How Parents Can Help Their Financially Anxious Millennials

Four surveys show where kids of boomers and Gen Xers could use nudging

Millennials seem to have it all going on: They’re confident, tech-savvy and understand the importance of work/life balance far better than many of their boomer and Gen X parents. Turns out, though, new studies show that Gen Yers (roughly 80 million in their 20s and 30s) are financially anxious about money. They could use some advice — especially Millennial women — and their parents might be just the ones to offer it.

Four financial services and tech firms recently came out with surveys about Millennials; their findings are fascinating, worrisome and hopeful.

69 Percent of Millennials Want to Get Over Their Money Anxiety

The most interesting, and comprehensive survey, is the 2017 Wells Fargo Millennial Study, which surveyed 1,771 Gen Yers to gauge their happiness and financial knowledge. A key finding: 69 percent of Millennials say they want to get over their anxiety about money.

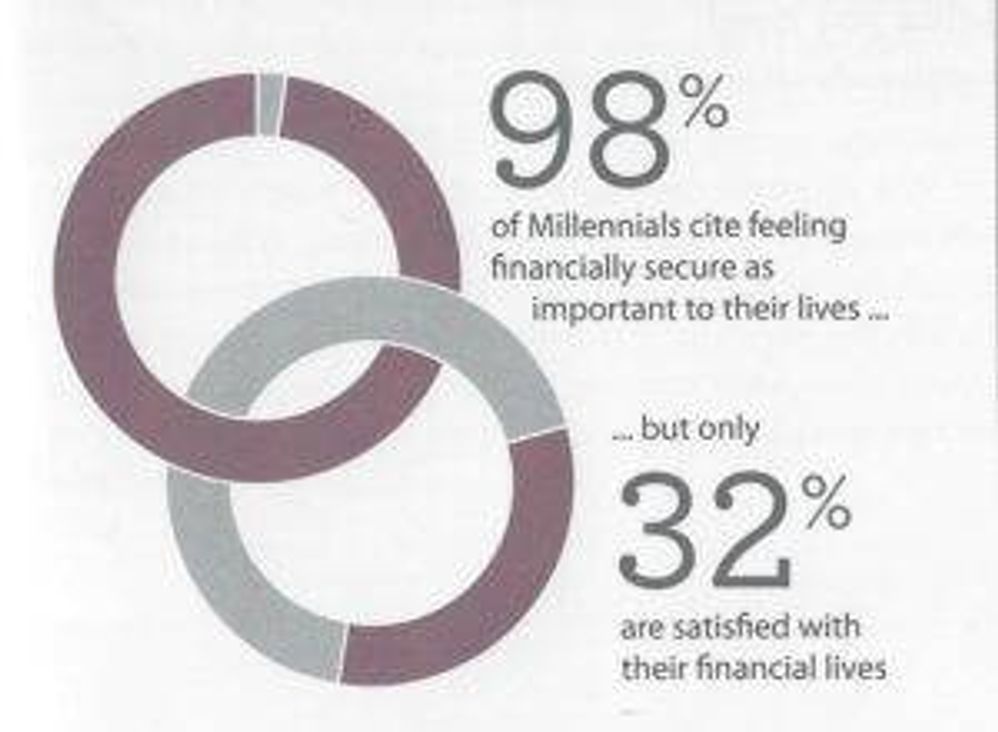

Although 98 percent of the Millennials Wells Fargo surveyed said feeling financially secure was the most important aspect of their lives, just 32 percent said they were satisfied with their financial lives. (By contrast, 56 percent were satisfied with their family relationships.)

“Millennials tend to put their money worries in a box, separate from the rest of their lives,” said Kristi Mitchem, president and CEO of Wells Fargo Asset Management, at a media event about the survey. “ They need to take them out of the box and deal with the things they can.”

Some of the Millennials’ money worries are based on what they’ve been saddled with and others are ones of their own doing.

Student Loan Debt and Millennials

Among the former: student loan debt. In the Wells Fargo survey, 40 percent of Millennials said they had a significant amount of student debt.” Median amount for the Class of 2014: $29,000. “Debt still remains a roadblock for Millennials,” said Paul Kelash, vice president of consumer insights for Allianz Life, whose firm just released its Generations Ahead study. “How they handle this debt will play a large role in their ability to prepare financially for retirement.”

Among the latter worries: overspending. In the Generations Ahead Study from Allianz Life Insurance Company of North America — which surveyed 1,000 Millennials — 63 percent described themselves as spenders and half said they spend more on going out than on rent or mortgage.

Spending Is an Issue

Nearly one in five Millennials Allianz surveyed (17 percent) admitted they spend money “as soon as I get it.” By comparison, only 6 percent of boomers surveyed said they spend money that way. Reliance on debit cards and easy mobile payment services like Venmo, where spending money doesn't always feel real, is part of the reason.

“Although Millennials are showing signs that they understand the importance of actively planning for their retirement today, they are not immune from some bad habits that could derail their positive start,” said Kelash.

Understanding the Importance of Retirement Planning

One example that they understand the importance of actively planning for retirement today: “Millennials started saving for retirement earlier than many Gen Xers,” said Kelash.

A Capital Group survey says that 91 percent of Millennials are saving for retirement through 401(k)s or IRAs. It also found that retirement savings ranks second only to paying rent or mortgage as a financial priority for Millennials.

According to Allianz, Millennials have a median retirement savings of $35,000 — the same amount as the older Gen X cohort.

'Saving the Earth While Saving for Retirement'

Some are investing in the stock market, especially in what they consider to be socially-responsible stocks, mutual funds and ETFs. In the Wells Fargo survey, 58 percent of Millennials said they’ve either chosen stocks or funds they think have a positive impact on the world or have considered doing so.

“Saving the earth while saving for retirement,” Frederik Axsater, executive vice president and head of strategic business segments at Wells Fargo Asset Management, calls it.

How Technology Is a Help

Millennials — no surprise — are also keen on using tech to help them manage their money.

Allianz’s survey said 70 percent of Millennials use online apps for this purpose. “Apps are a way of life for most Millennials, so it’s logical that they would look to technology for assistance in helping them meet their saving and spending goals,” said Kelash.

In a new Varo Money survey, 47 percent of Millennials said they were interested in mobile apps from their banks that would let them automatically pay bills and analyze their cash flow; 43 percent would like to set up automatic savings this way and 41 percent want a bank mobile app to analyze their spending patterns.

Discouraging News About Millennial Women

But Millennial women don’t seem to be taking money management as seriously as Millennial men.

The Wells Fargo survey asked Millennials five statements about personal finances (such as “I am saving enough for retirement” and “I feel in control of my financial life”) and although 55 percent of men responded positively to all five, only 45 percent of women did. Just 62 percent of the women said they feel in control of their financial life, while 78 percent of men did.

What’s more, 82 percent of Millennial men said they were the primary decision makers for investments and retirement planning but only 59 percent of Millennial women did.

“This is a call to action for Millennial women,” said Mitchem. “They’ve fallen into a gender divide regarding how to apportion tasks in a relationship. What’s concerning is that this is a very old paradigm. But this paradigm has legs into a generation known for equality. We’ve got to get women to break out of these traditional gender roles.”

How Parents Can Help Their Millennial Kids

The boomer and Gen X parents of the Millennial women can help, by talking with their daughters about money management and offering advice. The parents can do the same for their Millennial sons.

“Ask your Millennial children: ‘Are you saving for retirement? If not, here’s how to get on the path. Do you set financial goals? If not, here’s how to set goals,'” Mitchem said. “Make them feel more in control of their financial life.”

Those conversations, Mitchem added, will help the Millennials be happier in their lives.

The Wells Fargo survey found that 62 percent of Millennials consider themselves happy in general, but a stunning 79 percent who answered positively to the five questions about money management said they consider themselves happy.

Most Millennials are confident they’ll be able to fund their life goals, the Allianz survey noted. “Ultimately, Millennials are an optimistic generation and believe in their ability to take action and achieve success on their own terms.” A little nudging from their parents could turn that confidence into reality.