Investments and Politics: A Dangerous Combination

The truth about presidential elections and stock market returns

Investors are frustrated. They love certainty, but we are living in one of the most uncertain times in history.

If COVID-19 wasn't creating enough uncertainty, the upcoming elections sure are. Many investors are asking if they should alter their portfolios based on the election's results. The common assumption is that presidents – and their policies regarding taxes and regulations – will directly affect stock market returns.

They're wrong, and as a result, too many investors make the huge mistake every election season of letting the vote influence their investment strategy.

It's a classic case of behavioral finance. When your candidate wins, you are happy and thus optimistic about the nation's future (if only for the next four years) – and your emotional high may cause you to increase the amount of money you have in stocks and stock funds. The result: you could end up with too heavy an allocation to stocks, and therefore too much risk relative to your long-term personal financial goals.

Similarly, when your candidate loses, you are disappointed and thus pessimistic about what lies ahead for the next four years. Your negative views may cause you to sell some of your stocks – or even "go to cash" entirely. The result: You could end up harming your ability to achieve your financial goals.

Here's the better course of action. Every election cycle, you should look at your investment strategy and…do nothing. And history shows why. My colleagues and I examined the returns of the S&P 500 Stock Index from 1948-2019, based on which political party controlled the White House, Senate and House of Representatives.

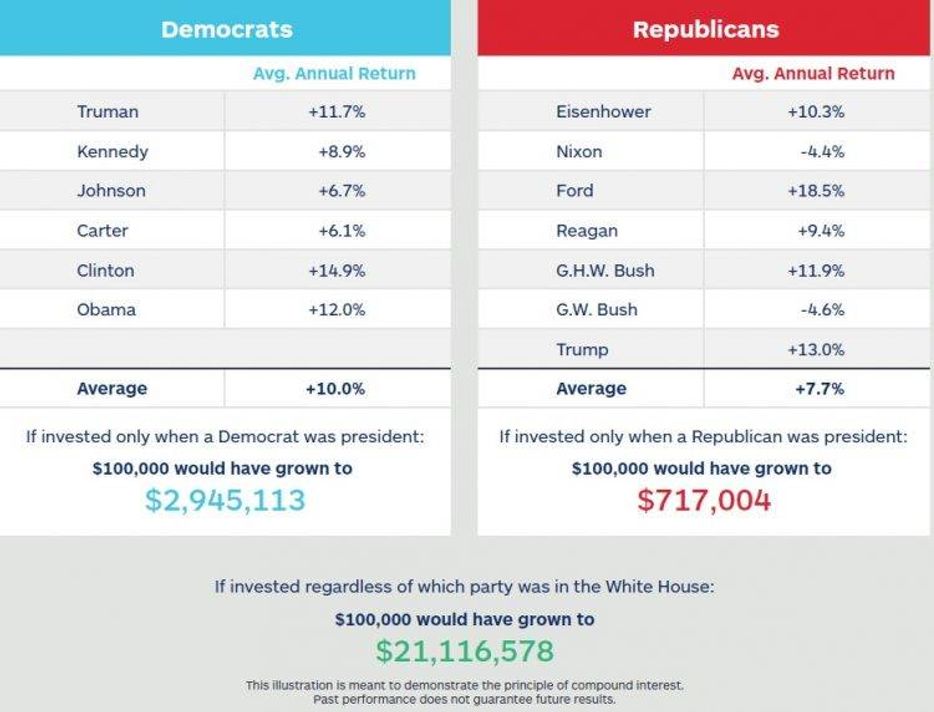

Although Republicans have a reputation for being more "business friendly," returns have been better on average when Democrats occupy the White House, as shown in Figure 1. But investing only when Democrats are in the West Wing is a mistake, because history shows that wealth can be created by being invested consistently – regardless of which party is in power.

But looking at the presidency isn't enough; we must also consider Congress, which wields considerable power regarding tax law, economic policy and regulations. Of theeight possible combinations, one never occurred and two happened so rarely that the result was statistically inconclusive.

All of the remaining five possibilities, shown in Figure 2, showed positive average annual returns. And look closely at what happened when there was a sweep: Republicans controlling all three chambers produced average annual returns of 15.9%, while Democrat sweeps generated 14.5%. Both are outstanding – and well above the S&P 500's average annual return of 10% per year since 1926.

So much for fearing that the results of the election will directly impact your investments.

Yes, it's important for you to be politically engaged. But that's very different from letting your political views sway your investment strategy. When it comes to achieving financial success, don't mix your investments with your politics.

After all, money is green – not red or blue.

For help with your investment strategy, talk with an Edelman Financial Engines Advisor.

Sources: Bloomberg, Library of Congress, Senate.gov, History.House.gov, Figure 1, Figure 2

An index is a portfolio of specific securities (common examples are the S&P, DJIA, NASDAQ), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index.

All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1348570

Edelman Financial Engines is committed to always acting in the best interest of our clients. We believe that all American investors – not just the wealthy – deserve access to personalized, comprehensive financial planning and investment advice. Today, we are America's top independent financial planning and investment advisor with 158 planner offices across the country and entrusted by more than 1.2 million clients to manage more than $220 billion in assets1. [1] As of June 30, 2020.