The New Tax Forms You Need to Know

There's a special 1040 for 2019 and a new W-4 for 2020

Now that tax season has kicked in, prepare for some pretty big changes on your 2019 tax forms. You may even wind up filling out a new version of the 1040 specifically for people 65 and older. And the W-4 withholding form from employers has been completely revamped.

“I’d say the tax forms are very different this year,” said Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting in Riverwoods, Ill.

Here’s why: The Trump administration wanted to let people fill out “postcard-size” 1040s last year — cutting the form from 79 lines to 23. But doing so led the Internal Revenue Service (IRS) to create six other forms for information that got left out. Some taxpayers need to complete these forms, known as Schedules, too. The new Schedules led to an outcry in the tax preparation community, with about 540 comments (mostly negative) to the IRS.

"For the second time in two years, the tax forms will look very different.”

So, for 2019 returns, the 1040 is longer than a year ago, but the number of Schedules has shrunk, from six to three. The new Schedules have 10 to 22 lines. They’re for things like the child care tax credit, education credits, energy tax credits, the Alternative Minimum Tax, self-employment tax, household employment taxes, alimony received or paid, business income, rental real estate, unemployment compensation, student loan interest, health savings accounts and self-employment retirement plans.

In short, “for the second time in two years, the tax forms will look very different,” said Gregg Wind, a Los Angeles-based partner at the accounting firm Kallman Logan & Co. “But with just three supporting Schedules, I’d say the tax forms are now less complicated. I see this as a good development.”

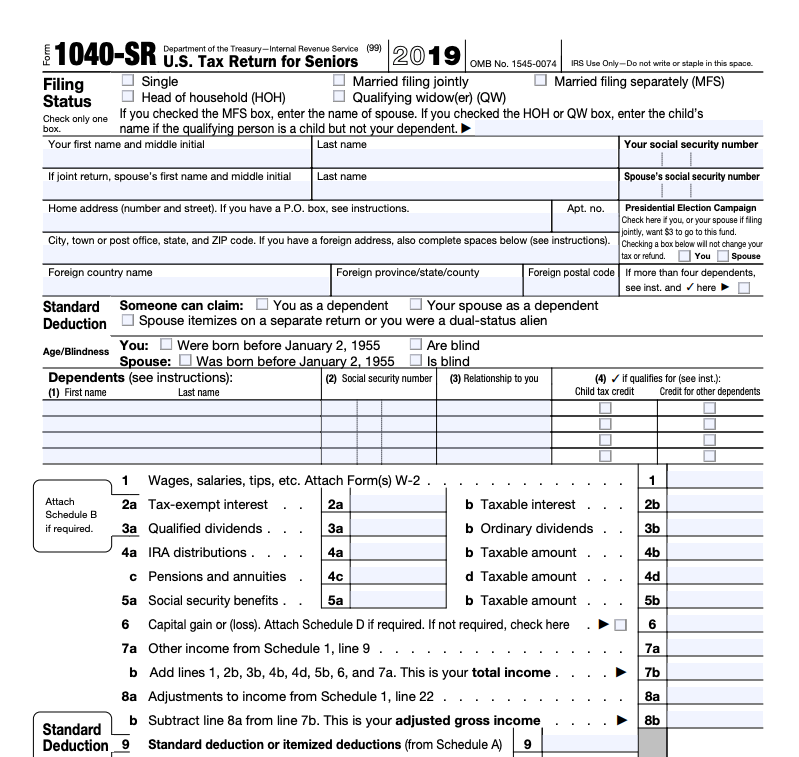

The New 1040-SR Form for People 65+

The other big tax form news for 2019 returns is what’s known as the 1040-SR: U.S. Tax Return for Seniors.

This new 24-line, two-page form was devised by Congress in 2018, with a push from AARP and others, to make tax filing a little easier for older Americans. Those taxpayers couldn’t use the previous simplified 1040-EZ because it lacked lines for Social Security benefits or Individual Retirement Account distributions. "Now the Form 1040-SR allows seniors to report income more common to them like investment income, Social Security and distributions from qualified [retirement] plans," said Lisa Greene-Lewis, a CPA and tax expert at TurboTax.

You can fill out the 1040-SR regardless of your filing status or whether you itemize or claim the standard deduction, as long as you were 65 or older in 2019 — or if you were married filing jointly, at least one of you was. If you will itemize and file the 1040-SR, you’ll need to fill out Schedule A, Itemized Deductions.

“Interestingly, the 1040-SR is tied to your age, not whether you’re retired,” said Luscombe. “If you’re over sixty-five and still working, you can use it. And if you’re retired and under sixty-five, you can’t.”

Ultimately, Luscombe said, “I think the 1040-SR was a good idea. But what ended up is probably not what people were hoping for. It’s basically a large-type 1040 with a couple of changes.”

The font size of the 1040-SR is, indeed, larger than on the 1040 and the spaces to include figures are bigger. The shading in the 1040’s boxes has been eliminated, too, for better legibility.

There’s also a special Standard Deduction Chart, so taxpayers 65 and older ideally won’t miss out on the higher standard deduction they’re entitled to claim due to their age. Generally, for 2019 returns, single people can claim a standard deduction of $12,200; heads of household can claim $18,350 and couples who are married filing jointly get a $24,400 standard deduction. But there’s an extra $1,650 standard deduction for those 65 or older filing as single or head of household. If you’re married filing jointly and you or your spouse were 65 or older, you can up your standard deduction by $1,300 to $25,700.

The 1040-SR has room to include interest and dividends, IRA distributions, Social Security benefits, capital gains and losses, other income, a child care tax credit, an earned income credit, an American opportunity credit for college and a business income deduction.

One piece of advice from Wind: “The 1040-SR isn’t mandatory if you’re sixty-five or older. It’s an option.”

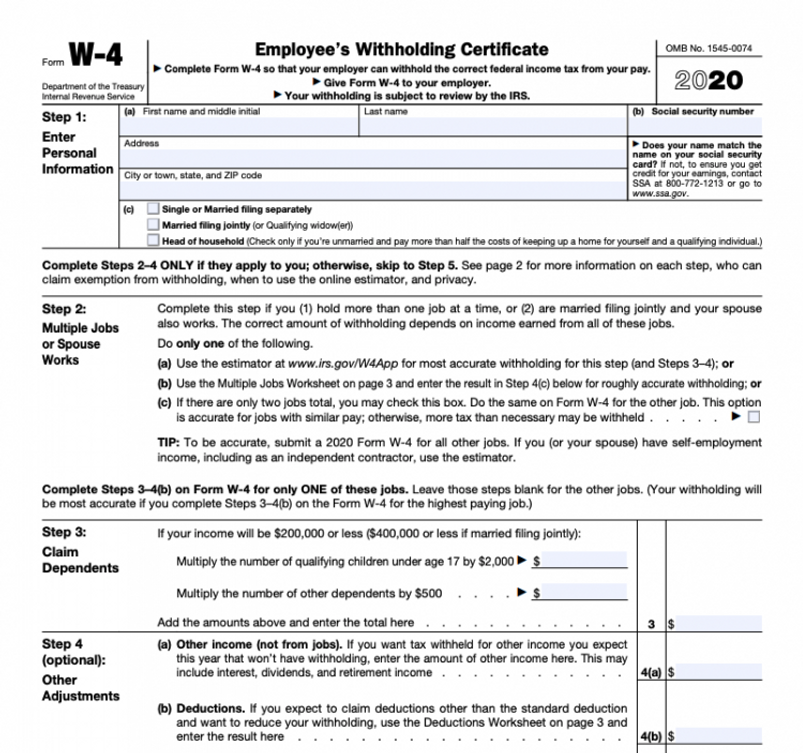

The New W-4 Withholding Form

The IRS has overhauled its W-4 withholding form for 2020, too, the first time since 1987. The big change here: no more withholding allowances.

You’ll, of course, need to fill out this five-step form from your employer if you get a new job this year. But you’ll also likely want to complete it even if you don’t — as long as you earn income as an employee in 2020. That’ll be especially true if you’ve become divorced or widowed in the past year, changing your filing status.

"If you have a simple tax situation — W-2 income and claim the standard deduction — you may not need to file the new IRS Form W-4," said Greene-Lewis. But you should file the new Form W-4 with your employer if, for example, you didn't see the tax outcome you expected when you filed your 2019 taxes this year, she added.

Filling out the new W-4 will help you have the right amount of taxes withheld throughout the year. And that can pay off in one of two ways. You won’t underpay your taxes and ultimately face a big tax bill (and possibly a tax penalty). And you won’t overpay your taxes, essentially loaning the IRS money in 2020 that you’ll get back as a refund in 2021.

You’ll also benefit from completing the new W-4 if you’re holding down two jobs this year. There’s a special worksheet for that.

The reason: “If you have two jobs and one doesn’t know about the other, you will probably end up in an underwithheld situation, because both employers will assume you are in a lower tax bracket than you really are,” said Luscombe.

The W-4 got its new look because the 2017 tax-reform law killed the personal exemption and dependent exemptions. “When that went away, you no longer had a withholding allowance number to tie it to,” said Luscombe. “So, the new form gets rid of the concept of the withholding allowance.”

Without those simple withholding allowances, however, prepare to spend more time and effort running your numbers for the new W-4.

“I would say the new W-4 is a little more complicated and a little more time consuming,” noted Luscombe.

To help, the IRS suggests using its free online Tax Withholding Estimator for what it calls a “paycheck checkup.” But to do so, you’ll want to have your most recent pay stub (and your spouse’s if you’re married); information for your other sources of income and your most recent federal income tax return.

In other words: fill out your new W-4 at home.

But the IRS suggests people with complex tax situations — long-term capital gains or dividends or those who owe the Alternative Minimum Tax — skip the Tax Withholding Estimator. Instead, the agency says, follow the instructions in Publication 505, Tax Withholding and Estimated Tax.