What You Need to Know About Medical Debt

You may be able to negotiate the amount you owe, but act quickly to avoid having to deal with a collection agency

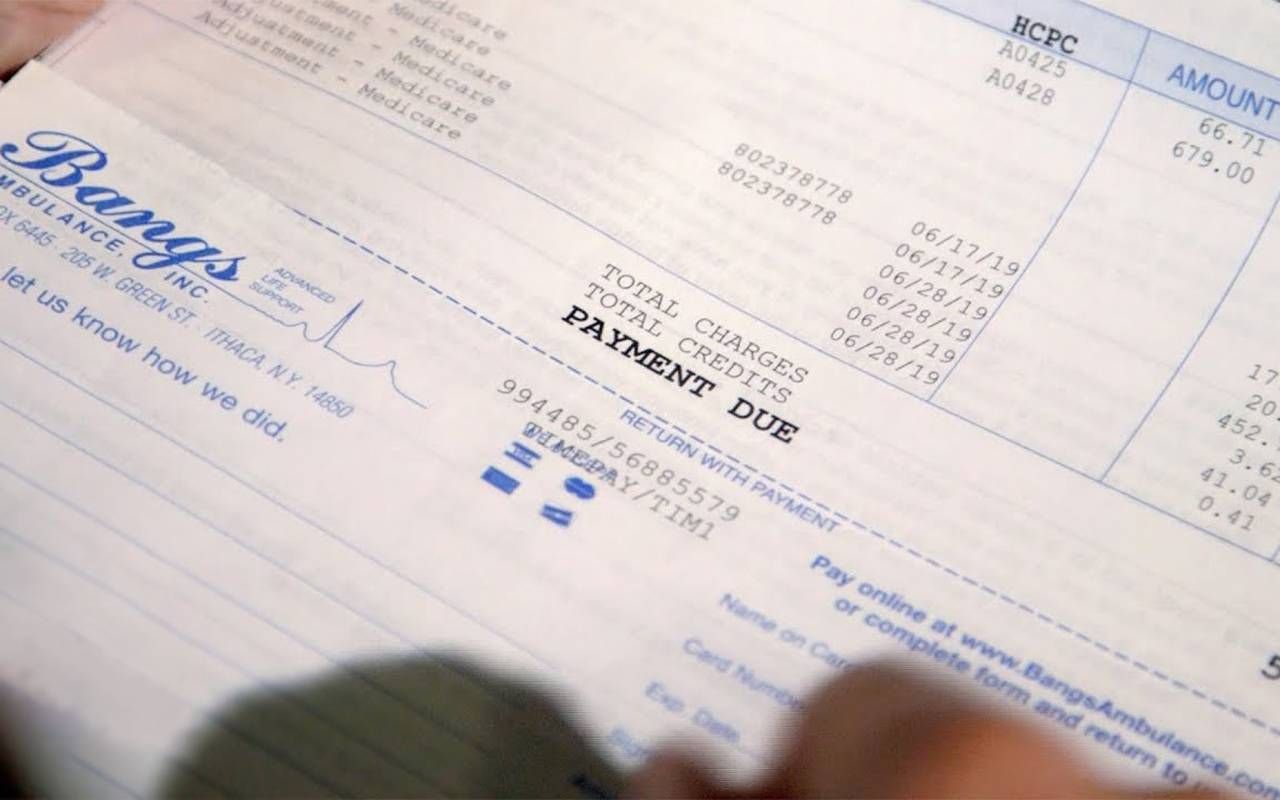

You've got your health back after a medical problem and are feeling fine. Now it is time to tackle those medical bills. Here are some important steps to take — and common mistakes to avoid.

1. Determine how much you can afford to pay. Before you pay a single bill, take a close look at your financial situation. Find the time to dig into your budget.

"If you haven't already done so, create a budget of income and expenses," advises Jason Weckerly, a certified financial planner at Montgomery Wealth Management in Chalfont, Pennsylvania.

"Ignoring the debt until you can afford to make a payment . . . is a common mistake."

"The budget should include all sources of income and differentiate between essential and discretionary expenses," he adds. "This step is critical. Moreover, from a psychological perspective, this exercise can help to make one feel more empowered and less overwhelmed by the debt."

2. Contact the hospital or other medical creditor as soon as possible. Don't wait to discuss your medical debt with a creditor. You don't know when a doctor or hospital will send your bill to a collection agency, "which is paramount on the list of what we want to avoid," Weckerly says. "Ignoring the debt until you can afford to make a payment . . . is a common mistake."

3. Talk to a human being about your medical debt. Be determined and patient in pushing your way through a creditor's automated phone tree system until you get to speak with an actual person. Once you have a human on the line, Weckerly recommends asking the following questions:

- Are payment plans available?

- If so, what is the minimum amount the doctor or hospital would accept on a monthly or quarterly basis?

- If a payment is missed, what is the typical grace period before your office sends the debt to collections?

- Are there any fees associated with a payment plan option?

"Typically you won't see any extra fees or interest charged from the original creditor; however this can vary," Weckerly says.

4. Revisit your budget and include your spouse. In some states, your medical debt may become joint debt with your spouse.

"They would rather receive partial payment than no payment at all."

"Return to the budget and take an honest inventory of what expenses labeled 'discretionary' can be sacrificed to meet the monthly debt obligation," says Weckerly. "If married, be sure to include your partner in the conversation. Not including one's partner is a common mistake.

"I've dealt with many clients in the past who are married but 'plan separately.' Realize that any debt acquired during marriage is typically treated as joint debt, depending on state law. Include them in the conversation wherever possible."

5. Don't be afraid to negotiate your medical bills. Offer quicker payment if the doctor or hospital will agree to a lower amount.

"Doctors and health care providers are often willing to negotiate on the amount of debt owed," says Lynnette Khalfani-Cox, author of "Bounce Back: The Ultimate Guide to Financial Resilience."

"They would rather receive partial payment than no payment at all, and therefore are open to discussing lower lump-sum payments or interest-free payment plans," she adds. "It's not uncommon for providers to accept as little as 25 to 50 cents on the dollar of what you owe."

6. Ask for financial aid or charity assistance. If you are unable to manage a large medical bill, be candid with the medical provider. Assistance may be available.

"If you have a large medical bill to a hospital, be sure to reach out to their financial aid office or charity care program," says Jay Zigmont, a Certified Financial Planner and founder of Childfree Wealth in Water Valley, Mississippi. "Most nonprofit hospitals have a program to forgive medical debt if you meet their requirements.

"If you qualify for Medicaid, you may be eligible to have retroactive medical bills covered."

"They may also offer you a payment plan. I worked with a client who owed six figures to a hospital. The client contacted the hospital and was put on a payment plan of $20 per month, indefinitely. It sounds silly, but it happens."

7. Look for help from advocacy organizations. If you feel overwhelmed by medical debt, reach out to advocacy organizations or government agencies such as Medicaid.

"There are several organizations such as RIP Medical Debt, HealthWell Foundation and the Patient Advocate Foundation that work with individuals to help pay off medical debts," Khalfani-Cox says. "Also, if you qualify for Medicaid, you may be eligible to have retroactive medical bills covered. It's worth exploring these options if you have a disease that's left you struggling with medical debt."

8. Catch a credit break on medical debt below $500. Medical debt below $500 that is in collections will no longer be reported on your credit report. So if you slip up on paying a small medical bill and it goes to collection, you don't have to worry about it hurting your credit rating.

"Medical debt below the $500 threshold doesn't hurt your credit rating anymore."

"Fortunately, medical debt below the $500 threshold doesn't hurt your credit rating anymore. Since the first half of 2023, the three major credit reporting agencies, Equifax, Experian and TransUnion, no longer include medical debt in collections under $500 on credit reports," Khalfani-Cox says.

"This change is part of a broader shift in how these agencies are handling medical debt reporting," she adds. "They also no longer include paid medical debts on credit reports since July 1, 2022, and they've increased the period before medical debt in collections appears on your credit reports from six months to one year."