Medicare Enrollees, It’s Time to Review Your Plan

Missing the Annual Enrollment Period may cost you money and key coverage

My husband and I turned the magical age of 65, just 23 days apart. While buttercream-iced cakes with 65 lighted candles made for a spectacular celebration, our greatest gift was Medicare eligibility. Both of us retired early and have paid high COBRA rates for private insurance coverage.

During the eight-week Annual Enrollment Period, which starts on October 15, we and our fellow Americans aged 65 and older will have an opportunity to enroll in the traditional Medicare program or one of its private competitors, collectively known as Medicare Advantage. We must decide by December 7, when the enrollment period ends. Plan changes take effect on January 1, 2024.

First, Find an Expert

Knowing how complex Medicare is, how should you proceed? Ask for help from an expert. If your car's transmission goes out, do you immediately ask the first friend who offers advice? Someone without experience in auto mechanics could damage your transmission. Medicare also holds this truth.

Knowing how complex Medicare is, how should you proceed? Ask for help from an expert.

Gina Downs, vice president of Senior Connection, a private health insurance consulting firm in Evansville, Indiana, stressed the importance of using an expert.

"Our organization serves people from all backgrounds, from doctors, health professionals, attorneys, to others," she said, "because many are confused with the complexity of how Medicare works."

"The vast majority of those individuals we serve do their research before our meeting," Downs added. "Often, a beneficiary's understanding doesn't match reality due to the changing complexity of Medicare."

Compare Plans to Your Needs

She recommended that people considering traditional Medicare or one of the private alternatives work with an unbiased broker who represents multiple companies. She warned people to be wary of sales representatives who offer only one company's products.

Reading Google reviews of products before meeting an expert can help, Downs added. Senior Connection, affiliated with Key Benefit Administrators, is one of the largest third-party administrators in the country.

As you approach the Annual Enrollment period, here are some issues to ponder.

Money, Money, Money. Medicare enrollees should monitor their situation as plans evolve and personal health needs vary. Regardless of the plan type, Medicare recipients may spend more of their income on health care than they comprehend at a younger age. Fidelity Investments estimates that a person on Medicare in 2023 will spend $157,000 on lifetime health care costs for a single person and $315,000 for a couple. The same statistic for a single in 2002 was $80,000, quite an increase.

Medicare has not yet announced the monthly premium it will charge in 2024 for Part B coverage, which includes doctor fees, outpatient care, home health care and medical equipment. Dan Adcock, director of government relations and policy for National Committee to Preserve Social Security and Medicare, projects the Part B standard monthly premium for 2024 will be $174.80, a $10 increase over 2023 but about the same as 2022 ($170.10).

As Simple as A, B, D

Adcock said higher-income beneficiaries — individuals with taxable income over $97,000 or couples with a joint return on income exceeding $194,000 will pay higher monthly premiums. The Part B annual deductible is projected to be $240, up $17 from the prior year.

He added that the base premium of Part D (prescription drug coverage) is estimated at $34.70 a month. Like the Part B premiums, wealthy individuals will pay more.

"Historically, health care costs, including Medicare premiums, increase faster than general inflation," Adcock said.

The Old Switcheroo. In September, Adcock said enrollees receive an Annual Notice of Change explaining any cost increases or plan benefit changes for the next year.

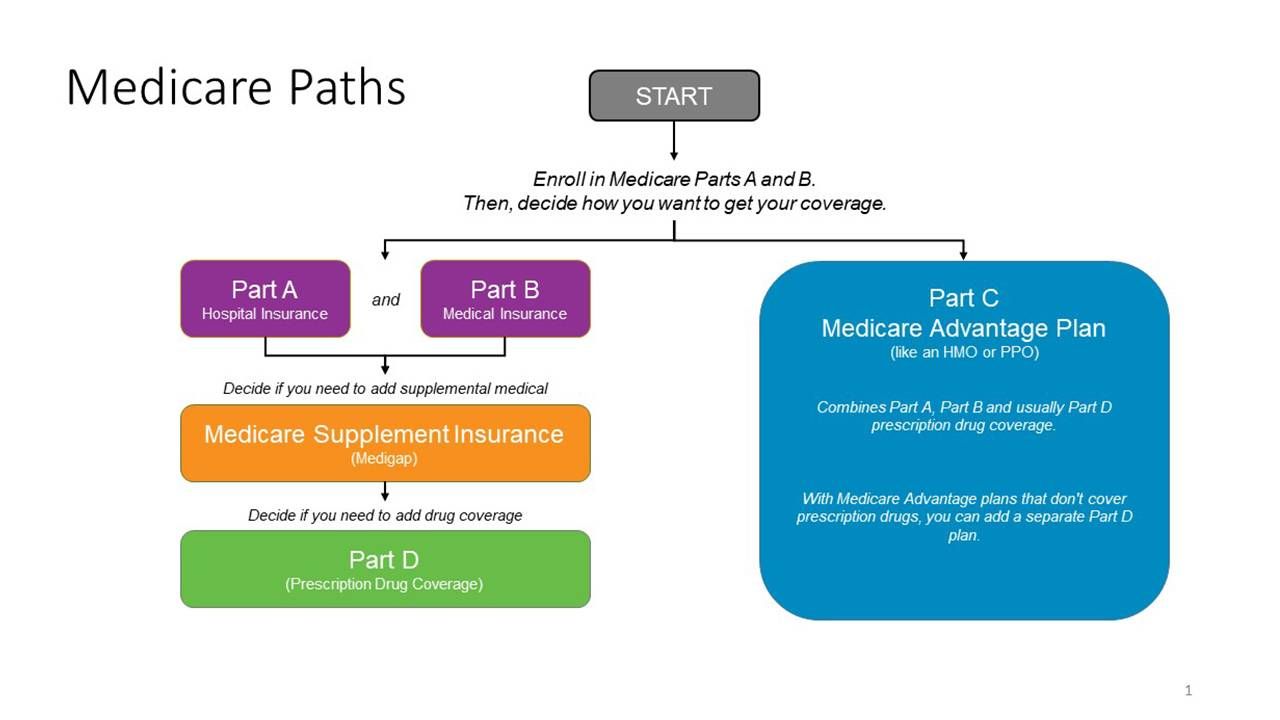

As long as you are enrolled in Medicare Parts A and B, you can change from traditional Medicare to a Medicare Advantage plan during the annual enrollment period.

"Historically, health care costs, including Medicare premiums, increase faster than general inflation."

You also can do the reverse, though details vary by each person's health circumstances. You can move from one Medicare Advantage to another Advantage plan and change or enroll in a prescription drug card plan.

When you meet with the expert, he or she will review your current options, help you uncover changes for the next year, and offer new options. Don't wait until the last minute; the closing date for the Annual Enrollment Period is December 15. You will automatically stay on your current plan if you do not file the paperwork for a change.

It's Not Easy Being Green. All Medicare enrollees are different. My husband and I were accustomed to the ease of relying on employer-sponsored plans, so the choice wasn't much of an issue. Easy peasy — or so we thought.

But Medicare choices aren't easy, which is why we seek expert help and urge others to do so. Our medical situations are not alike, and due to differing employer-sponsored plans, we each had physicians in different networks. Changing doctors, especially specialists, is often difficult, especially in areas with a shortage of pulmonologists, diabetologists and rheumatologists.

My husband chose a Medicare Advantage plan, provided by his employer, similar to his health insurance plan. The deductible alone was about a third of any marketplace plan, a huge selling point. I chose traditional Medicare with a supplement and drug card. I use supplemental oxygen, and with my previous health plan, rental for a portable and home concentrator had been over $130 a month, whereas Part B on traditional Medicare paid the whole cost.

Count Your Treasures. Last year's medical and prescription data is golden as you access needs for the coming year. You must understand what coverage you currently have, how much insurance paid out, and how much your out-of-pocket costs were so you can share them with the expert at your open enrollment meeting. No one wants to keep stacks of paperwork, and most insurance companies give you a portal to your data. If you have resisted setting up the portal, now's the time. And if you feel intimidated, isn't setting up computer stuff one of the reasons for grandchildren?

Knowledge Is Power

In looking at your coverage, remember that coverage of a medication doesn't mean it will be inexpensive. I have a generic pill that is cents on the dollar, while my most significant inhaler is $140. Both are covered drugs. My Part D drug card covers both drugs but at different tiers. As the Smokey Robinson song says, "You better shop around."

"I am optimistic for those who enroll today and in the future because Medicare is an overwhelmingly politically popular program."

There is good news and bad news on the medication front. Last year's Inflation Reduction Act allows Medicare to negotiate with pharmaceutical companies over some drug prices, with the first 10 drugs announced in September. Companies will be penalized if they allow drug prices to increase beyond inflation. However, the new prices won't be available until 2026.

Know Your Risk Tolerance. In 2022, for the first time, more people chose a Medicare Advantage plan over traditional Medicare. NCPSSM's Adcock asserts that individuals must assess their financial risk tolerance in choosing a plan. As he explained, with traditional Medicare, a supplement, and a Part D drug card, the enrollee knows costs ahead of time. Almost all hospitals and physicians take traditional Medicare — whether in Portland, Peoria or Poughkeepsie — while Medicare Advantage plans operate on networks. If you are looking at a Medicare Advantage plan, check if your physicians and preferred hospital are in the network. Out-of-network costs may be much higher.

Limits of Advantage

With Medicare Advantage, there may be no or low-cost monthly premiums and modest additional benefits for dental, hearing, prescriptions and vision. Most plans have out-of-pocket limits. There are differences between what plans pay, whether prior authorization is needed, and in some cases, networks are limited. Medical Advantage plans are not the traditional government-funded Medicare but plans administered by private insurance companies.

While Medicare Advantage or traditional Medicare may meet your needs, be aware of the differences between plan coverage and your health needs.

Medicare's Future. According to Adcock, Medicare's financial future is safe. "The 2023 Medicare Trustees report projects that the date of depletion of the Medicare Part A Hospital Insurance Trust Fund will be in 2031. After 2031, the Trustees project the revenue from this fund will cover 89% of program costs," he said.

"If the reserves are depleted, the remaining amount will come from payroll taxes. I am optimistic for those who enroll today and in the future because Medicare is an overwhelmingly politically popular program," said Adcock. "Congress won't deal with these issues until the last minute, so it may be years before it is addressed."

Individuals can express their concerns with their members of Congress here.

Like many things in life, medicine is complicated and ever-changing, no matter the choices you make. All the due diligence in the world doesn't make Medicare easier to understand, but resources are available to help you transition to a new year, whether you stick with your current policy or change.

Watch your mailbox for your Annual Notice of Change from your current policy and make an appointment with an expert in your area for October 15 through December 7.