Longevity Literacy Is Key to Retirement Readiness

Most Americans score miserably when asked how long people aged 65 tend to live

Chances are, if you were asked to name the principal elements of planning and preparing for retirement, you would say things like saving regularly, managing expenses and keeping debt down.

You probably wouldn't mention one thing that's also vital: your longevity literacy, which is an understanding of how long people tend to live after reaching retirement age.

Having a high degree of longevity literacy "is a fundamental part of planning for retirement," said Annamaria Lusardi, senior fellow at the Stanford Institute for Economic Policy Research at the Stanford Center on Longevity's Century Summit 2023. "Empowering people with longevity knowledge can move them toward having financial security."

Longevity Literacy and Retirement Readiness

Lusardi and fellow researchers at the Global Financial Literacy Excellence Center and the TIAA Institute found in a 2023 study that longevity literacy is directly correlated with retirement readiness. (My "Friends Talk Money" co-hosts and I discussed the study in a recent episode.)

"The number of people who know how long a 65-year-old will live, on average, is really small."

They discovered that workers with strong longevity literacy are typically more confident they'll have enough money to live comfortably in retirement than those with weak longevity literacy.

Retirees with strong longevity literacy were more likely than others to report their lifestyle met or exceeded their preretirement expectations and more confident they will have enough to live comfortably through retirement.

But there's a big problem: Only 12% of U.S. adults have strong longevity literacy; 31% have weak longevity literacy, researchers at the TIAA Institute and the Global Financial Literacy Excellence Center determined after surveying 3,503 U.S. adults.

"The number of people who know how long a 65-year-old will live, on average, is really small," Lusardi said at the Century Summit.

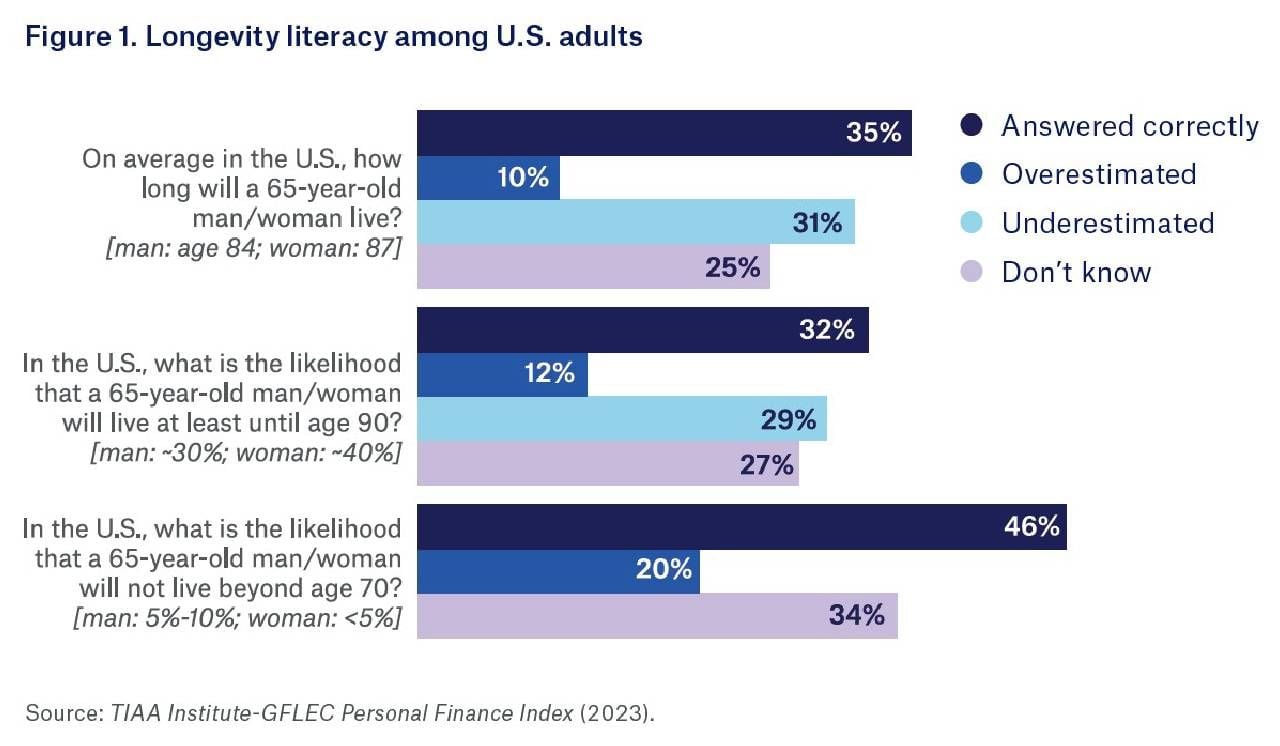

Just 35% of surveyed respondents correctly said that the average 65-year-old man will live to 84 and the average 65-year-old woman to 87.

The survey also asked about the likelihood of 65-year-olds living to at least 90 and not living beyond 70. Responses to those questions were abysmal, too.

Just 32% knew that the likelihood of a 65-year-old man and woman living to 90 was 30% and 40%, respectively. Under half (46%) knew that the likelihood of a 65-year-old not living beyond 70 was only 5% to 10% for men and under 5% for women.

Lousy Longevity Literacy

Boomers were only barely more longevity literate than members of Gen X, Gen Y and Gen Z and none of the generations demonstrated especially high longevity literacy; just 13% of boomers had strong longevity literacy compared to 12% of Gen Y, 11% of Gen X and 10% of Gen Z.

This is the second consecutive year the Global Financial Literacy Excellence Center at the Stanford Graduate School of Business (formerly at George Washington University School of Business) and the TIAA Institute (the research arm of the TIAA financial services firm for nonprofits) have measured longevity literacy. The researchers' conclusions were similar for both studies.

"Men more often demonstrate a complete lack of understanding of the retirement planning horizon."

Their latest survey also found that men score much lower than women on longevity literacy and are more likely than women to underestimate how long 65-year-olds are likely to live.

While 26% of women surveyed underestimated how long a 65-year-old will live, 35% of men came up with ages shorter than reality. Similarly, 27% of women underestimated the likelihood that a 65-year-old will live at least until 90, but 32% of men fell short.

"Men more often demonstrate a complete lack of understanding of the retirement planning horizon," the report said.

Surya Kolluri, head of TIAA Institute, said at the Century Summit that this gender difference "flips the script" on what other studies have found about financial literacy. In those, women tend to be less knowledgeable about personal finances and investing than men.

Pessimistic About Longer Lives

In their November 2023 report for the Center for Retirement Research at Boston College (Longevity Risk: An Essay), economists Karolos Arapakis and Gal Wettstein cited other studies showing that life expectancy statistics "do not necessarily reflect how individuals perceive how long they will live."

"Empirically, parental age of death has been a poor predictor of an individual's mortality."

Many people in their 50s and 60s are pessimistic about their survival probabilities for two reasons, the authors wrote.

One is that the media usually reports the life expectancy for people at birth, not at 65. Elevated rates of suicide, homicide, unintentional injuries and other factors among teenage and young adults reduce life expectancy that starts at birth. Measured that way, average U.S. life expectancy in 2022 was 77.5, a slight rise from 76.4 in 2021, according to the Centers for Disease Control and Prevention. It's 80.2 for women and 74.8 for men.

The other reason people underestimate longevity is that they base their own mortality dates on when their parents died. "Empirically, however, parental age of death has been a poor predictor of an individual's mortality," said Arapakis and Wettstein.

Why Longevity Literacy Matters

It's good to know the real longevity for 65-year-olds because that information can help you save appropriately for retirement. If you underestimate longevity, you're likely to not have a big enough nest egg to last your lifetime.

The Center for Retirement Research report cited an internal Greenwald Research presentation that suggested "advisors are deeply concerned about many of their clients' ability to manage longevity risk." Translation: the ability to avoid running out of money.

"People are taking a longevity risk by not knowing the answer to the longevity questions," said Kolluri.

Improve Your Retirement Security

One starting point on the longevity literacy road is knowing how much you hold in retirement savings. But many people don't.

"Nearly one-fourth of people are unsure how much retirement savings they have," Kolluri noted.

"Nearly one-fourth of people are unsure how much retirement savings they have."

Annuities — financial products from insurers that convert a lump sum into monthly income for the rest of your life — are one way to keep money flowing throughout retirement.

However, financial advisors don't seem to recommend annuities to many of their clients, the Center for Retirement Research report said. Just 14% of Americans have bought an annuity.

"The question is why," said Dylan Tyson, president of Prudential Retirement Strategies at the Century Summit. "What are the structural barriers in the design of our retirement system?"

He pointed to research showing that 80% of people say lifetime income is something they want, acknowledging that financial services firms need to make annuities easier to understand and keep costs as low as possible.