How Wall Street Hijacks Your Money

'Uninvested' author Bobby Monks says it's time to fight back

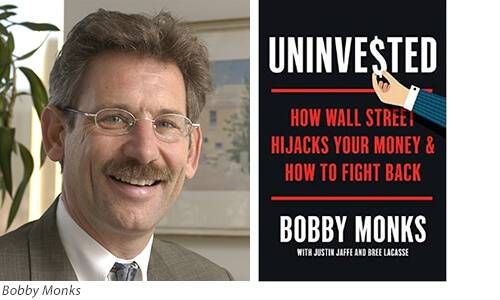

Robert C.S. “Bobby” Monks, author of Uninvested: How Wall Street Hijacks Your Money & How to Fight Back, is the 2016 version of Network’s Howard Beale — if Beale had financial advisers and Wall Street in his sights instead of TV networks.

Monks is anything but a small investor, though small (and, to some extent well-off) individual investors are who he’s hoping to help with this book, co-written with Justin Jaffee and Bree LaCasse.

Monks was chairman of Spinnaker Trust, where he managed over $1 billion in assets, and the former chairman of Institutional Shareholder Services, the leading provider of corporate governance and proxy services. He’s also the founder and director of Atlantic Bank and a serial entrepreneur who has founded, led and grown 19 businesses — from real estate to technology.

In Uninvested, Monks and his co-authors rail against advisers who don’t put their clients’ interests first; dense mutual fund prospectuses that are painful to read (they note that Fidelity Magellan Fund’s “Statement of Additional Information” has 39,000 words and goes on for 56 pages — some statement!) and an investment regulatory system that’s ridiculously out of whack.

I spoke with Monks, who splits his time between Maine and New York, about how he thinks Wall Street is hijacking investors’ money and what we can do to fight back. Highlights:

Next Avenue: Why did you write this book?

Monks: I have a good idea what goes on under the tent, and as I became older, it became clear to me the average investor is systematically taken advantage of.

That’s not to say that all 401(k)s, mutual funds, investment advisers or money managers are bogeymen, but the system has evolved to the point where it’s dysfunctional and takes advantage of investors.

Ninety percent of financial advisers don’t have to put the interests of their clients first. That’s not a good thing. [The U.S. Department of Labor is working on what’s known as the “fiduciary standard” rule to deal with this.]

And the fees that folks are charged is a problem. If you talk to a registered investment adviser or a financial adviser and ask what fees am I being charged, a lot of times, they don’t even know. Because the fees are multi-layered: there’s the adviser’s fee, the mutual fund fee, trading costs and hidden fees within a fund that are not disclosed.

It’s really important to have a functional investment process in this country. If you don’t, it’s not healthy for capitalism.

You say that no one is watching while investors sleep. What do you mean?

There are a variety of regulator organizations; the biggest is FINRA, which is a self-regulatory organization. It’s essentially paid for by the people it’s supposed to regulate, so there’s an inherent conflict of interest there.

The SEC [Securities and Exchange Commission] has been underfunded for many years. It has a huge responsibility for regulation and doesn’t really have the resources to do it, so it can’t enforce the basic rules.

Like what?

For example, the readabilty of prospectuses and other financial forms. By law, they have to be easily understood. In reality, they are anything but readable.

In your book, you write about what you call ‘Willard’s Way’ to invest. What is that?

Willard Libby is an interesting character. He’s the father of a longtime friend. He had no background in finances, but researched companies he liked and invested in a small number of companies over the years, held onto them for a long time and kept meticulous records, checking his stocks every two weeks. He did very well investing this way up to his 90s.

Picking stocks of companies you’re familiar with is as good as anything else and the fees are so much lower than investing other ways.

Do you think investors shouldn’t buy mutual funds due to hidden and high fees and should only buy individual stocks?

I think buying stocks is one option. Diversification can be accomplished simply by investing in stocks of multinational corporations that are very diversified.

What we are advising isn’t a particular methodology of investing.

One option is to invest in an index fund [which might buy the market as a whole]. But the problem is: How do you know which one to invest in and when to buy it and when to sell it? If you pay to hire someone to tell you when to sell, that defeats the point of a low-cost index fund.

You envision something called a Cooperative Investment Partnership or a CIP, which you say would be the optimal money management arrangement. How would it work?

The CIP came out of my experience on the board of a mutual insurance company. If the company made a profit, it distributed money back to customers. We are trying to copy that model. We’re hoping to get it started by February of next year.

Why haven’t investors fought back?

I’m not sure folks understand they have the power to sit down with a money manager and ask a series of questions, and if they don’t like the answers, they can pick up their money and walk. People go to a firm with a fancy office and address and just hand over the money.

So how can investors fight back?

Ask your money manager: Do you have to put my interest first? Can you tell me how many fees I’m charged? Do you invest in the same stocks you’re putting me in and, if not, how come? If you’re not happy with what you hear, go to somebody who can answer those questions.