How to Retire With Enough Money

Tips from that new book's author, plus how she'd change 401(k)s

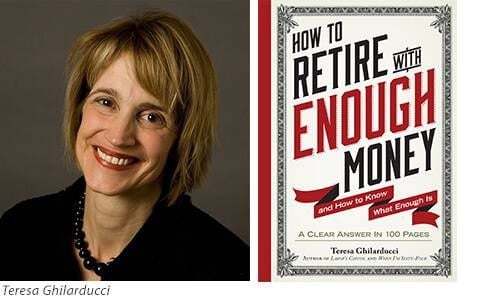

The last person I’d expect to offer optimism and advice about Americans and retirement is Teresa Ghilarducci, the fiery economics professor at the New School for Social Research. And yet, that’s exactly what she does in her new, friendly, slim book, How to Retire With Enough Money and How to Know What Enough Is: A Clear Answer in 116 Pages. I recommend it.

U.S. News once called Ghilarducci “the most dangerous woman in America” for her provocative proposal to replace the voluntary 401(k) system with a mandated “Guaranteed Retirement Account” with contributions of at least 1.5 percent of pay by all workers and employers (just explained in detail in The New York Times). Ghilarducci still thinks 401(k)s are flawed, but she believes it’s nevertheless possible to retire comfortably if you do a few things right — and don’t do a few others. For a prosperous retirement, however, Ghilarducci writes that people who are 55 need to save 30 percent of their incomes (good luck with that).

I just interviewed her for details. Highlights from our conversation:

Next Avenue: You say that we’re in the Do It Yourself System of Retirement Planning. How long has it been that way?

Prof. Teresa Ghilarducci: Ever since 401(k)s were marketed [in the 1980s] and companies discovered that having a 401(k) was cheaper than a defined benefit pension plan, so they replaced pensions with 401(k)s. The very name 401(k) announces its accidental nature; an obscure part of the tax code has become the main vehicle for employees to save for retirement and for employers to provide a retirement benefit.

And how is the Do It Yourself System working out?

The experiment is failing. We don’t have bad humans; we have a badly designed system.

How is it badly designed?

The design requires consistent and high levels of contributions that are not realistic, unless employers and employees are engaged. In 2008, we saw that firms quite rightly did everything they could to survive and 20 percent stopped their 401(k) match.

Employers have to choose investments to offer and they’re getting advice from conflicted advisers who earn money without necessarily taking into account the best interests of employers and employees.

Other design flaws could make even the most disciplined, well-educated employee fail: there are limited investment choices and the design allows withdrawals before retirement.

Another design flaw in the 401(k): workers are forced to pay retail fees. The old-fashioned pension plans were pooled and professionally managed, with wholesale fees.

Are we in a retirement crisis or heading towards one?

There is a new group of experts who I call ‘retirement crisis deniers.’ They say people will have enough to maintain their pre-retirement standard of living, which is to say that middle-class workers will be middle-class retirees. They’re wrong.

Why?

I don’t accept that people will be able to adjust their consumption standards as much as their incomes in retirement and I’m fearful that people won’t be able to work as many hours or as long as the deniers expect.

The retirement crisis is starting, and we see it in cities and states because their budgets are being impacted by increasing numbers of old people using emergency housing and emergency food services. A lot of adult daughters are having to organize the health and financial architecture of their older parents’ lives. That’s all part of the DIY system.

There’s also stress associated with managing a DIY system, and stress leads to higher cortisol levels and heart attacks and strokes.

And about half of American workers don’t have access to 401(k) plans, often because they’re self-employed, part-timers or work for small businesses.

Employees at medium-size firms often don’t get 401(k)s, either. Employers have thrown up their hands and not bothering to have them.

The self-employed can set up IRAs but many don’t. Why not?

There are three design flaws: The tax break hardly makes it worthwhile to go through the administrative burden of setting one up. IRA fees can be very high and the choices among investment vehicles are bewildering — the pimply-faced guy in a windowless room at the bank is trying to sell you assets that make the company rich, not you. And the third design flaw is that the IRA doesn’t pay out like a pension; there’s no way to have a lifetime annuity with it.

You believe there is hope for the average person trying to create a secure, comfortable retirement. What do people in their 50s or 60s need to do?

This may sound like I’m a diet guru, but investing in your joint health and heart health can save you lots of money. If you don’t want to eat apple and would rather eat pie, think of it in terms of dollar bills: eating the apple may stave off diabetes, so you’ll have lots of cash you’d otherwise pay at the drugstore,

How should people invest for retirement?

In plain vanilla, low-cost stock and bond index funds.

What should people do for housing in retirement?

Stay in your house until it’s paid off. Renting is risky because rents will increase, but you don’t want to take on a mortgage after 50. Don’t get into debt in retirement at all.

A growing number of retirement experts, such as Prof. Alicia Munnell at Boston College, now recommend some homeowners increase their retirement income through reverse mortgages. What’s your view?

I’m not there yet.

What about working longer — either full-time or part-time in retirement? Is that realistic and possible?

Planning to work in retirement is a faith-based plan. Faith is not a plan. Most people say they will work in retirement but most retirees don’t work, due to age discrimination and their own health capacities.

You think people should try to delay claiming Social Security?

Yes. Delaying collecting Social Security for even a year or two will help people in retirement. It’s the best deal on the planet by delaying; you get 8 percent more from Social Security if you start collecting it at an older age.

You also say there are a few things people shouldn’t do in retirement, like living with your kids when you’re retired. Why not?

Often, people with low retirement balances have children going through their own struggles. Plus, it reduces dignity.

You say another bad idea is to move to a state with lower taxes. Why?

Because you lose too much by moving. Retiring in place, gerontologists tell me, adds to your emotional well-being and slows dementia. Isolation is a huge risk in retirement and moving to save on taxes increases your chance of isolation.

What do you think should be done to keep Social Security solvent?

I think they should raise the earnings cap on Social Security and get more revenue into the system and that we should start edging up the FICA tax. We should also raise the tax to add long-term care insurance to Medicare.

Ultimately, to help Americans retire, you’d like to see the voluntary 401(k) system replaced with a mandatory system that would have what you call a Guaranteed Retirement Account.

Yes. Congress should mandate that. Twenty-three states are passing that kind of law and Congress should mandate savings on top of Social Security.

Will that happen?

I think it will happen. Not tomorrow, but sooner than I thought a few years ago. Boomers are getting older and more worried and they vote.

If you could ask the Presidential candidates one question, what would it be?

‘Do you think all hard-working Americans deserve a secure retirement after a lifetime of work?’ They’d have to say ‘yes.’ So then I’d say: ‘If so, do you support a plan to help people save for their own retirement like mandated savings on top of Social Security that would be safe from government cutbacks, employer cutbacks and from workers taking out the money for emergencies?’

No, not ‘mandated’ — ‘universal savings.'

Finally, you say that although the rule of thumb is that people will need 70 to 80 percent of their pretax pre-retirement income in retirement, you’re aiming for 100 percent yourself. Why?

I want what most people want: To have a little bit higher standard of living to enjoy myself.

How are you doing it?

I force myself to save and to live in a much smaller place than mortgage brokers would tell me to. I’m living beneath my means.