Retirement: More Fun Than You've Heard

A Merrill Lynch/Age Wave study finds retirees loving leisure time

Maybe all the retirement experts have gotten it wrong.

They often sound warnings about how hard the adjustment to retirement will be and how Americans’ meager savings will mean that this will be a dark, perhaps dire, time of their lives.

Now, along comes the new Merrill Lynch/Age Wave report, Leisure in Retirement: Beyond the Bucket List, showing that retirees are generally having loads of fun in their unstructured life, regardless of their income. The study dubs this newfound freedom “time affluence.”

Rethinking Retirement Stereotypes

“This report caused me to rethink my own stereotypes more than any other study we’ve done,” its author Ken Dychtwald, CEO of Age Wave, a noted research firm specializing in aging, told me. “People are coming into this time of life not wishing they were still working and productive, but quite the opposite. They’re saying: ‘Finally, I can do what I want, when I want and on my own terms. That’s what I’ve been dreaming of my whole life.'”

New retirees, he added, are musing about all the enjoyable ways they could fill their days. “They’re thinking: ‘Maybe I’ll learn to paint or start to walk around the neighborhood or volunteer or go back to school,’” Dychtwald said.

The research study surveyed 3,712 adults, along with six focus groups. Its overall conclusion: “Leisure in retirement has evolved into an extended period of newfound freedom.” Or, as Dychtwald interpreted the results: “Leisure is not just killing some hours, but a transformation of oneself. And people are experiencing it with gusto.”

Best of all, the retirees said, leisure activities generally aren’t expensive. Health, they note, is a bigger limit on their leisure time than wealth.

“The nice thing about leisure is you don’t have to spend a lot of money on it,” said Dychtwald. “Sometimes the best moments are with your grandchild or watching a beautiful sunrise or playing piano for the first time in your life at age 71.” Also, the report noted, with more freedom to travel, retirees can take advantage of money-saving deals that mere mortals (that is, full-time workers and parents of young kids) can’t.

Happy, Happy, Happy

Among the findings from the retirees surveyed:

- 92 percent said they enjoy the freedom of a less structured life

- 86 percent said it is relatively easy to find inexpensive leisure activities to enjoy

- 82 percent said they have the most enjoyable leisure experiences with their spouse or partner (only 27 percent said those times were with their friends)

- 75 percent said that health limitations don’t substantially affect their leisure activities

- 61 percent said who they spend time with was far more important than what they do

- 60 percent said spending time with grandkids was more fulfilling than spending time with their own children

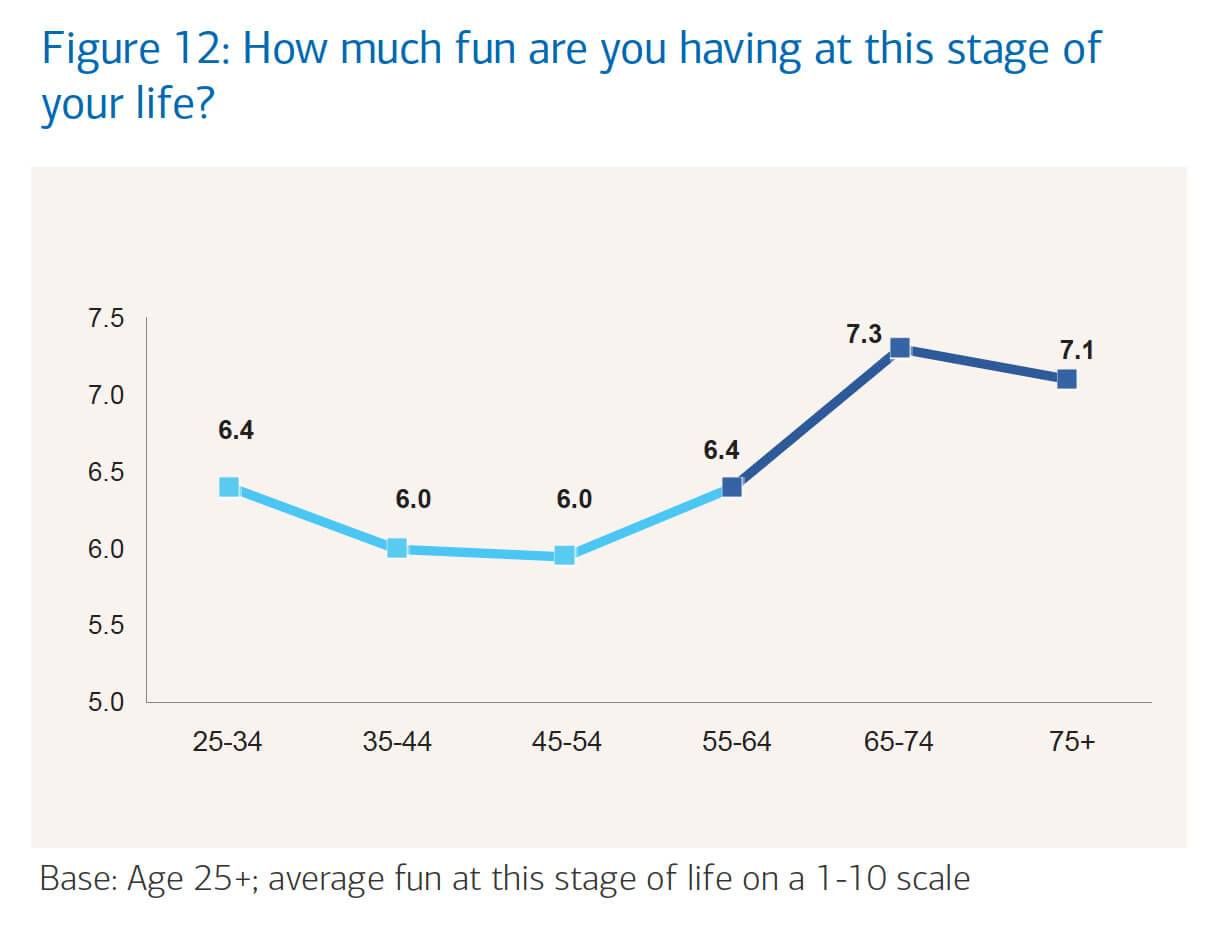

And people age 65 to 74 (presumably mostly retired) reported having more fun at this stage in life than any other age group surveyed — the ones having the least fun are those age 35 to 54 (presumably trying to hang on to their jobs, save for retirement and pay for their kids' college).

4 Stages of Retirement Leisure

In the report, Dychtwald and his team describe four stages of retirement leisure:

Stage 1: Winding Down and Gearing Up (less than five years from retirement) Here, leisure travel is about escape and recharging your batteries.

Stage 2: Liberation & Self Discovery (less than two years into retirement) “It’s almost like a superhero movie. Changing from one identity to another is tough,” said Dychtwald. Nearly half of these recent retirees (47 percent) felt guilty about not using leisure productively. There’s a peak during this stage in seeking “personal growth, adventure (including biking and hiking) and enjoying trips that offer learning and home sharing.”

Stage 3: Greater Freedom & New Choices (three to 15 years into retirement) Enjoyment of leisure “continues to improve and deepen,” the report said. Spending on leisure travel rises, along with interest in immersive experiences.

Stage 4: Contentment & Accommodation (more than 15 years into retirement) At this point, much of retirees' leisure time is spent relaxing or connecting with family and friends. “I think what begins to happen in your late 70s is sore hips or fear of skin cancer or you’re caring for your spouse or you’re getting panicked about money,” said Dychtwald. “The frictional elements start to rise up a bit more and you tone down the amount of fun.”

Interestingly, the researchers found, few people are planning for leisure in retirement — not planning what they’ll do, what it’ll cost or how they’ll pay for it.

According to the survey, 53 percent of retirees (age 50 and older) said they’ve done “hardly any” planning for leisure activities for the next year; 77 percent have done hardly any for the next five years and 84 percent have done hardly any for the next 10 years.

And this might surprise you: Only 15 percent of retirees have a bucket list. “A lot of retirees don’t even like that term,” said Dychtwald. “To them, it’s tied into kicking the bucket and what you’ll do before you die. They don’t want a bucket list; they want to have transcendent moments.”

Planning for Leisure Costs

Cynthia Hutchins, Merrill Lynch’s director of financial gerontology (and a Next Avenue 2015 Influencer in Aging), told me she thinks that more of us should incorporate leisure time and expenses into our retirement planning.

“You should plan for the cost of the big things you want to do over the next ten, fifteen or twenty years, like a big trip with your family. But you should also think about how you’ll spend your leisure time day to day,” she said.

Roughly five years before you retire, Hutchins advised, “Visualize what you want your retirement life to look like and set goals around that.” Then, estimate what those goals might cost and figure out how you’ll pay for them. “If leisure is important to you, you should be budgeting for it just like anything else,” Hutchins said.

Bill Van Sant, a Certified Financial Planner and senior vice president and managing director for Girard Partners, a Univest Wealth Management firm based in Souderton, Pa., recommended having a strong dose of realism about what your leisure activities will cost. In addition, he said, you'll want to determine how you’ll pay for them when you have a smaller income than during the years you were working full-time.

“If someone wants to golf and belongs to a country club, they won’t have the same income coming in, but the dues will still be the same,” said Van Sant. “Is that going to work?” To pay for those dues, that golfer might need to tap into savings, work part-time or switch to a public course, he noted.

When a client says she’ll want to travel, Van Sant will ask where and how. “If the client plans to drive an RV, I’ll say: ‘Well, an RV costs $100,000.’” That can pull a person up short.

“For my clients who are within five years of retirement, I try to paint a picture with them about what they expect to do and then quantify the money they’ll need for it,” said Van Sant. “And I take the worst-case scenario; the one that’s the most expensive. I’d rather be conservative and round up expenses and round down income.”

Van Sant said he frequently finds his retired clients don’t end up doing as much in retirement — or spending as much on leisure — as they expected, so that lessens the sting. “They get pulled into family situations, like babysitting,” he said.

The bottom line: If you have a financial adviser, talk about incorporating leisure into your financial plans. And if you don’t have a financial adviser but are nearing retirement, this would be a good time to get one. That could help you become one of those retirees having so much fun.

As Dychtwald said about the retirees soaking up their leisure time: “I wouldn’t mind taking a dip in that pool.”