Why Americans Still Feel So Shaky About Retirement

3 reasons from a new survey, plus what could help

The economy’s humming, the stock market is soaring, interest rates to borrow are still pretty low (albeit on the rise). So why does the Employee Benefit Research Institute (EBRI) 2017 Retirement Confidence Survey show that Americans feel less confident about having enough money to live comfortably through retirement than a year ago? And why are so many of us so stressed about retirement?

Turns out, there are three good reasons.

I’ll get to them shortly, but first, a brief explanation about EBRI’s 27 annual survey — the longest-running one of its kind.

EBRI conducted online interviews in January 2017 with 1,082 workers and 589 retirees. Among its many findings: only 60 percent of workers said they feel very or somewhat confident about their financial outlook for retirement (down from 64 percent in 2016). And 31 percent said they feel “mentally or emotionally stressed about preparing for retirement;” 43 percent of those without employer-sponsored retirement plans felt that way. Overall, 47 percent of workers — and 87 percent without 401(k)-type plans — have less than $25,000 in savings, the survey said; 35 percent have $100,000 or more.

Jack VanDerhei, EBRI’s meticulous research director, issued a small caveat about comparing this year’s results to last year’s: The 2017 survey was the first time EBRI surveyed people online, rather than by phone. Answering online may have led some to “give a more honest opinion, as opposed to what the person on the other end of the phone may have wanted to hear,” said VanDerhei.

That said, VanDerhei added, most workers aren’t feeling more confident about their retirement prospects despite the trends in the economy and the markets. “I still think we’re in a situation where even though financial markets have had a good year, we’re not necessarily looking at a lot of workers feeling confident, particularly regarding their ability to save for certain types of expenses in retirement, like long-term care,” he told me.

3 Reasons Americans Lack Retirement Confidence

Based on my reading of this survey and others, and my conversation with VanDerhei, here are the three reasons so many Americans aren't feeling confident about retirement:

Lack of Retirement Confidence Reason No. 1: Fear of expenses in retirement, especially health care and long-term care costs. Only 54 percent of workers surveyed said they felt confident about being able to afford medical expenses in retirement. And 57 percent told EBRI they were not confident they will have enough money to pay for long-term care if they need it.

“There is a great deal of uncertainty in terms of potential Medicare reform going forward,” said VanDerhei. “If you are a worker trying to plan ahead for whether you’ll be able to deal with health care costs, you’re seeing a lot of discussion about Medicare not being completely funded going forward.” Just 38 percent of workers EBRI surveyed said they’re confident Medicare will continue providing the same level of benefits that retirees receive today.

In addition, said VanDerhei, “corporations have been cutting back on retiree health insurance over several decades, which leads to more paranoia by people about their ability to cover health care costs.”

Fidelity Investments estimates that the average 65-year-old couple retiring in 2016 will spend $260,000 to pay for out-of-pocket health costs over retirement. But most workers, Fidelity recently found in its own survey, vastly lowball that figure. In fact, 22 percent underestimated the $260,000 amount by about $200,000. Retired women pay about $600 more per year than men in out-of-pocket health costs, AARP Chief Public Policy Officer Debra Whitman recently told USA Today.

When Nationwide just surveyed women 50 and older about potential health care and long-term care costs in retirement, 65 percent couldn’t estimate their health costs and 77 percent couldn’t estimate their long-term care costs. (Most of the women Nationwide surveyed said they would rather die than live in a nursing home.)

While most retirees won’t incur long-term care expenses, some will — and for those who do, the costs can be staggering. A private nursing home room now tops $92,000 annually, on average, and a home health aide costs over $46,000, according to the 2016 Genworth Cost of Care Study.

“Nothing happened in the last year that would likely make people feel any better about paying for long-term care,” said VanDerhei. “In terms of the number of companies offering long-term care insurance or the pricing of the products, that has become even more stressful.”

Lack of Retirement Confidence Reason No. 2: Debt. EBRI found that only 32 percent who feel debt is a major problem for them are confident about retirement, compared with 78 percent of those who said debt is not a problem for them. (The average household owes $134,643 in debt, including mortgages, according to Nerdwallet.com.)

Unlike in the past, debt in retirement has become a significant worry for many pre-retirees.

According to 2015 EBRI study, the percentage of American families headed by people 55+ with debt rose from 63 percent in 2015 to over 65 percent in 2013. About 9 percent have debt payments greater than 40 percent of gross income, a rule of thumb for debt trouble. “This level of debt among families with heads ages 55 or older, along with asset values still recovering from the 2008 recession, will add to the difficulty for many people of this age to save for a retirement that will not run short of money,” wrote EBRI’s Craig Copeland.

Little surprise, then, that in the Wells Fargo/Gallup investors’ survey coming out on Thursday, 24 percent said if they get a tax cut from Washington of a few thousand dollars, they’ll use the money to pay down debt.

Lack of Retirement Confidence Reason No. 3: Low returns on savings accounts, CDs, bonds and bond funds. Although many stocks have soared, returns continue to be puny on safer savings and investment offerings from banks and bonds — the types of holdings people gravitate to for financial security in retirement.

“People are still trying to deal with relatively low investment income on fixed-income investments,” said VanDerhei. “Nothing that happened in 2016 made those investment opportunities any better.”

Yes, the Federal Reserve is slowly and gradually raising rates, which could help savers and investors a bit going forward. In the new Wells Fargo survey, 37 percent of investors said higher interest rates would make them likely to transfer money out of the stock market and into safer investments, up from 23 percent two years ago.

Stressed, But Stymied

What’s particularly distressing in the EBRI survey is how little most workers are now doing to plan for retirement and to boost their confidence about their financial future. “There’s a total disconnect. People say they’re stressed, but they don’t take steps” to reduce that stress, said VanDerhei.

Only 41 percent of workers EBRI surveyed have tried to figure out how much they’ll need in retirement; 38 percent have estimated how much income they’ll need each month in retirement or estimated the amount of their Social Security benefit and just 34 percent have estimated their expenses in retirement.

In a Next Avenue blog post I wrote two weeks ago, I described this kind of thing as “The Shruggie” position — you know, the famous emoji. ¯\_(ツ)_/¯

VanDerhei thinks some people don’t run the numbers with free online retirement planning tools because they don’t trust the computerized calculations. “If you look at some articles in the financial press, they plug in the same information in dozens of software tools on the web and they get not just 12 different answers, but in many cases, very significantly different answers,” he said. He’s right. I’ve seen those articles. I’ve written some of them.

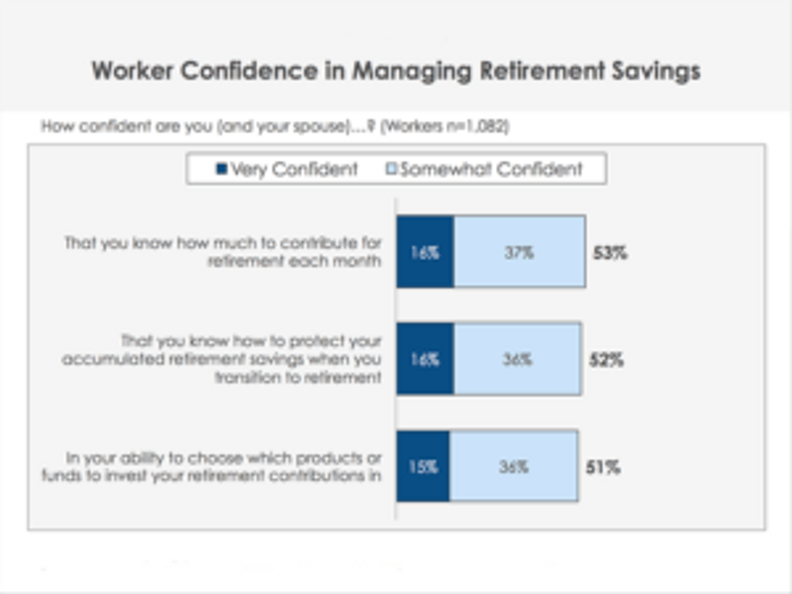

Many workers, however, are just plain confused and uncertain about what they should be doing for retirement. Only 16 percent in the EBRI survey felt confident they knew how much to contribute for retirement each month or how to protect their accumulated retirement savings when they transition to retirement.

In the 2017 TIAA IRA Survey, 28 percent of Americans without Individual Retirement Accounts said they don’t know enough about them and 17 percent thought they were too complicated. Only 54 percent said they understand how IRA tax benefits work.

And Capital One Investing’s Financial Freedom Survey just reported a drop in the percentage of Americans who said they feel confident they’re saving enough to retire comfortably — down from 72 percent in 2015 to 62 percent today. Among the reasons cited: lack of knowledge and experience investing and investing complexity.

Rather than just shrug, I think a better response to a lack of retirement confidence is to find a trustworthy financial adviser — a human or a robo-adviser or a hybrid — who can help put you on a path toward retirement security. Just 23 percent of workers have spoken with a retirement planning pro, according to the EBRI survey.

If more people did, I suspect the percentage of workers feeling confident about retirement might start going up, not down.

Next Avenue Editors Also Recommend: