Retirement: Employers Just Don't Get It

Insulated management needs to do more to assist older workers

Two new studies — one of 143 large American companies and another of 2,043 retirees show, stunningly, how clueless employers are about workers’ retirement challenges and wishes.

“The phrase that leapt to mind is ‘benign neglect,’” said Paul Rupert, founder of Respectful Exits, a new initiative whose mission is to change employer practices “to insure a fairer future for all aging workers.” Rupert thinks managers and HR departments have a worldview “that’s completely insulated.” Empathy, Rupert says, “is in short supply.”

The 2018 Longer Working Careers Survey of employers is from the benefits consulting firm Willis Towers Watson. And A Precarious Existence: How Today’s Retirees Are Financially Faring in Retirement is from the Transamerica Center for Retirement Studies (TCRS).

What Employers Don't Understand

The surveys indicate that many employers don’t understand: how dire the financial circumstances are for many of their older workers; that many employees in their 60s want to — or need to — keep working, either full-time or part-time and that these workers long for counseling to help them transition into retirement.

“A retirement income stream from a pension or a 401(k) is just one of dozens of decisions you make as you retire,” said Lauren Hoeck, a retirement consultant at Willis Towers Watson. “Just focusing on that is missing the bigger picture. We know that retirement is as much a physical, emotional and social decision as it is a financial decision.”

Catherine Collinson, CEO and president of Transamerica Institute and TCRS (and a Next Avenue Influencer in Aging), is pretty steamed about the studies’ findings.

“As much as employers help their employees save and invest through 401(k)s and other types of retirement plans, it is mind boggling how little they have done historically in terms of helping older workers transition into retirement,” she said.

Disconnect About Retirement Preparedness

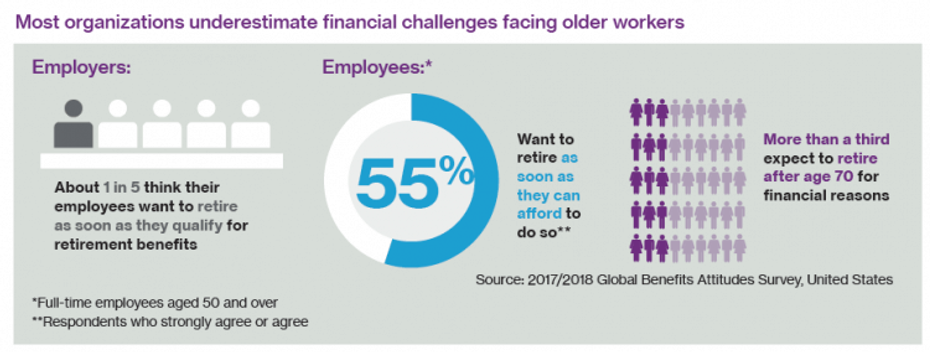

The longer working careers survey of employers found that about one in five employers think their employees want to retire as soon as they qualify for retirement benefits. The study also said 71 percent of employers believe most of their older employees are “likely to have adequate funds to retire when they choose.”

But in the firm’s 2017/2018 Global Benefits Attitudes Survey of American workers, more than a third surveyed said they expect to retire after 70 for financial reasons. And 55 percent said they want to retire “as soon as they can afford to do so.”

For many, that won’t be anytime soon, due to the Great Recession, a lack of savings and the realities of living paycheck to paycheck. The federal Bureau of Consumer Financial Protection says a quarter of adults 62 and older are "financially insecure." A new poll by the National Endowment for Financial Education says 68 percent of U.S. adults experienced unexpected financial setbacks in 2018. And an NHP Foundation study says 48 percent of Americans 55+ making under $60,000 a year are concerned that one costly ER trip will devastate them financially.

For a heartbreaking account of this problem, read The Wall Street Journal story last week by Ruth Simon: “'Just Unbearable.’ Booming Job Market Can’t Fill the Retirement Shortfall.” Simon noted that 5.8 million Americans (23 percent of full-time, year-round workers ages 55 and older) have what economists call “bad jobs” that pay poorly and don’t offer health benefits.

Another harsh reality: 56 percent of retirees Transamerica surveyed said they retired sooner than planned. Job losses and health problems were the chief reasons.

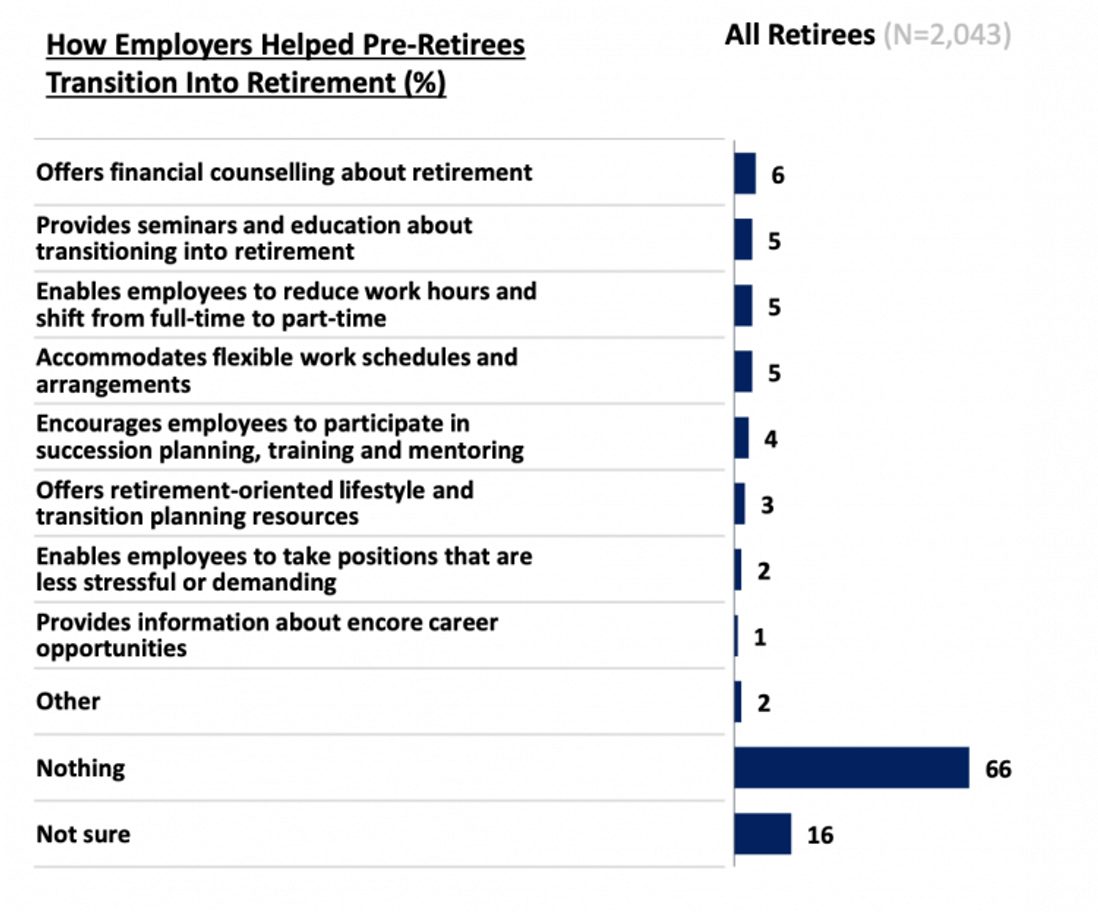

And here’s the data proving that few employers are doing much to help older workers prepare for, or move into, retirement. In the new Transamerica survey, 66 percent of retirees said their most recent employers did “nothing” to help them transition; another 16 percent were not sure.

How Counseling Sessions Could Help

One thing that would help older workers — and help employers, too — would be bringing in experts to offer one-on-one counseling sessions discussing retirement. “Not just to help with finances, but to look strategically at multiple aspects of well-being in retirement,” said Hoeck.

Transamerica found that very few retirees said their employers offered them financial counseling on retirement (6 percent) or provided seminars or education about transitioning to retirement (5 percent).

Collinson recommends employers: promote further awareness among older workers about the urgent need to focus on retirement planning; offer financial counseling and encourage older workers to calculate their savings and income needs and learn about retirement income strategies; provide lifestyle counseling and education about encore career and volunteering opportunities and offer guidance about how and when to claim Social Security and Medicare.

How Phased Retirement Programs Could Help

Another suggestion for employers: offer phased retirement as an option, allowing older workers to, for example, gradually reduce hours from full-time to part-time. In Transamerica’s research, 47 percent of workers said they want to phase into retirement.

But only 9 percent of firms in the Willis Towers Watson survey actually offer phased retirement programs. Many employers who don’t allow phased retirement to all workers said it’s due to “administration and compliance challenges.” Informal phased retirement programs — offered to just a small group of select, coveted employees — are more common.

Respectful Exit’s Rupert, who consults with employers about phased retirement, thinks the 9 percent figure is “way overstated.” Says Rupert: “Almost everyone who says they do it is terminating people and bringing them back as contractors.” In mid-January or so, Respectful Exits will launch a new site, ThePhazer.com, to help workers learn about and arrange phased retirements.

The tight labor market and employer worries about a brain drain from retiring boomer workers may make phased retirement programs more common — though hardly universal — in the next few years.

In the Willis Towers Watson survey, 23 percent of employers said they expect to offer phased retirement programs by 2020. And Rupert told me at least four companies this fall asked his firm to submit phased retirement proposals for them.

Collinson offered this reminder to employers: “People now have the potential of living longer, healthier lives than in any other time in history. Employers play a critical role in fulfilling this gift by helping re-envision aging, work and retirement and putting that vision into practice.”