7 Ways Women Can Cut the Cost of Long-Term Care Insurance

Since coverage costs more than for men, here are some shopping tips

A number of studies show that women often pay more than men for similar services and products — like dry cleaning and personal care products. The same “woman's tax” often surfaces when couples look to purchase long-term care insurance. But there are ways women can combat the high cost of long-term care coverage, as you’ll see shortly.

In some extreme situations, when couples’ price long-term care coverage, the wife’s quote can be nearly triple her husband’s, despite a proximity in age and similar health status. That certainly sparks sticker shock!

Why Women Pay More for Long-Term Care Insurance

Digging deeper into the reasons for the cost differential between men and women underscores just how important it is for women to have the coverage.

The U.S. Department of Health and Human Services found that half of people age 65 and older will need daily help as they age, with total long-term care expenses averaging over $91,000 for men and double that for women. That’s partly because women live longer than men. Women also have a higher rate of chronic illnesses, like depression, that can necessitate care over an extended period of time. Also, almost two-thirds of Americans with Alzheimer’s disease are women.

Three Comparisons Across the Country

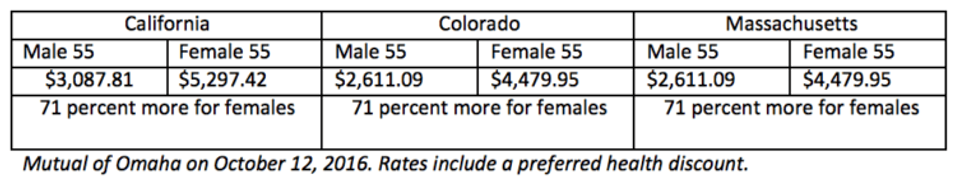

Take a look at the chart below with premium estimates from one of today’s most competitive insurers, Mutual of Omaha. While women aren’t paying three times what men pay in these cases, a 71 percent higher premium for women holds steady across all three states.

As an aside, if those premiums look steep, it’s worth noting that the quotes are for fairly robust coverage: $5,000 per month in benefits that rise with 5 percent compound inflation; a shared care rider (explained below) and three years of benefits.

Often, consumers decide to accept a lower inflation provision for upwards of a 40 percent discount in rates.

7 Shopping Tips for Women

How can women ensure they’ll receive the coverage they need at a price point that works for them?

1. Talk to an adviser about options. Discussing overall financial goals, concerns about the future and the cost/benefits associated with the various options will enable an adviser to solidify an appropriate plan of action.

Seeking the advice of objective advisers who do not sell insurance ensures the discussion and resulting decisions remain objective. If insurance is the answer, team up with a qualified long-term care specialist.

2. Reduce the risk of premium hikes. Purchasing a larger daily benefit with a lower Cost of Living Adjustment option can mitigate the risk for future increases.

3. Couples can consider shared-care policies. This option lets a married couple share, and potentially reduce, the gender differential on coverage available to men and women.

4. Plan for the needs of single women. Married people often delay filing long-term care insurance claims because the healthy spouse often performs the easy tasks. However, single women must rely on caregivers in the absence of a healthy spouse. At the same time, single women may be able to accept a greater level of co-insurance since there is no spouse to care for.

5. Open a Health Savings Account (HSA). Tax-exempt HSA dollars can be used to pay long-term care premiums, subject to deduction limits. You must be covered by a qualified “high-deductible” health insurance policy to open an HSA.

6. Choose a hybrid long-term care insurance policy. Hybrid plans include life insurance and ensure that a premium will never increase and there is cash value in these universal policies. They pay the family in either life insurance proceeds or long-term care benefits.

However, there are some trade-offs. Hybrid policies often require substantially more premium in the early years and inflation protection is very expensive.

7. Above all, plan early! Insurers are becoming more conservative, which means there’s been an increase in their rate of declining applicants due to their medical histories. We have seen applicants declined for long-term care coverage based on a condition that was allowed by the same insurer just a year before.

The sooner you plan, the more options you are likely to have in the future.