Older Renters Are Getting Squeezed

50 percent of those 65+ are 'rent burdened,' says a Pew report

(Editor’s Note: This story is part of a partnership between Next Avenue and Chasing the Dream, a public media initiative on poverty and opportunity.)

Boomers and Gen Xers are now the most “rent-burdened” Americans, according to a new Pew Charitable Trusts report, Americans Face a Growing Rent Burden. And things have only been getting worse for them.

Pew defines rent burdened as spending 30 percent or more of your income on rent; people who spend 50 percent or more on rent are, in Pew’s words, “severely rent burdened.”

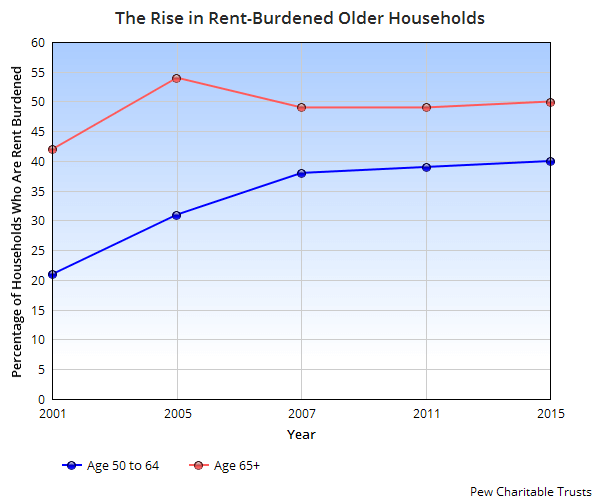

By those standards, 50 percent of renters 65 and older were rent burdened in 2015 (the latest year with available statistics); that includes the 23 percent who were severely rent burdened. By contrast, in 2001, 43 percent of them were rent burdened and just 15 percent were severely rent burdened.

And among renters age 50 to 64 — some of the Gen Xers and boomers — 40 percent were rent burdened in 2015 and 19 percent were severely rent burdened. In 2001, only 21 percent were rent burdened; a mere 10 percent were severely rent burdened.

"Older Americans are disproportionately likely to be rent burdened," said Erin Currier, director of Pew’s financial security and mobility project. (So are black Americans.) Among the nation’s nearly 43 million renters of all ages, 38 percent were rent burdened in 2015, up from 32 percent in 2001. Seventeen percent were severely rent burdened (up from 12 percent); put another way, 7 million households spent more than half their income on rent in 2015.

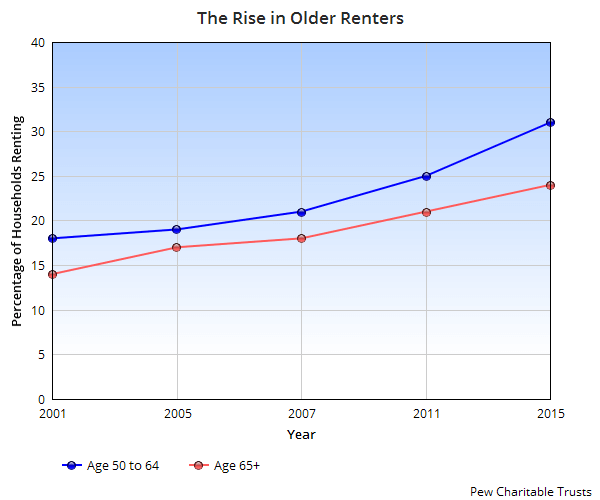

Older Americans also represent the biggest growth in renters, said Currier. "Unlike in the 1970s, when young families drove the increasing share of households that rent, the spike since 2001 has been driven by those 55 and older," she noted.

Renters in a Precarious Financial State

“Families are getting squeezed and have less control dealing with financial emergencies and income volatility," said Currier. "We see that they have less savings and that contributes to a greater sense of financial precariousness."

In fact, the Pew report says, rent-burdened families “often have trouble meeting basic consumption needs" and "typically have little connection to the banking system and limit savings.”

The median rent-burdened household had less than $10 in savings in 2015, says Pew, and the percentage of severely rent-burdened families without money in a financial institution rose from 54 percent in 2001 to 58 percent in 2015.

Similarly, a February 2018 Freddie Mac survey, Profile of Today’s Renter, found that 57 percent of boomer renters (age 53 to 69) and 66 percent of Gen X renters (age 38 to 52) either “live payday to payday” or “sometimes don’t have enough money for basics until the next payday.”

What's Behind the Squeeze on Renters

The financial squeeze on renters is due to a combination of factors, but the primary reason: Rents have been rising much faster than incomes.

Since 2001, Pew says, gross rent has increased 3 percent a year, on average — the median rent (not including utilities) rose from $512 a month to $678 between 2001 and 2015. During that period, however, income fell by an average of 0.1 percent annually.

“The widening gap between rent and income means that after paying rent, many Americans have less money available for other needs than they did 20 years ago,” the Pew report notes.

Other factors: shrinking vacancy rates, which make it easier for landlords to raise rents, and higher housing prices, which prevent some renters from being able to afford buying. The national rental vacancy rate was about 7 percent in late 2016, near its lowest level since the 1980s.

As Zillow senior economist Aaron Terrazas told Forbes: “For-sale inventory is tight, and with home prices continuing their rapid climb, it’s becoming more and more difficult for renters to become owners, forcing them to rent longer than they otherwise would have.”

In the Freddie Mac study, 50 percent of boomer renters said they don’t anticipate buying a home in the future, up eight points from a survey six months earlier; 15 percent think they’ll never be able to afford one. Similarly, 31 percent of Gen Xer renters don’t anticipate buying a home; 12 percent think they’ll never be able to afford one.

The Freddie Mac survey also said that 70 percent of boomers and 61 percent of Gen Xers whose rents rose in the past two years don’t plan to move. But it’s often not because they’re happy about renting; only 39 percent of boomer renters and 51 percent of Gen X renters say “renting is a good choice for me now.”

Rental Squeeze: Worst in the West

Rental affordability is toughest in the West, according to the Freddie Mac study. A stunning 64 percent of renters in the West told Freddie Mac they’re spending less on other essentials due to changes in their rent — that’s at least nine percentage points more than any other region.

Los Angeles is now the worst big city in America to rent, according to Forbes. The average rental is $2,172 (two-thirds higher than the U.S. average), which is 41 percent of the local median household income. The vacancy rate: 3.8 percent.

The high cost of apartments and homes in L.A. is one reason why something called Accessory Dwelling Units or ADUs are catching on there. An ADU is a teeny home plopped into someone’s backyard. Los Angeles issued 2,342 ADU permits in 2017, according to Fast Company. The year before: 120. L.A. Mayor Eric Garcetti’s goal: building at least 10,000 by 2021.

Quite a few of them, I suspect, will be occupied by Angelenos in their 50s and 60s.

Help for Squeezed Renters?

Will federal and state and local policymakers take steps to help ease the rental squeeze across the country, especially among older renters? The researchers at Pew think they want to consider it.

"The strong evidence that the rent burdened are not able to save money and transition to home ownership as in the past has broad implications for the economy at the local and national level," said Currier.

This story is part of our partnership with Chasing the Dream: Poverty and Opportunity in America, a public media initiative on poverty and opportunity. Major funding is provided by The JPB Foundation.