5 Ways to Retire Without Money

How one writer suggested doing it nearly 60 years ago

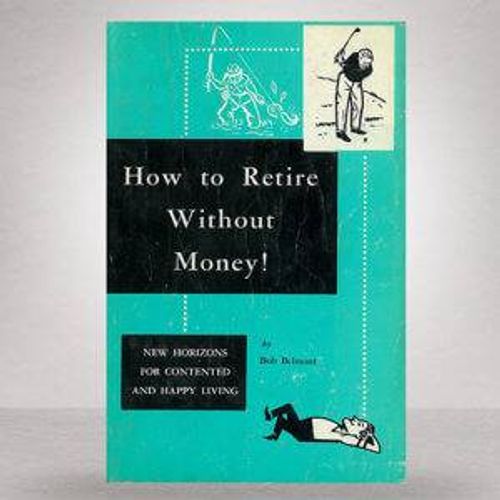

Nearly 60 years ago, a writer calling himself Bob Belmont published a modest little book with an immodest title: How to Retire Without Money! You aren’t likely to find it in your library, but you might come across a copy at a used book sale, as I did recently. I think I paid a quarter for it — and it was worth every penny.

Today, with nearly half of U.S. households reporting zero retirement savings, according to the nonpartisan Economic Policy Institute, Belmont’s book seems decidedly ahead of his time; I’ll share five of his ideas shortly, with some appropriate updates for 2017.

From Sci-Fi Writer to Retirement Adviser

Under the name of Mack Reynolds (more formally Dallas McCord Reynolds), “Belmont” was among the most prolific science fiction writers of his day. He would also gain immortality — or at least a lasting footnote — in the world of Star Trek, as the author of the first novel based on the TV series, the 1968 juvenile book Mission to Horatius.

One of Reynolds’ sci-fi specialties was conjuring up alternative economic systems and utopias in far-off galaxies. He did it by drawing, in part, on his Socialist upbringing and an early career as a Socialist Labor Party organizer. His father, Verne, had been the party’s presidential candidate in 1928 and 1932.

With that kind of background, writing about an idyllic retirement where cash was of little consideration might not have been a total stretch.

First published in 1958, when the author was around 40, How to Retire Without Money! seems to have been his only detour into the mysterious universe of retirement planning.

Raising Mynah Birds

Besides its value as a historical curiosity — with, for example, tips on raising talking mynah birds for fun and profit and buying adobe houses in Taos, N.M., for $500 and flipping them for $1,000 — what can today’s reader take from it? More than a little, I’d say.

As much a manifesto as a how-to guide, How to Retire Without Money! laid out a philosophy of a productive and fulfilling post-work life that’s likely to resonate with many of today’s generation of active retirees, regardless of how much money they have.

Well, Maybe Not Retiring Without Any Money

Despite the over-the-top premise of his title, Belmont tried not to overpromise. By “retire,” for example, he noted that he didn’t mean “a life of complete withdrawal from the world and no activity beyond a 24 hour day loafing.” He had known people in that situation, he said, “and they are seldom happy.”

He also hedged a little on the “without money” part; arguing that a happy retirement could be achieved on an income of $100 a month or, in a pinch, $50. That’s roughly the equivalent of $850 a month or $425 today — $10,200 or $5,100 a year.

The Book's 5 Key Points to Retire Frugally and Happily

How might you pull that off? Our author had no shortage of notions, many of which still ring reasonably true. Among them

1. Where you retire makes a big financial difference. Belmont focused much of his book on the question of where to retire, urging his readers to consider some unconventional, less-costly possibilities: houseboats, trailers and small farms, to name a few.

He was also big on artists’ colonies, like Sarasota and Colorado Springs, where life was unpressured and housing seems to have been available for a song (or possibly the occasional painting). He singled out “bargain paradises” in the U.S. and abroad — from the Gulf Coast of Florida and the Ozarks to places in Mexico, Greece and Morocco. Belmont and his wife seem to have lived in all of those places and many more, eventually settling in San Miguel de Allende, Mexico.

Many of Belmont’s paradises have long since ceased being bargains, alas (current average price for a single-family home in Colorado Springs: about $299,000). But his point on reining in housing costs is as valid as ever.

Fortunately, advice on that subject is even more abundant today than it was in Belmont’s time. Amazon.com lists of a raft of “where to retire” guides and sites like the Retirement Living Information Center and International Living are also rich resources.

2. Saving can be satisfying. Though Belmont didn’t believe people needed piles of money to retire, he didn’t advise starting out broke, either.

“Make a hobby of saving money,” he suggested. “Eat cheaper food, move to a smaller apartment, keep your entertainment costs to an absolute minimum. When you realize that your goal is retirement, a complete escape from this rat-race which has driven you to desperation, you’ll find that a year’s time devoted to building up a basic amount of capital with which to get started, can actually be fun.”

A single year of frugality may not be enough anymore, but trimming some expenses pre-retirement can still pay off.

Plus, if your retirement savings are unlikely to support you in the style you’ve become accustomed to during your years working full-time, paring back now will mean a less jarring transition later.

3. Debt is a drag. Belmont’s view of debt was unambiguous and stern: “By whatever means it takes, get rid of it. If things are such that it will take a year for you to get free of your present debts, even by cutting every corner, then postpone retiring until you are free of them,” he wrote.

Many of today’s near-retirees are in even worse shape than those Belmont was writing for, not only carrying a mortgage or two but significant credit card debt as well. Maybe even student debt of their own or for their kids.

Most experts today would advise paying off high-interest credit card debt first. Mortgage debt, especially at today’s historically low interest rates, may be less urgent from a financial perspective, although retirees of my acquaintance say it feels liberating to pay off the mortgage and be done with it.

4. Busy beats idle. No hammock strung between the palm trees for our man Belmont. “By all means, if you retire, find some useful and soul satisfying activity to absorb your hours,” he wrote.

That might mean spending time with hobbies, he added, or finding the right kind of paying job. “Work while in retirement is healthful just as is exercise and recreation. But the work must be wholesome, interesting,” he explained. If you don’t enjoy it, you’ve just traded one rat race for another. (For a 2017 approach to the work-and-play in retirement notion, read this Next Avenue interview with the authors of the new book, Victory Lap Retirement.)

5. Tomorrow might be too late. If Belmont had one message he was truly passionate about, it was not to delay retirement so long that you’ll be decrepit (or worse) by the time you’re ready to enjoy it.

“If you put it off today, you will find even more reason to put it off tomorrow and a double amount of reason to put it off next month,” he wrote. “Until finally you will find it is next year, and five years and ten and you’ll look up someday and find that life has passed you by.”

The Book's Reception and the Author's Passing

How to Retire Without Money! was not without its critics, of course. One financial columnist groused, “I strongly urge anyone with more than 24 hours to live to avoid retiring without money.” And, according to some accounts, the book wasn’t well received in Socialist circles. It may have contributed to Reynolds leaving the party around the time of its publication.

Unfortunately for Belmont/Reynolds, he would barely reach traditional retirement age himself. He died in 1983 at 65, leaving behind an impressive shelf of science fiction and one quirky, but engaging, book of retirement advice.