Americans In the Best Financial Shape Are 55+

A new FINRA survey finds sharp money contrasts with Millennials

Reading through the new Financial Capability in the United States 2016 study from the FINRA Investor Education Foundation, one thing kept popping up: generally speaking, Americans 55 and older are faring, and feeling, much better economically than the rest of the country — and particularly compared to Millennials.

Their “financial capability” has improved since the 2009 and 2012 FINRA studies, too (which is true for Americans overall).

A few notable findings from the 2016 survey of 27,564 American adults (plus 2,000 Americans with investments outside of retirement accounts) conducted by the research arm of FINRA, the financial services industry’s self-regulatory investor protection group:

- 72 percent of those 55+ said they have good or very good credit. Just 50 percent of those age 18 to 34 and 60 percent of Americans in general said they do.

- 56 percent of people 55+ have set aside three months’ worth of emergency funds, far more than the 40 percent of Americans 18 to 34 surveyed or 46 percent of respondents overall.

- Less than half (47 percent) of respondents 55+ said they worry about running out of money in retirement. Conversely, 56 percent of Americans overall and 65 percent of people age 35 to 54 do.

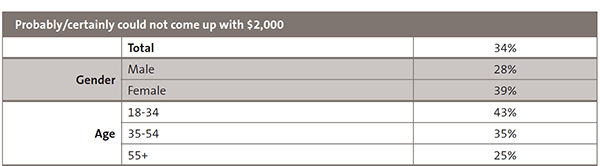

- Only 25 percent of people 55+ said they probably, or certainly, could not come up with $2,000 if an unexpected need arose in the next month (see chart below). Overall, 34 percent of Americans and 43 percent of those age 18 to 34 felt that way.

- Just 24 percent of those 55+ engage in expensive credit card behaviors, such as making only the minimum payment or paying late fees, while 52 percent of those 18 to 34 and 39 percent of Americans overall do. Similarly, while 29 percent of those 55+ said they have too much debt right now, 45 percent of those 18 to 34 and 40 percent of respondents overall, said they do.

- While 18 percent of people 55+ have had financial difficulty with the cost of medical services, 28 percent of Americans in general and 36 percent of those 18 to 34 have. Along the same lines, 14 percent of people 55+ have unpaid, past-due medical bills from a health care or medical service provider; 21 percent of Americans overall and 24 percent of those 18 to 34 have.

- Just 6 percent of those 55+ have taken a loan from their retirement account in the past year and only 4 percent have taken a hardship withdrawal from one. By contrast, 22 percent of those age 18 to 34 have taken such a loan and 20 percent of that younger group have taken a hardship withdrawal (overall, 13 percent of Americans have taken a retirement account loan and 10 percent a hardship withdrawal in the past year).

Pretty encouraging and uplifting for those 55+ Americans, no? Well, yes and no, actually.

Gerri Walsh, who’s senior vice president of investor education at FINRA and president of the FINRA Investor Education Foundation, and Gary Mottola, research director at that foundation, were less upbeat than I was about the results.

Cracks in the Mortar

“In many ways, people 55 and older are showing less stress than other demographics, but there are still some cracks in the mortar,” said Walsh.

Put another way: Yes, the older Americans may be doing, and feeling, better financially than their younger counterparts, but that doesn’t mean their finances are all that hot. As Mottola said: “On a relative basis, the older generation is doing better, but on an absolute basis, there are some measures that are potentially cause for concern.”

After all, 47 percent of the 55+ respondents are worried about running out of money in retirement. And roughly four in 10 in this age group have not set aside three months’ worth of emergency funds.

“Even among older Americans who tend to be doing better financially,” said Walsh, “one in four respondents 55 and older in the survey reported being financially fragile.”

And, Mottola added, people 55 and older aren’t a homogeneous group. Slice their numbers more finely, he said, and you’d find more worrisome numbers among minorities and women — two groups facing stiffer financial challenges than the public at large, the survey said.

Why Older Americans' Finances Look Pretty Good

Noted.

Still, I wondered, why are people 55 and older much less likely than others to tap their retirement funds and find themselves in serious debt?

“The data tell us the what, but not the why,” said Walsh. However, she added, “there may be a correlation with [more people 55+] having emergency funds set aside."

Mottola surmised that since this group is much closer to retirement — or in retirement — than others surveyed (the oldest in the poll was 94) — “they may possibly be more sensitive to the issue of pulling money out of savings,” he said.

The reason a smaller percentage of people 55+ have problems with health costs than younger people, said Walsh, is that the older ones are more likely to have health insurance.

Where Younger Americans Are More Impressive

Two curious findings from the survey, both technology related, revealed ways that people 55+ are less impressive than younger ones:

Just 10 percent of people 55+ use reloadable prepaid debit cards to make payments, which put a cap on spending (compared with 39 percent of those 18 to 34) and a mere 6 percent of respondents 55+ use mobile phones to pay at the point of sale (by contrast, 40 percent of those 18 to 34, and 22 percent of Americans overall, do). Checks, please!