A Money Pro's 3 Top Tips for Your Finances

Pointers from the author of 'What Your Financial Advisor Isn't Telling You'

If you’re not paying attention to your finances because you find it boring or you use the excuse “I’m not good with numbers,” I have two words for you: Oh, please.

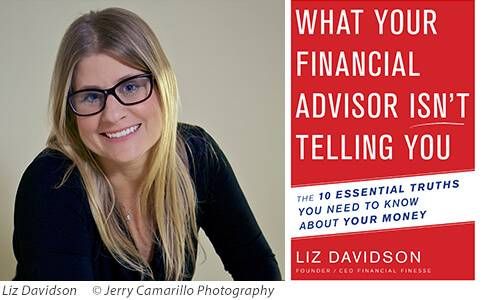

You are ultimately responsible for your financial life and financial security. You can’t rely on a spouse and certainly not on your financial adviser to care more about your well being than you do. That’s the core message of Liz Davidson’s new book, What Your Financial Advisor Isn't Telling You, and what she told me when I interviewed her about it. And I couldn’t agree with her more.

Davidson ought to know. She’s the chief executive and founder of Financial Finesse, a financial education firm in El Segundo, Calif., that offers financial wellness programs at more than 600 large employers.

I think you’ll be intrigued by the impetus for her book: A former hedge fund CEO, Davidson was stunned that even the high net worth individuals investing with her firm lacked knowledge of the principles of investing, the kinds of investments they were buying and the risks involved.

An Appalling Finding About Money Management

More than that, she found this appalling. If these theoretically smart investors didn’t have a clue, Davidson figured, average Americans likely had even less financial savvy.

Davidson's book divulges the nuts and bolts of what her 17-year-old firm delivers to its clients. That’s why I think if you’re ready to take control of your financial life — or if you need a nudge in that direction — Davidson’s book is a terrific way to start. She lays out easy-to-follow steps to get out of debt and ramp up your retirement savings, with digestible advice on how to talk honestly with your spouse or partner about your household’s finances and financial future.

By the way, Davidson isn't saying financial advisers are bad. "I devote a whole chapter on how invaluable a great adviser can be when you really need one," she told me. "The problem is people expect too much from their advisers — often thinking their advisers will make them financially secure, when that is actually their own responsibility. Contrary to popular belief, most of the greatest drivers of building wealth have nothing to do with an adviser — your marriage or life partner, the benefit choices you make at work, using credit and debt wisely and automating your saving and investing behavior."

Davidson’s a big proponent (as am I) of setting aside enough savings in your 401(k) retirement plan to get the employer match, if one is offered. Fortunately, more firms are offering matches and they’re dangling bigger matches than in the past.

According to an October 2015 report from the Aon Hewitt benefits consultant firm, about 42 percent of (primarily) large companies now offer a dollar-for-dollar match to their workers’ contributions, up to a specified percentage of pay, typically 6 percent. In 2011, only 25 percent did. And before 2013, the average match was just 50 cents on the dollar.

Davidson’s also keen on understanding your employer’s benefits and making smart decisions about them. She notes, for example, that the least expensive, high-deductible health plan among your employer’s coverage selections isn’t always the best choice. Davidson’s mantra: “You should fully maximize your employee benefits before you even consider hiring a financial adviser.”

How to Hire a Financial Planner

For those who are ready to hire a financial planner, Davidson is your Sherpa. Her book doles out sage advice on how to find an adviser who has your interests at heart, what questions to ask when hiring one, how much you can expect to pay and what you should look for in return for the money pro’s expertise. Here's what she told me: "Even if you use an adviser, it's up to you to make sure they understand your goals."

I agree with her recommendations to seek out fee-only planners in particular. Interview a few (there are searchable databases at sites of the Garrett Planning Network, the National Association of Personal Financial Advisors, the Financial Planning Association and the Certified Financial Board of Standards).

Here are three pieces of Davidson’s advice I especially endorse:

1. Have the money talk with your spouse or partner. If you feel like you two are on separate pages about money matters, force yourself to have a frank money conversation. (Davidson writes that she and her husband, a high school football coach, have had to walk this walk themselves.)

The blunt title of her chapter about couples and money is Your Life Partner May Be Your Worst Financial Enemy. Her opening salvo: “The person you spend your life with will matter much more to your financial security, and ultimately to how wealthy you become, than anything any financial adviser can do for you.”

It’s up to you “to determine how your relationship is affecting your finances,” she says. Sadly, too many couples don’t do this. Only a third of them discuss retirement plans, for example, down from around 40 percent in 2013, according to a new study by the Hearts & Wallets financial services research firm.

And if you or your spouse or partner made a financial faux pas in the past (bad credit, for example), Davidson says: get over it. “Agree to leave the past in the past and focus on the future,” she writes.

Davidson suggests having three bank accounts — ours, yours and mine. (This system works for me and my spouse, but not everyone is hardwired for this method.) Then, she urges, review your joint finances regularly. “This is an opportunity to review how you are spending your money and to make adjustments, and it ensures that you are working together to continually build together, rather than operating off of separate priorities and spending habits,” says Davidson.

2. Consider starting a book club that’s focused on money management. Your group could discuss a financial book chapter by chapter, or by its topic. Each person in the club would be encouraged to offer personal insights and club members with better financial habits could mentor others who are struggling.

3. Set aside a financial Independence Day once a year. Davidson says this a great way to commit to your financial wellness, using the day for “reflection, inspection, and reinvention of all aspects of your financial life.” To help you get started, she provides a checklist in the book and has a website and resources to form your own Independence Day group so, as Davidson says, you can "learn from, support and encourage each other."

Gee, Valentine’s Day is right around the corner…