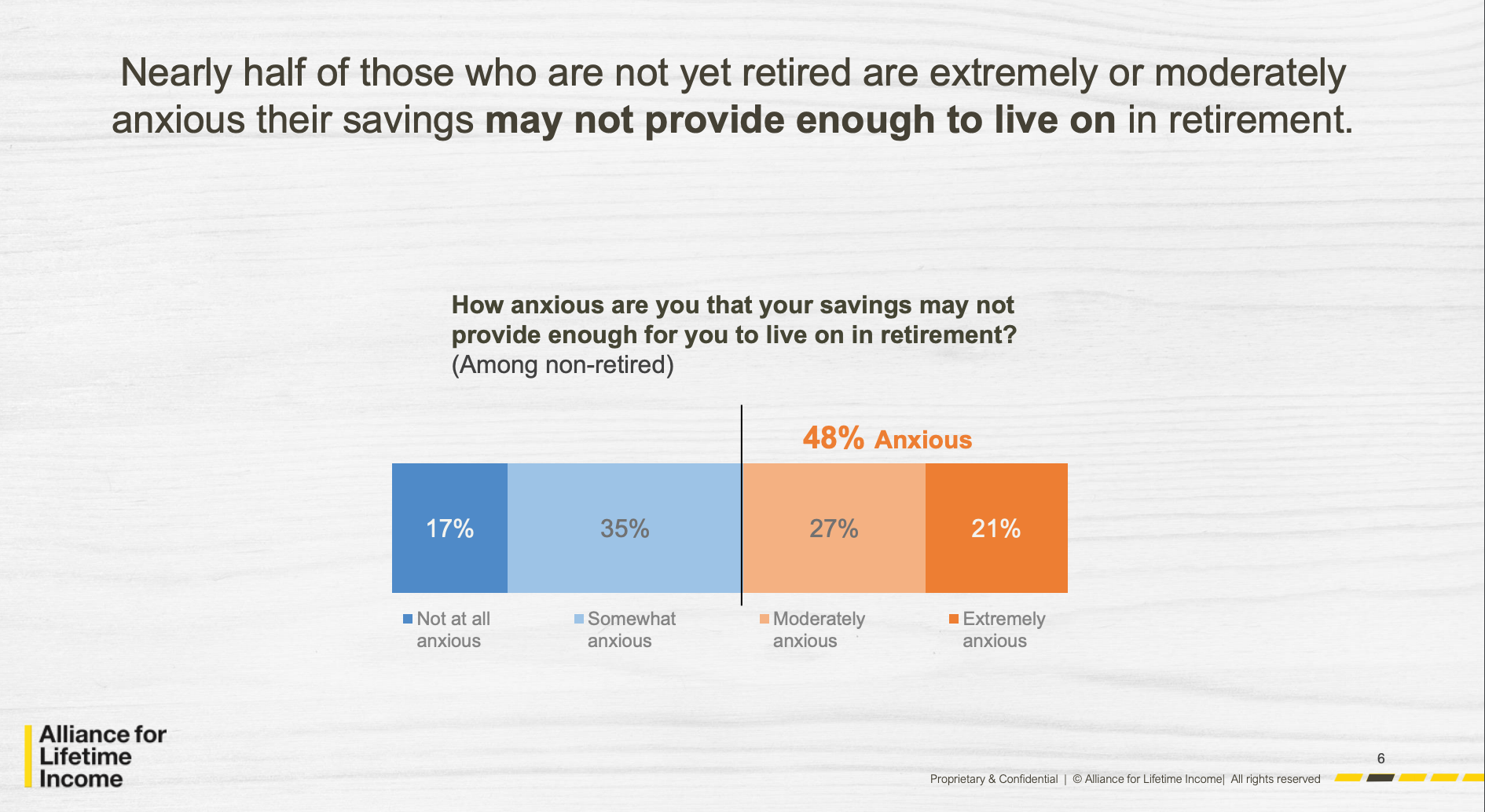

Given today's low interest rates, volatile stock market and COVID-19 job concerns, fears of running out of money in retirement are very real. A recent Alliance for Lifetime Income survey of pre-retirees found that 48% were anxious that their savings might not provide enough for them to live on in retirement.

"What we're talking about is peace of mind," said "Friends Talk Money" co-host Terry Savage, a nationally syndicated personal finance columnist and author of "The Savage Truth on Money."

A good starting point for determining how much you can afford to withdraw from retirement savings each year is what's known as "the 4% rule." It was developed by financial planner William Bengen 26 years ago.

The investment world of 2020 is a lot different than it was in 1994 when Bengen conceived the 4% rule.

How the 4% Rule Works

Bengen's number-crunching, based on longevity statistics and historical investment returns, found that you could withdraw 4% of your retirement portfolio in the first year and then 4% in each successive year for 30 years, adjusted for inflation.

But the investment world of 2020 is a lot different than it was in 1994 when Bengen conceived the 4% rule. "The four percent rule is a guide," Frisch said.

The 4% rule is based on a retirement portfolio that's invested 50% in stocks and 50% in bonds. "But that may not be your diversified portfolio," Savage said. "It's really critical that you just don't stick blindly to the rule."

Frisch said he anticipates interest rates remaining low for the next couple of years. "And ultimately, that is a big disadvantage to retirees," he said. That's because low rates mean low returns on bonds and savings accounts.

If you're not earning very much on your retirement investments, you can't afford to take out very much. So, a 4% withdrawal rate might be too high in today's investment world.

The 4% rule also doesn't take into account what you'd like to spend money on in retirement (like traveling, if possible) or what you'd need to (a new car) and when. Nor does it factor in rising health care costs and the possibility of long-term care costs.

As I said in the podcast, during retirement, "your needs change and the investing world changes."

The BlackRock LifePath spending tool might be helpful. It's a free, simple and blunt calculator to estimate your retirement spending.

What the 4% Rule Leaves Out

The 4% rule also doesn't account for future changes in the tax rules. You might wind up owing more, or less, in taxes during retirement than under the current tax system.

"Friends Talk Money" co-host Pam Krueger, co-host of MoneyTrack on public television and founder of Wealthramp.com, which vets financial advisers, raised another concern about the 4% rule: "We don't know how long we're going to live."

Bengen's 30-year yardstick might be fine in general, but what if you wind up living for 40 years in retirement?

I said in the episode that I'd veer towards the conservative view of the 4% rule, suggesting that retirees try to take out less than 4% this year and in the next few years while interest rates are low.

My co-hosts and I also thought retirees should reevaluate their withdrawal rate every year based on their personal circumstances, the economy, inflation, investment returns and tax law changes.

"You need to deviate from the rule knowing that your life is dynamic," said Krueger.

A sharp financial adviser could provide guidance for a holistic, evolving financial plan, too, said Savage.