How to Keep Fund Fees Low to Increase Your Retirement Portfolio

A personal finance professor shows how much expenses can sock you

The importance of keeping your investment portfolio costs low should be self-evident. They come directly out of your pocket. But you may be surprised to see how much it matters to stick with low-fee mutual funds and Exchange-Traded Funds (ETFs). I’ve run the numbers.

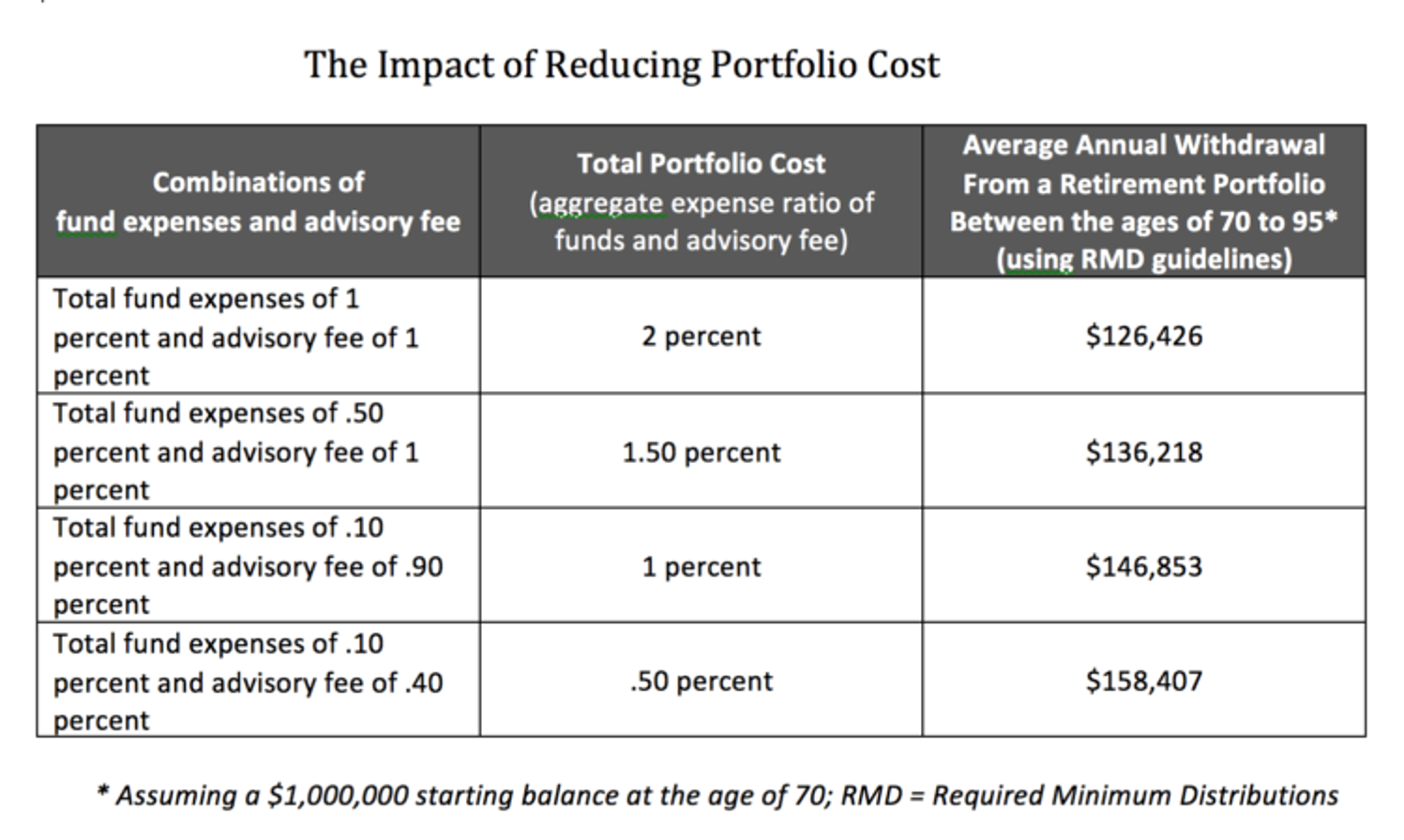

The two primary portfolio costs consist of what’s known as the “expense ratio” of the funds or ETFs (the annual fee charged as a percentage of assets) and the “advisory fee “(if there is a financial adviser involved).

The average expense ratio among all mutual funds is roughly 100 basis points or 1.0 percent (one basis point is one hundredth of one percent). Assuming an annual advisory fee of 100 basis points, or one percent, the total portfolio cost is 2.0 percent (or 200 basis points). At that level, for a diversified fund portfolio with a starting balance of $1 million, the average annual withdrawal for a retiree between age 70 and 95 is about $126,426 (assuming the retiree makes the government’s Required Minimum Distribution or RMD). Remember: this is an average withdrawal figure over a 25-year period; the actual RMD will vary each year based on your portfolio's performance during the prior year and each year's RMD percentage.

If the cost of funds in the portfolio is cut in half by using mutual funds or ETFs with lower expense ratios, the overall portfolio cost can be reduced from 2.0 percent to 1.5 percent. By doing so, the average annual withdrawal then increases to $136,218, meaning the retiree will have roughly $10,000 more income each year. That works out to a “raise” of about $830 per month during retirement.

$32,000 More a Year in Retirement

But you can do even better. It is now possible, by using low-cost ETFs, to build a diversified retirement portfolio for as low as .10 percent (or 10 basis points). If the advisory fee were reduced by a mere 10 percent down to .90 percent (or 90 basis points), the overall portfolio cost could be lowered to 1.0 percent. At that level, the retiree can withdraw an average of $146,853 each year — or an additional $10,000 annually.

Finally, if the adviser lowered his or her fee to .40 percent and the fund expenses amounted to .10 percent, the total portfolio cost would be just .50 percent. At that level, $158,407 would be the average amount withdrawn each year.

All together, by slashing fund expense ratios from 1.0 percent to .10 percent and the advisory fee from 1 percent to .40 percent, the retiree could receive $32,000 additional annual retirement income — or roughly $2,600 more each month between the ages of 70 and 95. Clearly, the impact of portfolio costs is huge.

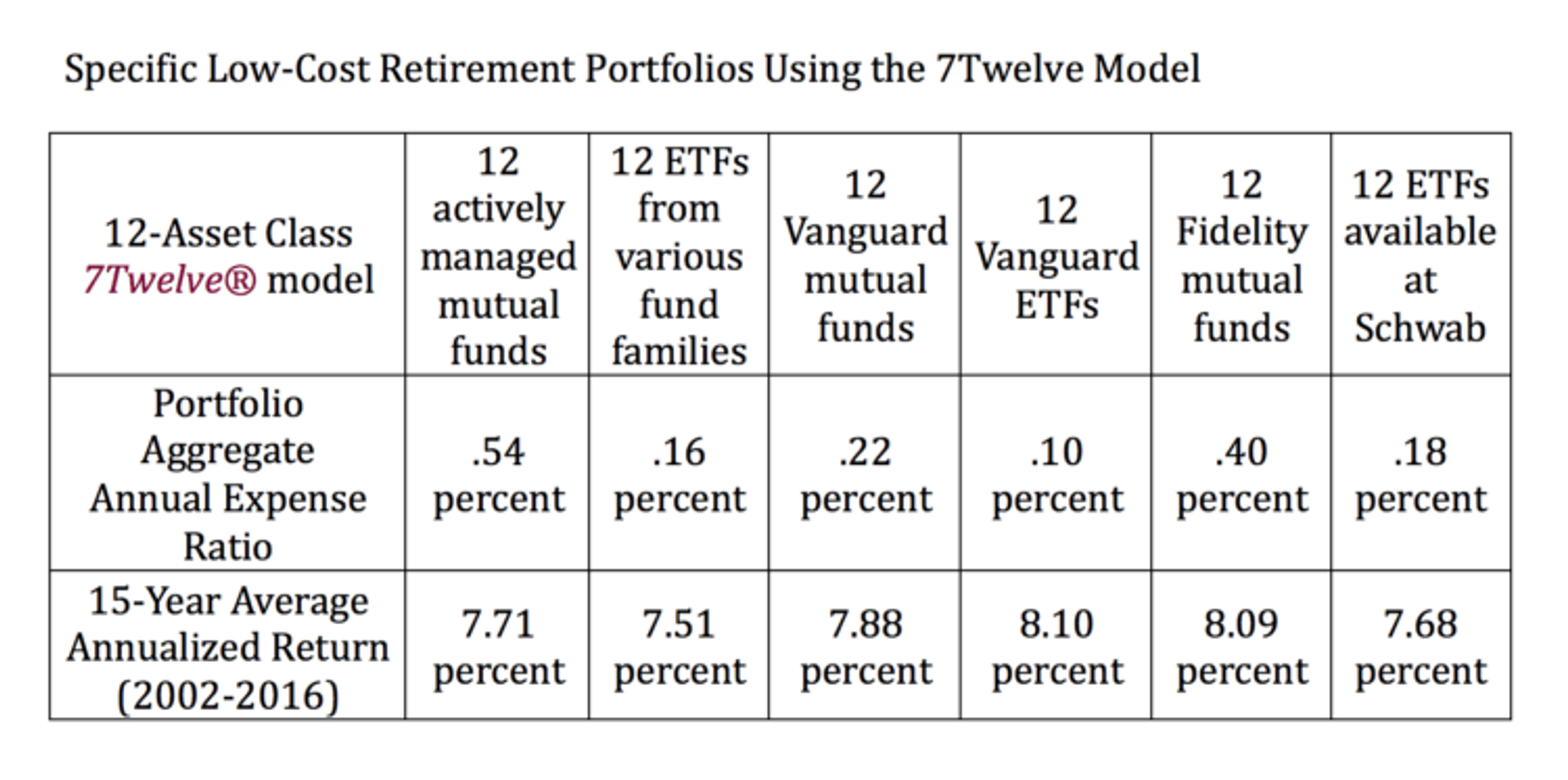

A Modern Diversified Portfolio

Here’s how to put together a low-cost, diversified portfolio that I call the 7Twelve® portfolio. If you use low-cost, actively managed funds from various fund families, the overall fund expense can be as low as .54 percent. If you use ETFs from various fund families, the cost can drop to .16 percent. And if you use just Vanguard ETFs, the overall fund expense ratio can be as low as .10 percent (I have no affiliation with Vanguard; they’re just an investment company specializing in keeping costs low).

The idea of building a diversified portfolio for as little as .10 percent is not theoretical. It is a reality and can and should be considered.