Here's the Reality About What We'll Spend in Retirement

A survey shows retirement expenses vary greatly from what people expect

Our ability to avoid outliving our money is, in large part, due to our expenses in retirement. Turns out, a new study reveals, we’re pretty lousy at predicting how much we’ll actually spend on housing and health care when we retire. And another study shows our spending just before retirement and in the first years of retirement is often wildly volatile.

In the first study, the Hearts & Wallets financial research firm, asked 495 “late career” workers age 53 to 64 whether they thought they’d spend more, less or the same on key expenses in retirement than they currently do. The researchers also asked 1,994 retirees whether they’re spending more, less or the same on those expenses as they did before retirement.

Spending in Retirement: Perception Vs. Reality

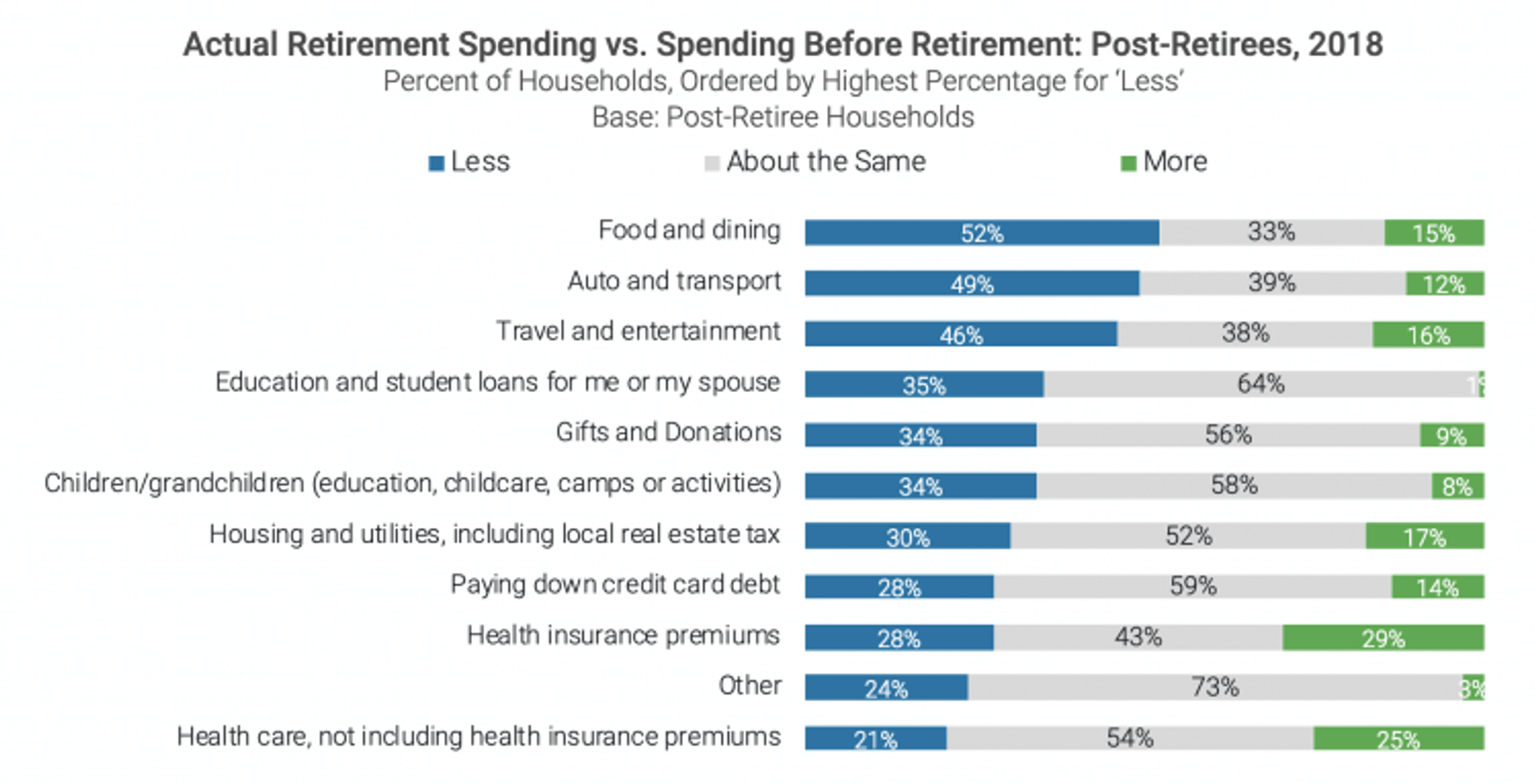

There were pretty striking differences between the predictions and the reality, suggesting that pre-retirees in their 50s and 60s get more serious projecting their expenses in retirement.

The survey said most retirees spend the same or more on housing compared to before they retired.

“We should be a little less worried about [what we’ll spend on health care] and focus a little more on housing,” said Hearts & Wallets founder and CEO Laura Varas. “The big misunderstanding was in housing.”

Here’s why:

Let’s start with housing. Nearly half of the late career respondents (46%) said they anticipated spending less on housing in retirement. But only 30% of retirees surveyed actually are spending less on mortgages or rents and utilities than when they were working full-time; 17% of retirees are spending more.

In fact, the survey said, most retirees spend the same or more on housing compared to before they retired. An Employee Benefit Research Institute report on retirement spending noted that single retirees spend 47% of their income on housing, on average; retired couples spend an average of 36% of their income on housing. Single people with the lowest levels of wealth spend even more on housing: 55% of their income, on average.

Why Our Housing Projections Are So Off

There are a few possible reasons behind the gulf on housing spending in retirement that Hearts & Wallets found, according to Varas and her report’s co-author Amber Katris.

“I think it’s a combination of not being realistic and also changing housing preferences” when people get to retirement, said Varas.

Some pre-retirees, she noted, haven’t done the math about what they’ll likely spend on housing in retirement. Others may wind up not moving as they’d planned — either staying in their current home or moving to one that costs as much or more than where they’re now living.

Varas’ advice: “I would be very methodical in understanding whether I’ll be able to spend less on housing in retirement.”

Health Care Cost Projections for Retirement

Health care forecasts revealed an opposite result and may provide some comfort to people thinking about their retirement costs.

Although 38% of late-career respondents told Hearts & Wallets they expect to spend more on health care costs (not including health insurance premiums) in retirement, only 25% of retirees actually are spending more than before. (Rising health care costs was cited as the top concern among Americans anxious about the adequacy of their income during retirement in a new Alliance for Lifetime Income survey.)

But health insurance spending, the Hearts & Wallets study found, was a little more complicated.

As with health care costs, a higher percentage of late-career people thought they’d spend more on health insurance premiums in retirement than the percentage of retirees who actually are (35% vs. 30%). But 28% of late-career people said they expect to spend less on health insurance premiums in retirement and that’s exactly the percentage of retirees spending less on them than before they retired.

The Employee Benefit Research Institute study on retirement spending found that retired people spend between 11% and 13% of income on health care, on average.

The spending categories retirees are most likely to spend less on than before retirement, according to Hearts & Wallets, are the discretionary ones: food and dining out; cars and transportation, and travel and entertainment.

The 'Spending Surge' Around Retirement

Another retirement spending study (from J.P. Morgan Asset Management) shows a spending surge just before and just after retiring. The median spending by JP Morgan’s Chase credit card customers one-to-two years before retirement was $43,000 and that figure rose to about $45,000 in retirement before gradually declining over the next two-to-three years.

“There were a lot of big checks” written during the two years leading up to retirement and the three years after, said JP Morgan Asset Management Executive Director Sharon Carson at a recent Employee Benefit Research Institute webinar on retirement spending. “Our survey found people spending money on travel and home renovation.”

The J.P. Morgan researchers also found pretty wide variations in spending patterns of retirees: 38% of retirees decreased their spending versus before retirement; 35% increased spending; 22% didn’t change their spending habits and 7% were “roller coasters” — both increasing and decreasing their spending temporarily in retirement.

Advice About Investing Near Retirement

Based on her firm’s analysis, Carson urged people not to be too aggressive investing in the stock market as they near retirement. Otherwise, if the market falls, they could have trouble coming up with the money to pay for their spending surge.

A J.P. Morgan Asset Management report on the retirement spending study said: “Withdrawing assets in volatile markets early in retirement can ravage a portfolio with too much equity exposure, and a surge in spending can have even greater ramifications.”