Americans: Getting By, But Not Getting Ahead

4 reasons for the financial fragility, from the 2017 Prosperity Now Scorecard

Despite a growing economy and the lowest U.S. unemployment rate in 16 years, things aren’t looking up for many Americans — financial fragility is especially an issue for people with low incomes and for minorities, according to the latest 2017 Prosperity Now Scorecard.

Getting By, But Not Getting Ahead

“Since last year’s Scorecard, the big-picture indicators show that people may find it easier to get by — unemployment is down and poverty is down,” said Kasey Wiedrich, director of applied research at Prosperity Now (formerly CFED), a progressive public policy nonprofit. “But when you really look at whether people are able to get ahead, to achieve financial stability and build wealth, we’re not seeing improvements.”

The median net worth in the United States ($76,708) has not changed significantly over the previous three years, Prosperity Now noted. And nearly 20 million households (about 17 percent) have zero net worth or owe more than they own.

The U.S. economy, the Scorecard’s report said, has shown “signs of gaining momentum — but only for a lucky few.” It’s not quite a glass half empty/glass half full scenario. It’s more like a glass that’s mostly empty.

4 Reasons for the Economic Dichotomy

There are four big reasons for the dichotomy, according to the numbers Prosperity Now crunched for its latest “data and advocacy tool,” which assessed all 50 states on 113 measures in five issue areas: Financial Assets & Income; Businesses & Jobs; Homeownership & Housing; Health Care and Education:

Income volatility Prosperity Now looked at this economic measure for the first time and found that one in five U.S. households “experiences moderate to significant income fluctuations from month to month.” The most common cause of income volatility, according to a Federal Reserve System study: unreliable employment. Income volatility, Wiedrich noted, translates into an inability to save. As Rachel Schneider, senior vice president at the Center for Financial Services Innovation and co-author of the book on income volatility, The Financial Diaries, recently told me: “We have a false narrative that people are overspending and not saving for retirement. The reality is they have very real needs they have to pay for this year.”

Low-wage jobs True, unemployment is down. So is underemployment — a measure that includes discouraged workers not actively seeking work and people working part-time because they can’t find employment. The underemployment rate slid to 9.8 percent, the first time it dropped below 10 percent since 2007. But the rate of low-wage jobs in America has remained stagnant since 2012.

Today, one in four U.S. jobs is in a low-wage occupation, the Scorecard noted. Put another way, those jobs don’t pay enough to cover the cost of living for full-time workers.

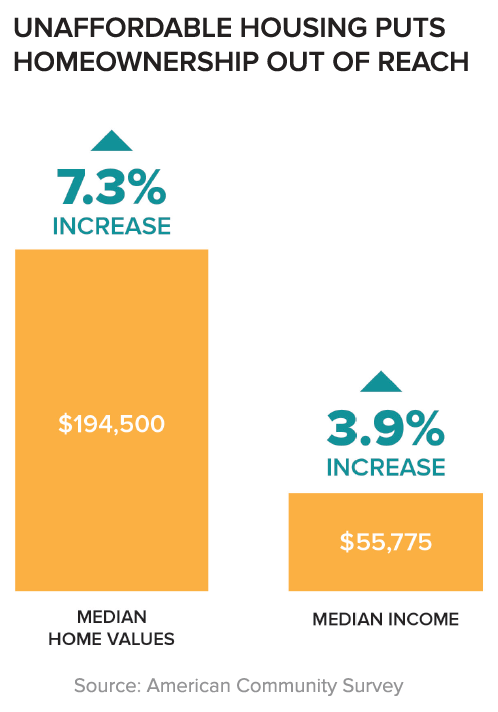

Housing unaffordability In the past year, median home values soared by 7.3 percent ($194,500 is the new median home value), but median income only rose by 3.9 percent. Meantime, 50.6 percent of all renters remain “cost-burdened” — they spend more than 30 percent of their income on housing. Consequently, the U.S. homeownership rate held constant at 63 percent last year. Yet foreclosures and delinquent mortgages fell and, Prosperity Now found, there was a 3.8 percentage point decline last year in the national rate of homeowners with high-cost mortgage loans.

In other words, said Wiedrich, “for people who don’t already own, homeownership is becoming less affordable.” And homeownership is the chief way of building wealth in America.

Racial economic disparities The Prosperity Now Scorecard cited striking chasms between the financial well-being of blacks and Latinos compared with whites. For example, black workers are now more than twice as likely as white workers to be unemployed (8.7 percent vs. 4.0 percent). The unemployment rate for blacks ticked up slightly in the past year, as it dropped dramatically for whites.

And while more than half of white households in all 50 states own their homes, that’s the homeownership rate for black households in just four states, the Scorecard said. As Laurie Goodman, co-author of the Urban Institute’s recent report, “Are Gains in Black Homeownership History?” recently told Next Avenue writer Rodney Brooks, “Black people are moving into homeownership at a much slower rate than anything we have seen in the past.” A December 2016 report from the National Academy of Social Insurance, “Social Security and the Racial Gap in Retirement Wealth,” noted that the typical white household age 47 to 64 has housing wealth of $67,000 and the typical African American household in that age group has zero home equity.

Income poverty — the percentage of households earning less than the federal poverty line — “remains disproportionately high among communities of color,” the Scorecard report said. The income poverty rate for blacks is roughly 25 percent and for Latinos it's about 22 percent; for white households, the rate is a hair over 10 percent.

Signe-Mary McKernan, economist and co-director, opportunity and ownership initiative at the Urban Institute, told Brooks in March 2017: “The American dream has not happened for African Americans and Hispanics.”

The 'Financial Red Zone'

Put this all together, and it’s not hard to understand why 44 percent of U.S. households didn’t set aside any savings for emergencies in the past year.

Or why roughly 37 percent live in what Prosperity Now calls “the financial red zone of liquid asset poverty” (meaning they don’t have enough in cash and other liquid assets to replace income at the poverty level for three months if they lose their jobs or can’t work). The liquid asset poverty rate is down from 44 percent in the last Scorecard, but the Prosperity Now folks say part of that drop is merely due to a change in the way the government compiles the stats.

Washington, Wealth-Building and Retirement

A few recent federal actions haven’t helped.

For instance, Prosperity Now notes that in 2017, Congress “gutted” the federally-supported Assets for Independence anti-poverty program. This little-known, 19-year-old program, administered by the U.S. Department of Health and Human Services, has helped low- and moderate-income families save to buy a home, pay for college or start or expand a business by matching a portion of the money they've put aside.

Purchasing those assets and starting to build wealth is “a key factor in economic mobility,” said Wiedrich. Indeed, a recent Urban Institute study found that the participants in the Assets for Independence program saved significantly more than low-income people who weren’t in it.

Congress also just repealed an Obama administration rule change that would have made it easier for states to create retirement plans for workers without them.

Prosperity Now is also fearful of what’s on the agenda in Washington. “We think there’s a lot of attempt now to cut back on benefits that will really hurt families and worsen outcomes, particularly for low-income families,” said Wiedrich.

Rays of Sunshine

On the other hand, over the past year, there have been a few rays of sunshine at the state and local level to help residents become more financially secure.

According to Prosperity Now: three states improved their paid leave policies; nine made advances in the minimum wage and five revved up Secure Choice retirement programs for people without access to employer-sponsored retirement plans. The Aspen Institute Financial Security Program’s David S. Mitchell and Gracie Lynne just published an article saying that Oregon, one of the Secure Choice states, is mulling the idea of including in its program what’s known as a “sidecar account” — a helpful way for people to save automatically and regularly for emergencies, not just for retirement.

After participating in the Aspen Institute’s recent Economic Security Summit, Alex Mazer, co-founder of the retirement-security group Common Wealth, wrote that “the declining economic security of the average American is increasingly seen as the biggest challenge facing the country.” He pointed to stagnant wages, wealth and income inequality and persistent inequities across racial, gender and geographic lines.

He’s right. But, as Prosperity Now’s report said: “While the situation is dire, it is far from hopeless.”