Why COVID-19 Could Shrink Social Security Benefits

The effect of the pandemic and the payroll tax cut on the solvency of Social Security

(This July 2020 article was updated August 9, 2020 after President Trump signed an executive order for a payroll tax cut.)

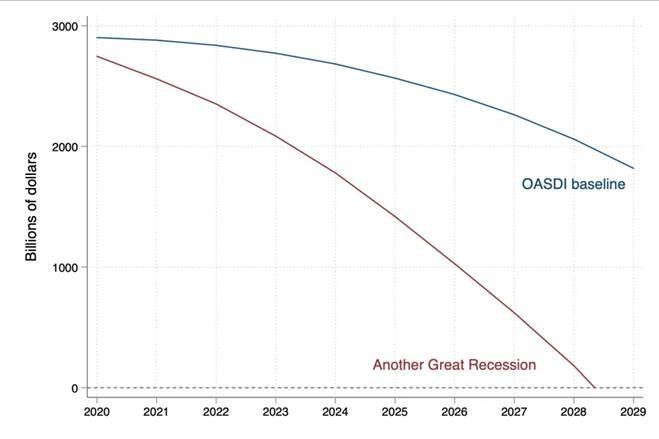

The economic fallout from the pandemic is so severe that it’s likely to move up the long-anticipated date of the depletion of the Social Security Trust Fund for retirement benefits from 2035 to 2033 or perhaps even 2029 — just nine years from now.

On top of that, President Trump has signed an executive order suspending Social Security and Medicare payroll taxes for workers earning under $100,000 (whether he can do that legally is an open question). Cutting payroll taxes would have only created unwanted additional financial pressure on Social Security and Medicare, endangering some Americans’ retirement and health care security.

What Social Security Insolvency Means

To be clear, it’s critical to emphasize that depletion of the Social Security Trust Fund — what some call insolvency — doesn’t mean Social Security goes bankrupt. The 2035 depletion date projected by Social Security’s trustees before the pandemic began marks the year when payroll tax revenues will cover only 79% of currently legislated benefits.

The high unemployment rates of the pandemic recession — the worst since the Great Depression — are what could move forward the date of reckoning.

Nevertheless, a possible Social Security retirement benefit cut of roughly 20% is a horrifying prospect for the millions of older Americans who’ll rely on Social Security checks.

The high unemployment rates of the pandemic recession — the worst since the Great Depression — and the payroll tax cut are what could move forward the date of reckoning. When people are out of work, businesses are shut or hurting and Americans aren't paying payroll taxes, there’s less money going into the Social Security trust fund.

Our Commitment to Covering the Coronavirus

We are committed to reliable reporting on the risks of the coronavirus and steps you can take to benefit you, your loved ones and others in your community. Read Next Avenue's Coronavirus Coverage.

Alicia Munnell, director of the Center for Retirement Research at Boston College and a noted Social Security scholar, forecasts that if the economic collapse causes payroll taxes to drop by 20% for two years, the 2035 depletion date would move up to 2033 or so.

“Therefore, once this crisis subsides, stabilizing Social Security's finances should be a high priority to restore confidence in our ability to manage our fiscal policy and to assure working Americans that they will receive the income they need in retirement," Munnell wrote.

The Social Security Outlook From The Bipartisan Policy Center

The Bipartisan Policy Center, a Washington D.C. think tank, offers an even grimmer prediction.

It uses the Great Recession of 2008-2009 as its baseline, adjusts for the aging of the population and some other things and comes up predicting that another downturn like the last one would accelerate Social Security’s depletion date to 2029.

“For years, the trustees have warned that policymakers need to act to avoid depletion of reserves in Social Security’s trust fund. But now that moment will arrive sooner than anyone expected,” The Bipartisan Policy Center researchers wrote.

A similar story holds for Medicare, specifically the Medicare Hospital Insurance Fund (also known as Part A) primarily for Americans 65 and older. It’s the other Social Security Trust Fund and is largely funded through payroll taxes, too.

The Social Security Trustees Report, again published before the pandemic, forecasted the Medicare Part A Trust Fund would be depleted in 2026. At that point, incoming payroll and other revenue would be sufficient to pay 89% of Medicare hospital insurance costs.

A Grim Prediction for Medicare

But Dr. David Shulkin, former Secretary of the U.S. Department of Veteran Affairs in the Trump administration and now at the University of Pennsylvania’s Leonard Davis Institute, says the pandemic could lead to Medicare Part A Trust Fund insolvency in 2022 — a mere two years from now.

“Much like the current pandemic,” Shulkin wrote on his blog, “solving the problem of Medicare and Medicaid financing is going to require public and private collaborations with both government and industry wide attention to identify workable solutions to prevent the collapse of our health system.”

To be sure, these are projections. The recovery could be faster than expected, especially if unexpectedly rapid progress is made with COVID-19 vaccines.

Then again, a second-dip recession can’t be ruled out, either.

To get a little more specific, here are the basics of payroll taxes:

Employees and employers each pay 6.2% of wages into Social Security, up to $137,700 in 2020.

An additional 1.45% of pay is levied on the employer and employee for Medicare. Employees earning more than $200,000 individually, or $250,000 if married and filing jointly, pay an additional 0.9% Medicare surtax. The self-employed pay 12.4% of earnings toward Social Security and 2.9% for Medicare. Those making over $200,000 are also subject to the Medicare surtax.

What a Payroll Tax Cut Would Mean

Suspending the payroll tax wouldn’t put more money in the pockets of the 17 million-plus unemployed, since they’re not working and not paying the taxes. The same goes for retirees who aren’t in the labor force.

Upper middle-class workers would benefit the most, yet economists worry that they’d be more likely to use any tax relief to hike their savings. The economic impact of a payroll tax cut, wrote Mark Zandi, chief economist at Moody's Analytics, would be “even smaller in the pandemic as social-distancing limits the ability and willingness of higher-income households to spend.”

Once the pandemic is finally in the rear-view mirror, Washington should turn toward improving the finances of the Social Security retirement system and the Medicare health insurance system.