How to Help a Nonworking Spouse Save for Retirement

A spousal IRA can plump up the size of a couple's nest egg

It can happen to any married couple. After both spouses diligently save for retirement their entire working careers, one of them suddenly is thrust out of a job.

Many of those unfortunate unemployed people had fully expected to continue deferring funds from their salaries to build nest eggs ahead of retirement 10 to 15 years out.

What to do now?

Retirement Saving for Unemployed Spouses

Here’s what the out-of-work spouse should not do: Put retirement savings on hold. That could have serious negative consequences for his or her financial future.

If your spouse has been laid off, is currently in between jobs or is missing work for an extended period of time due to illness or injury, it’s important to take steps to help him or her contribute to a retirement savings plan. While there are a few options available, an underutilized and excellent option to consider for a nonworking spouse is a spousal Individual Retirement Account (IRA).

How Spousal IRAs Work

The spousal IRA, formerly sometimes known as a homemaker IRA, was retitled the Kay Bailey Hutchison IRA in 2013, after former Republican Sen. Hutchison — a strong advocate for getting individuals to take advantage of IRAs.

A spousal IRA is much like a regular IRA, except it’s opened in the name of an unemployed spouse. To be eligible for one, you must be married, file taxes jointly and contribute an amount equal to or less than you and your spouse’s combined earned income for the year.

Here’s an example:

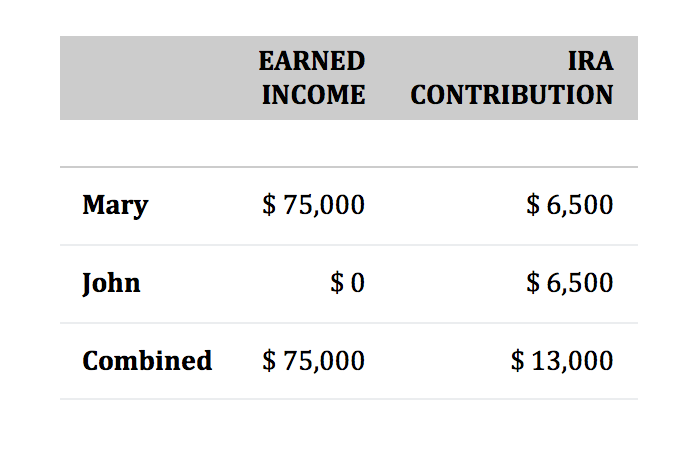

Mary is 55, works full-time as a teacher and has been married to John for 30 years. They’ve consistently contributed to their retirement funds. John, a 58-year old electrical engineer, is suddenly laid off and does not expect to earn any income this year. If Mary and John will file taxes jointly, John may be eligible to contribute to his own IRA based on his wife’s earned income, with a maximum contribution of $6,500:

Here’s why that’s a good idea: When saving for retirement in an IRA, a couple may be able to reduce their taxable income by the amount of the spousal IRA contributions. For 2015, the maximum IRA contribution is $5,500 or, if you’re 50 or older, $6,500. That’s true for spousal IRAs, too. Any gains on your account won’t be taxed until you take money out in retirement. (You may be able to deduct your IRA contributions, too, depending on factors such as whether your spouse is covered by a retirement plan; consult your tax adviser.)

As with a regular IRA, any spousal IRA withdrawals before age 59½ are generally subject to a 10 percent tax penalty in addition to normal taxes due. One caveat: If you will be 70½ or older by the end of the year, you won’t be eligible to make a spousal IRA contribution, even if your spouse is younger.

The Benefits of Spousal IRAs

Couples should remember that helping your nonworking spouse save for retirement can be equally as important as funding your own —after all, retirement assets are usually shared. While the maximum annual contribution limit may not seem a significant amount of money, contributing that amount every year could make a real difference in a couple's retirement savings over time.

If you or your spouse is not working, see if you meet the criteria for spousal IRA eligibility, and, if so, consider investing in one. Meet with a financial adviser to determine which retirement options are right for you.

© 2015 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017