Estate Planning Advice for LGBT Couples After the Supreme Court

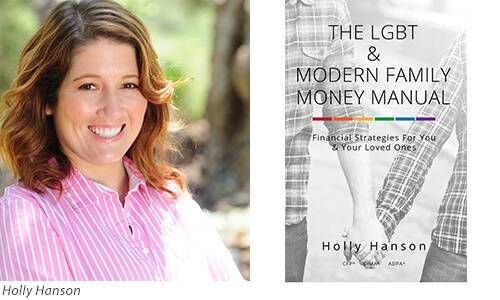

Tips from 'The LGBT & Modern Family Money Manual' author

(The following is adapted from The LGBT & Modern Family Money Manual.)

No matter what your familial configuration or marital status, estate planning is something every person needs to address. But the rules are complicated, and changing, for LGBT couples, especially with today's Supreme Court decision making same-sex marriages legal in all 50 states. And if you’re an LGBT couple operating without the legal protections and advantages afforded by marriage, a few key documents are especially important.

The Supreme Court decision means protections under the law are now inherently available for same-sex couples that they would not have had access to before — or would have had to go through additional expense and time to get the same security for themselves and their family.

As a result of the ruling, it is important to talk to your partner about the future in a way you may have not considered before. Engage your trusted advisers in how the court ruling affects you personally, so you make the changes needed to protect you and your family for the future

Here are the estate-planning basics for legally-married LGBT couples now:

The Marital Deduction

Before the fall of the Defense of Marriage Act (DOMA) and states coming on board legalizing same-sex marriage, a same-sex couple would be treated as two single people for tax purposes. Now, same-sex married people can pass an unlimited amount of assets — either in life or death — to their spouses without paying federal or gift tax.

The Portability Clause

The portability clause is an estate-tax exclusion (limited to $5.34 million) that is now open to legally-married LGBT couples. In short, the portability clause means that if they have any unused exclusions under estate tax laws, it can be passed to the surviving spouse in the case of one spouse’s death.

For example, if one spouse passes away and uses $3 million of the estate tax exclusion, the surviving spouse can “port” the remaining exclusion (in this case, $2.34 million) as their own to pass on to their heirs tax free.

Gift Splitting

As an individual, you can give $14,000 in 2015 tax-free to any individual and defer gift tax up to the federal lifetime exemption ($5.34 million). What changed after the recognition of same-sex marriage is, if agreed upon, a couple can combine their individual allowances, gifting up to $28,000 to a nephew or cousin (or stranger on the street!) without having to send two separate checks.

Qualified Retirement Plans

In the case of qualified retirement plans such as 401(k)s — but not IRAs — a legally recognized spouse has the right to be the sole, primary beneficiary. If you were legally married and your state recognizes that marriage, that means that in order to name anyone other than your spouse as the sole, primary beneficiary on that account, you would need to get the proper consent from your spouse. Now, an added layer of protection has been put in place for LGBT spouses in states that recognize the marriage.

Rollover Rights

Similarly, legally-married LGBT spouses now receive equal protection in the area of rolling over their deceased spouse’s IRAs.

Let’s say, for instance, I have a traditional IRA worth $500,000; my wife, Sophie, also has a traditional IRA and we each have named the other as primary beneficiary. If I pass away, Sophie now has the right to roll my IRA into her own without starting to take the required distributions or liquidating the account to a taxable account upon my passing. Now, Sophie can delay that until she is 70 1/2, so the money can grow tax-deferred in her IRA and give her more control over the distributions during her retirement.

Useful Estate Planning Documents for LGBT Couples

I strongly encourage you to set up the following documents:

Domestic partnership agreement This lets the two of you lay out plans to share income, expenses and property. If you have children, you’ll need to outline custody plans in case something happens to one or both of you or in the event of separation.

A living will This spells out your inheritance and how you want the succession to play out within your family orbit. It also talks about guardianship of your children. You can name an executor of your estate to take care of everything once you pass away. For people with pets, you can also name someone to take care of your pet in the case of your passing.

A living trust This document is created during your lifetime and helps you control who receives your assets upon your death as well as allowing your beneficiaries to avoid the delays and costs involved in the probate procedure. There are many types of trusts: revocable or irrevocable, special needs, life insurance, and more — making it important to work with a professional to determine which you will need.

Powers of attorney(s) for finance and health care A power of attorney is a legal document that gives someone you choose power to act in your place. You will want to set up a durable power of attorney should you want the document to stay in effect if you become incapacitated and unable to handle matters on your own. Equally important is a medical power of attorney.

One type is a health care directive, which sets out your wishes for health care if you are ever too ill or injured to speak for yourself. A second type is a living will, providing written instructions to your agent and health care provider, allowing for your medical care in the event you are unconscious and have no reasonable chance of recovery.

A final arrangements document This document is not recognized as a legal document per se. But by writing one with your signature notarized, you’re giving a voice after your death to your instructions and it can be helpful if your partner is left to make tricky decisions. It can give you tremendous peace of mind knowing that this document can provide guidance after you die if your family is not in agreement over how things should be handled and wants to know what you would have wanted.