Could the Retirement Crisis Be Overblown?

We'll 'course correct,' says a new Merrill Lynch/Age Wave survey

Could it be that, to paraphrase Mark Twain, the reports of the retirement crisis are greatly exaggerated? That’s the thrust of a Merrill Lynch/Age Wave study, Finances In Retirement: New Challenges, New Solutions.

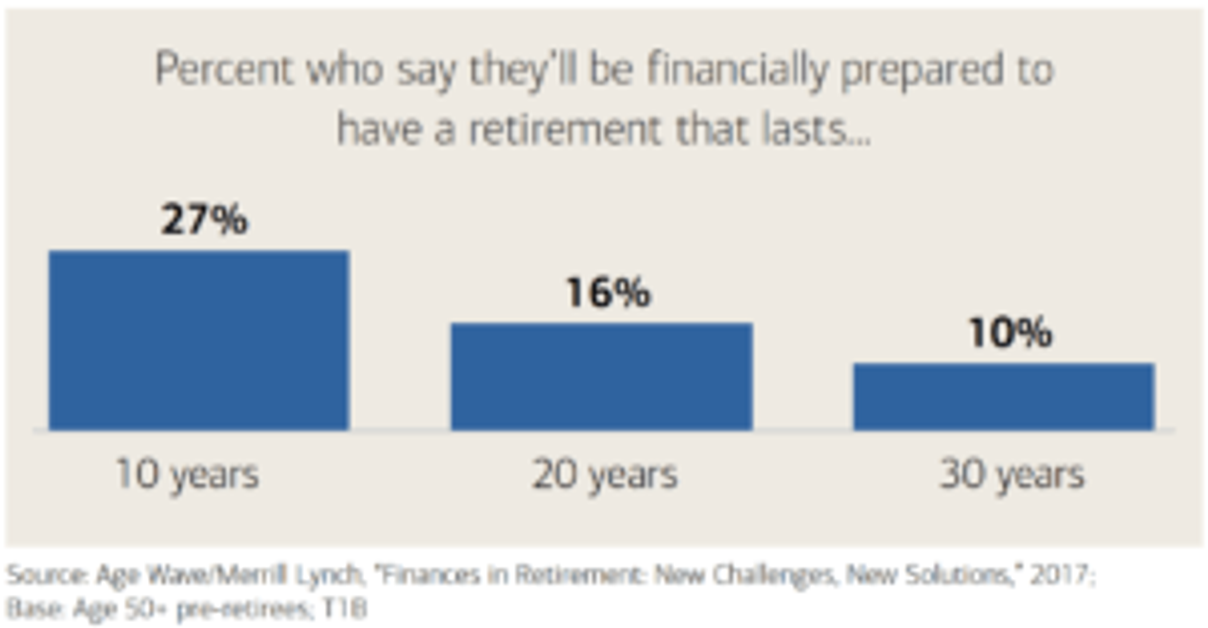

For the eighth and final installment in their series on life priorities and retirement, the firms surveyed 4,854 Americans age 25 and older, focusing on pre-retirees age 50+. They found that only 27 percent of the pre-retirees believe they’ll be financially prepared for a retirement lasting 10 years; 16 percent will for 20 years and just 10 percent say they’re on track for a 30-year retirement. But, they say, they’re willing to make a boatload of “course corrections” in all corners of their lives — finances, work, family, health, leisure and charity — to compensate.

Why the Retirement Crisis May Not Happen

“Thinking only about money is missing the whole person when we’re thinking of retirement," said Ken Dychtwald, president and founder of AgeWave and a 2016 Next Avenue Influencer in Aging. “When we dove into this study, we found people are thinking of the dimensions of their lives as currencies — activities and assets they could trade up or down or alter to make retirement more comfortable and secure.”

That left AgeWave and Merrill Lynch “feeling quite enthusiastic,” said Dychtwald.

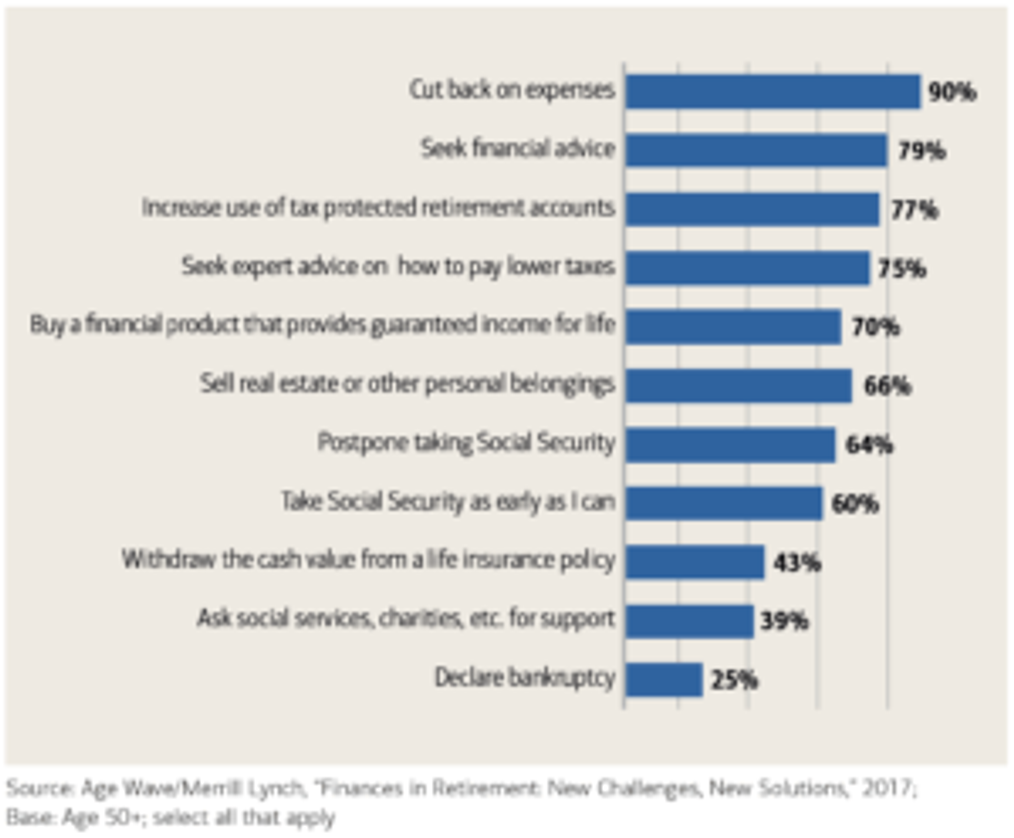

The tables included in this post show you some examples of intended course corrections, but the gist is this: If I won’t have enough money to retire the way I want, pre-retirees say, I’ll just cut expenses, stay healthier, work longer, downsize my home or give less to family and charity.

The 'Course Corrections' People Say They'd Be Willing to Make

A few examples of the course corrections pre-retirees say they’d be willing to make to have a more comfortable and secure retirement, in declining order (not good news for their kids or for charities):

- Make healthier choices to save money later: 91 percent

- Cut back on expenses: 90 percent

- Cut back on everyday leisure: 82 percent

- Limit or cut back on my donations to charities: 77 percent

- Volunteer my time/skills more and give monetary donations less: 75 percent

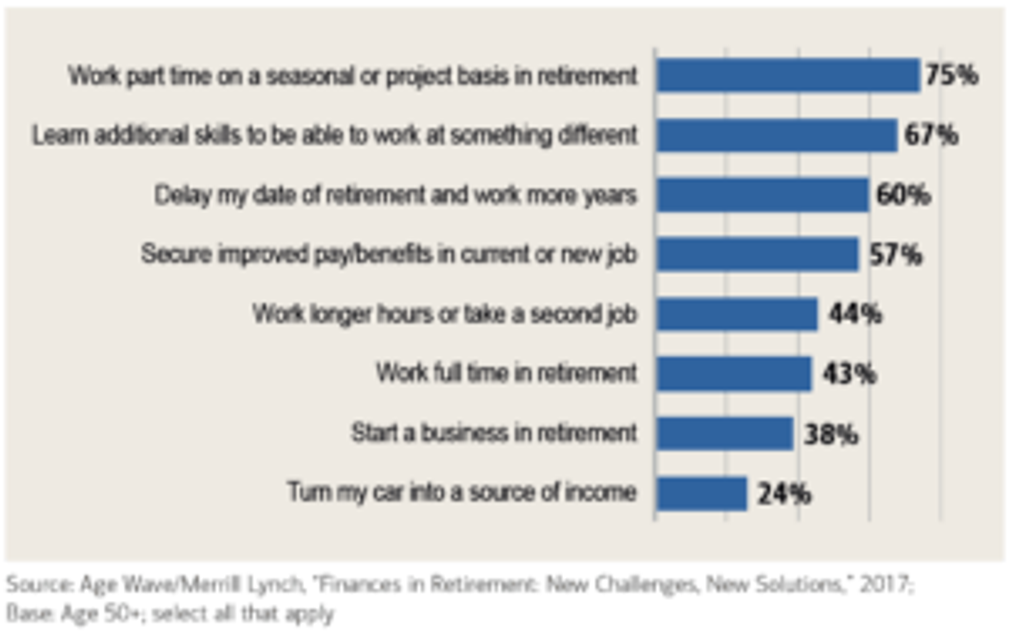

- Work part-time in retirement: 75 percent

- Downsize my home: 75 percent

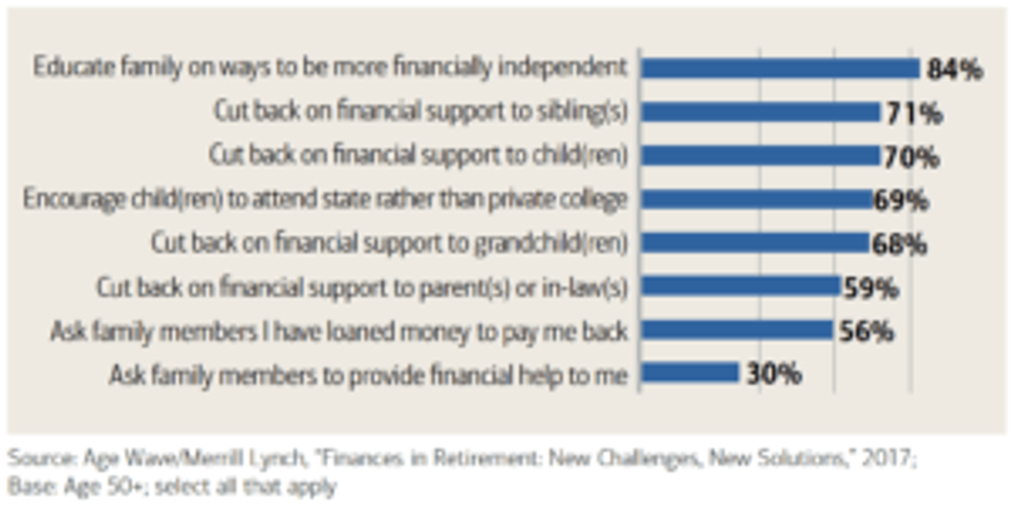

- Cut back on financial support to children: 70 percent

- Purchase long-term care insurance: 68 percent

- Move to a less expensive location: 67 percent

- Postpone taking Social Security: 64 percent (though 60 percent said they’d “take Social Security as early as I can” — puzzling)

- Turn a hobby into an income source: 62 percent

- Cut back on financial support to parents or in-laws: 59 percent

- Take a housemate or become a housemate: 28 percent

- Rent a room or part of my home on a short-term basis: 27 percent

- Turn my car into a source of income: 24 percent

Interesting, I think, that the pre-retirees are much more willing to cut back on financial support to their children than to their own parents. Dychtwald, who has written about “The Bank of Mom and Dad” before, agreed: “People said: 'I don’t want to cut back on my parents or in-laws; I love them, I owe them. Maybe my kids ought to be more independent, but they don’t know enough about money.'”

The question I have: Will people really make these course corrections as they approach, or in, retirement?

To me, they sound a bit like New Year’s resolutions. It’s easy to say you plan to do something; it’s quite another to actually do it.

Where the 'Course Corrections' Have Begun

Age Wave and Merrill Lynch, however, believe pre-retirees and retirees will. They point to a few examples demonstrating that some already have begun making course corrections.

“We’re now seeing more older people taking roommates, realizing they can’t afford to live alone. I was picked up at the airport yesterday by an Uber driver who was 78. The fastest-growing segment of people renting out their rooms for Airbnb is what they call 'modern elders,' said Dychtwald. “So there are lots of examples of people willing to make lifestyle corrections that provide more security. As more people do it, it becomes normal.”

Just ask retired engineer Rick Abell. He told reporter Glenn Ruffenach in the recent article, “The Biggest Surprises in Retirement,” in The Wall Street Journal: “If you want to have a comfortable retirement, sacrifices are necessary while working.”

And, Dychtwald added, “in coming decades, when millions of boomers have to decide whether they want an unpleasant retirement or whether they might move or work a few extra years, things will fall into place a lot easier.”

Kevin Crain, head of workforce financial solutions for Bank of America Merrill Lynch, agreed. He thinks we’ll see more course corrections occurring as more people see their friends, relatives and colleagues making them. Today, said Crain, pre-retirees have “a lack of role models.”

Living Longer, Retiring Sooner

But here’s the knotty problem: Americans’ average life expectancy has been steadily climbing since 1950 (it’s now around 79), yet their average retirement age has been falling (now hovering around 64). In other words, the need for course corrections is only growing.

Just 13 percent of workers now say they plan to delay their expected retirement, though, down from 22 percent in 2013, according to a 2016 survey by the Employee Benefit Research Institute (EBRI). And, although Crain said that “a high percentage of people told us they want to work part-time in retirement,” just 27 percent of retirees actually do, EBRI said.

Dychtwald, a pioneer in the study of boomers and retirement, told me he expects to see an upward trend in Americans’ retirement age over the next 10 years.

“I think it will lift by three to four years, I’m quite sure of it,” he said. “A push-pull will happen: A lot of industries will have greater needs for some older men and women to continue working and more employers will provide flexible work arrangements to keep those people.”

Next Avenue Editors Also Recommend: