Where to Invest for Income When Rates Are Rising

You might consider pass-through securities to avoid the risks of bonds

In recent years, extremely low interest rates on government bonds and high-quality corporate bonds have failed to provide an acceptable level of income for retirees and other investors. As a result, investors have sought higher income from alternative sources such as high-yield bond funds and dividend mutual funds.

But as the U.S. and global economies have been experiencing stronger growth, interest rates have been rising, which means prices of bonds and bond funds are falling. This makes holding high-yield bond funds riskier. Similarly, dividend funds may also face lower values as rates rise and equity markets adjust to lower levels.

One strategy to avoid these potential pitfalls is to instead invest in what are called pass-through securities. These are required to pay out almost all their earnings in cash distributions. As a result, pass-through entities don’t pay corporate taxes and can pass along to investors their earnings before taxes, avoiding double taxation.

4 Categories of Pass-Through Securities

There are four broad categories of pass-through securities:

1. Closed-end funds: These are composed of a specialized portfolio of securities actively managed by an investment adviser and typically concentrated in a specific industry, geographic market or sector.

They can be debt or equity-based funds that invest primarily in bank loans, high-yield securities, foreign securities (including those in emerging markets) and mortgage- or asset-backed securities.

Closed-end funds must distribute substantially all their income to shareholders.

2. Real estate investment trusts (REITs): They can either invest in income-producing real estate properties or in mortgages. Some, known as hybrid REITs, invest in both.

REITs must distribute almost all their income to shareholders.

3. Asset management and business development companies (BDCs): A BDC is an organization that invests in, and helps, small- and medium-size companies grow in the initial stages of their development. Asset management firms structured as partnerships are also eligible.

BDCs must distribute substantially all their income to shareholders.

4. Master Limited Partnership (MLPs): These include energy production, transportation and processing companies. An MLP must generate 90 percent of its revenue from natural resources — energy pipelines, energy storage, commodities or real estate.

Diversification Through Pass-Through Securities

Investing in only one of the four broad categories of pass-through securities, however, exposes income investors to interest rate and overall market valuation risk, as well as industry or market-specific risks. That’s why investors may be better off with a diversified pass-through securities fund. (Full disclosure: GraniteShares sells the HIPS U.S. High Income ETF, a diversified pass-through security fund.)

A diversified approach may reduce the risk that the portfolio will decline in value, while also providing the potential for high income.

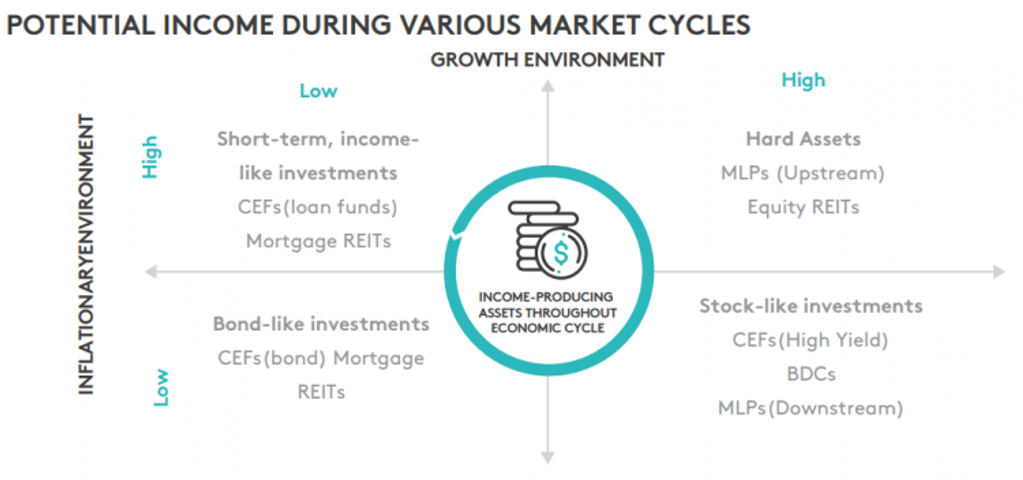

The diagram below illustrates how certain pass-through securities perform during various market cycles, seeking to preserve capital while at the same time attempting to provide investors with high income.

As the market cycle continues, potentially leading to higher rates with lower growth, short-term, income-like investments may provide better performance. Similarly, if concerns of recession or depressed growth recur, bond-like investments in a lower-growth, lower-rate environment could potentially provide better performance.