3 Questions to Ask to Assess Your Asset Allocation

Investing and retirement advice from a Schwab financial planning pro

With more frequent spikes in market volatility, after nine years of a bull market — and the 2008-‘09 bear market a not-too-distant memory — it’s understandable to have your stomach churning and be asking…what’s next for the market? One thing we know is that market risk and big drops in the market may be easier to handle, generally, if you’re younger. But if you’re later into investment life, a down market can derail your plans.

So if you’re in your 50s or 60s, here are three questions to ask yourself to help make sure your portfolio and asset allocation are positioned for the market now:

Question 1: What’s my goal for each investment?

Do you know why you’re investing? Many investors don’t. This is the place to start.

“Making money” is one goal. But in your 50s and 60s, or at any age frankly, it’s most important to start with what you’re investing for.

Retirement? A house down payment? A child’s education? Think about each dollar you’ve invested, each account you have and what you’ll do with the money.

For most of us, the biggest chunk of money will be earmarked towards retirement. That’s a great place to start. But do you have other goals with different time horizons? If so, start by writing down each account or investment. And think: what do I need the money for?

Question 2: What’s my risk capacity for each account?

Your risk tolerance is how much risk you can stomach. Asking yourself about that for each account is a common question when building a portfolio. But how much risk can you afford? That’s your risk capacity.

And risk capacity becomes more important as you get closer to why you saved and invested the money to begin with — to support your financial life.

One way to add risk capacity to your investment thinking is to put a time horizon on your investments. If you need money soon — for a wedding, a home or a child’s education — don’t invest too heavily in stocks.

If you’ll need the money within three to five years, or think you’ll sell out of riskier investments if you see a steep market decline, consider lowering the risk in your portfolio by increasing your allocation to cash and bonds.

If you won’t need the money soon — for retirement in more than five to 10 years or another long-term goal — a heavier dose of stocks may make more sense.

Here are tips and starting points to help put a time horizon on each investment or investment account now:

- Goals for the next two years: Given the tight time horizon, these objectives would benefit from relatively liquid cash investments, such as certificates of deposit, money market funds or short-term U.S. Treasury bills.

- Goals for the next three to 10 years: With an investment horizon that’s neither short nor long, these objectives would benefit from assets that focus on not just growth but also capital preservation, such as a relatively conservative mix of bonds and stocks.

- Goals more than 10 years out: With enough time to ride out the inevitable market vagaries, these objectives can benefit from a more-aggressive allocation to stocks, which can rise and fall more dramatically in value in any single year but offer the greatest potential return over the long haul.

Question 3: How should I use asset allocation to manage my investments now?

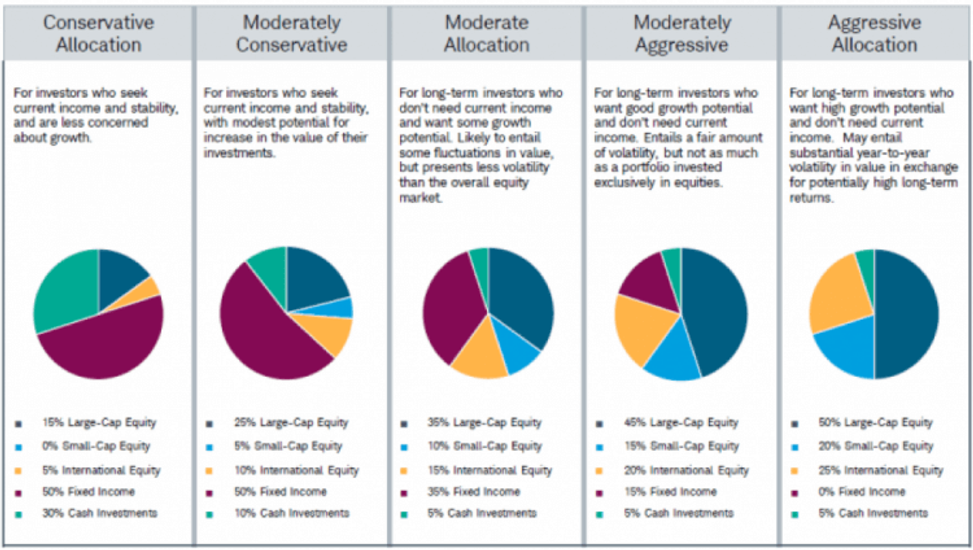

Guidelines are great. But what about specifics? What’s the right mix of investments for you now? The illustrations below provide a starting point on how you might approach asset allocation from left to right based on risk tolerance, risk capacity and time horizon.

How about retirement? That may be your most important investment goal.

If you plan to use all of your retirement savings to support yourself and not leave money behind, aim to get to the middle of the chart above by the day you retire. That’s roughly 60 percent of your money for retirement invested in a diversified portfolio of U.S. and international stocks, using mutual funds or other diversified investment vehicles, and roughly 40 percent in fixed income (bonds), using mutual funds or other investment vehicles and cash.

As with any financial issue, needs and conditions vary, so consult with an adviser. But using the guidelines above is a good place to start, we believe, for most investors to be ready for any market. Just keep in mind: Diversification and asset allocation do not ensure a profit and do not protect against losses in declining markets. Investing involves risk, including loss of principal.