How Adding Riskier Investments Can Make Your Portfolio Less Risky

Though counterintuitive, this diversification really pays

It is quite common for individual investors to apply the traditional 60/40 investing formula: Put 60 percent of your money in U.S. stocks — for growth opportunity — and 40 percent in U.S. bonds — for income and stability. After all, a well-diversified portfolio of stocks and bonds is critical to the potential for long-term investing stability and success.

However, a TIAA-CREF analysis of portfolios from 1999 to 2013 found that proper diversification requires owning different types of stocks and bonds in the U.S. and overseas (such as emerging-market stocks and high-yield bonds) as well as real estate through Real Estate Investment Trusts or REITs. Investors often overlook one or more among this broader range of investments when building their portfolios.

Why Adding Riskier Assets Is Wise

While it may seem counterintuitive, those looking to reduce portfolio risk should consider adding riskier assets. That’s because riskier assets are actually powerful diversification tools.

By adding the right amount of some riskier asset classes to a portfolio, the overall portfolio can become less risky and has the potential for higher returns over time. Investors should diversify broadly to avoid over-concentration in any single asset class.

More volatile assets can lower the overall risk of a portfolio because they characteristically react differently to market events than more traditional assets. Historically, they have gone up in value or held steady when other assets decline, and vice versa.

Since these riskier assets have the potential for higher long-term performance, including them in a diversified portfolio may actually help to increase returns over time.

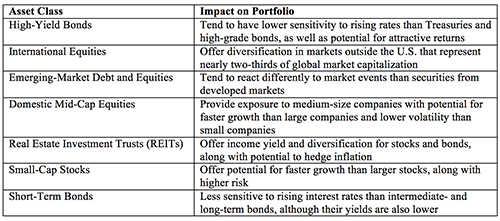

All of the asset classes in the table below have unique characteristics and offer various benefits to a portfolio:

Testing the Hypothesis

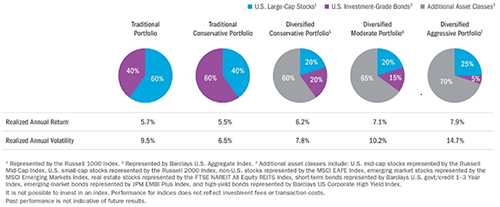

TIAA-CREF created three hypothetical portfolios that included a broad range of investment types to find how diversification influences performance over time. Then, the diversified portfolios (pie charts 3, 4 and 5 below) were compared with two traditional portfolios consisting only of U.S. large-cap stocks and high-quality, medium-term U.S. bonds (pie charts 1 and 2).

Portfolio 1: Conservatively Diversified. This portfolio (pie chart 3) contains 20 percent U.S. large-cap stocks; 20 percent U.S. high-quality, medium-term bonds and 60 percent from a broader range of asset classes.

Portfolio 2: Moderately Diversified. This portfolio (pie chart 4) contains 20 percent U.S. large-cap stocks; 15 percent U.S. high-quality, medium-term bonds and 65 percent from a broader range of asset classes.

Portfolio 3: Aggressively Diversified. This portfolio (pie chart 5) contains 25 percent U.S. large-cap stocks; 5 percent U.S. high-quality, medium-term bonds and 70 percent from a broader range of asset classes

Portfolios with Broader Diversification Outperformed Others (1999 to 2013)

The Results of the Analysis

The results from the analysis were unambiguous: Riskier assets outperform more traditional portfolios in the long run. Although the higher returns were accompanied by higher short-term volatility, all three of the hypothetical diversified asset allocation strategies — conservative, moderate and aggressive — outperformed portfolios comprised of only domestic large-cap stocks and high-quality, medium-term bonds.

Analyzing performance across asset classes during the time frame of 2009 to 2013 explains why diversified portfolios outperformed. As an example, emerging market debt experienced 11.2 percent returns during the period while large-cap U.S. stocks returned 5.9 percent.

Next Steps for Investors

Most individual investors are aware of the importance of a diversified portfolio. Perhaps what is less understood is the importance of investing in a broader range of asset classes to improve diversification and returns over time. Meeting with a financial adviser may be a worthwhile step when deciding on the right mix of high-yield bonds, real estate, international developed-market stocks and emerging-market stocks and bonds because it is a task that takes careful planning and expertise.

Investors, along with their financial advisers, need to consider their particular age, goals and risk tolerance to create an appropriate long-term strategic plan and asset allocation.

The closer you get to retirement, ask yourself what you’d do if there was a major bear market in stocks. If you’d panic and sell, you may be in too aggressive an asset allocation.

If you are nearing retirement, it’s also important to take the time to rebalance your investment portfolio. While younger people are more likely to have a higher percentage of their portfolio in high-risk, high-reward stocks, those who are closer to retiring need to adjust their portfolio and seek low-risk, stable income to maintain their overall risk profile.

Consider an Income Plan, Too

Not only do investors in this age bracket need to think about asset allocation, they should also consider an “income plan” to manage and replace a portion of their paychecks in retirement. At TIAA-CREF, we strongly recommend considering investment solutions that offer annuities with secure and stable streams of retirement income.

Ask your financial adviser about your income plan and a strategy for creating income that you will not outlive. The income plan should include all sources of income including Social Security, pensions, annuities, and investments.