Washington Seeks to Protect Retirees from Junk Fees, Hidden Costs

A new proposal seeks to block financial advisers from giving investment recommendations that aren’t in the saver’s best interest

Retirement savings is the latest industry targeted by the Biden administration as part of broad federal efforts to eliminate hidden costs, or "junk fees," for consumers.

In October, the administration proposed to hold financial advisers to a fiduciary standard in an effort to protect retirement savers from receiving investment advice that might benefit financial professionals — earning high sales commissions or unloading underperforming assets from their firms' portfolios — but not their clients.

"People should be able to trust that when they get advice from a so-called expert, they're getting real help, not getting ripped off."

If codified into law, the proposal would close loopholes so that investment advisers make recommendations only in the saver's best interest and would cover non-securities like fixed index annuities and "one-time-basis" rollovers such as moving assets from 401(k) plans to IRAs.

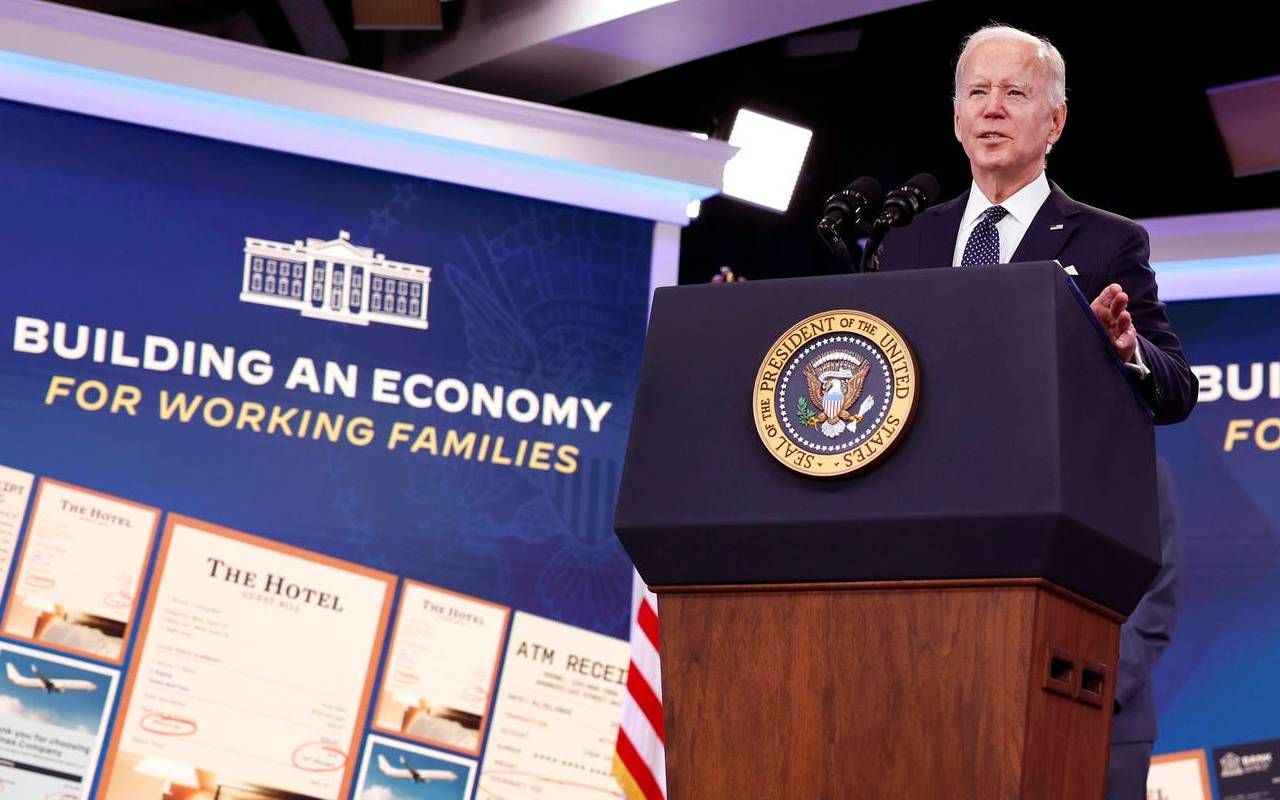

"People should be able to trust that when they get advice from a so-called expert, they're getting real help, not getting ripped off," President Biden said at an Oct. 31 press conference.

The president said bad financial advice from unscrupulous financial advisers driven by their own self-interest can cost retirement savers up to 1.2% a year in lost investment.

What the Proposal Targets

"That doesn't sound like much, but if you're living long, it's a lot of money," Biden said. "Over a lifetime, that can add up to 20% less money when they retire. For a middle-class household, that can amount to tens of thousands of dollars over time."

"We call it junk advice, more so than we call it junk fees," said Dylan Bruce, Financial Services Counsel for the Consumer Federation of America before adding that ultimately the proposal seeks to create a fiduciary standard for financial advisers that matches the savers' expectation that the retirement investing advice given is in their best interest.

"Fiduciary relationships," which require one party to put clients' financial interests above their own, have long existed in law, real estate and other fields. But the Employee Retirement Income Security Act, the federal law that governs retirement plans, does not require financial advisers to be fiduciaries when deciding which assets to recommend, what to charge for their service or which assets to buy when a client rolls over savings from, say, a 401(k) plan to a private IRA.

This is no small matter considering that in 2022, Americans rolled over $779 billion from defined contribution plans which include 401(k)s, into IRAs.

"For most individuals, the decision on how to manage and specifically whether to roll over those retirement assets, that's going to be the single most important investment decision of their entire life," Bruce said.

Fiduciary Standard for Rollovers

A conflict of interest can arise when financial advisers earn commissions or are paid by the companies who produce the products they recommend, resulting in retirement savers choosing an investment path that costs them serious money in the long run.

"If the advice they give is tainted by conflicts of interest, that leaves the retirement investor worse off, but it leaves the advice provider much better off."

"If a financial services provider is able to guide that decision toward an account or product that earns them money through commissions or fees, that can lead to a huge payday for the adviser," Bruce said. "If the advice they give is tainted by conflicts of interest, that leaves the retirement investor worse off, but it leaves the advice provider much better off."

To the average person, knowing when and how to rollover assets from a 401(k) can be intimidatingly complicated. Just 36% of women reported feeling well-versed on 401(k)s, according to Betterment's 2023 Retirement Readiness Annual Report.

"Right now you could have a point-in-time recommendation where the provider is encouraging a rollover from a 401(k) into an IRA account where the retirement saver is going to have only investment options that are relatively higher cost and potentially where the new provider takes a revenue share from some of those investment options," Betterment Vice President of Legal Josh Rubin said.

Industry Pushes Back on the Proposal

Industry representatives have said the proposal could limit advice for smaller account savers, but Bruce dismissed that claim as a "scare tactic."

The proposal would deprive savers of junk advice, (that is,) bad advice," Bruce said. "Small savers . . . are most vulnerable to bad advice because they have fewer economic resources and therefore can least afford to lose any of their savings to bad advice."

"Small savers . . . are most vulnerable to bad advice because they have fewer economic resources."

Others, like Rubin, who testified recently before the Department of Labor regarding the proposal, said that parts of the proposal could indeed limit options for savers, particularly when it comes to educating savers about their investment options.

"There's a role to play where providers should be able to sort of provide information about their services, that doesn't rise to the full level of recommendation," Rubin said before adding that savers could miss out on the chance to shop for different plans while learning about their pros and cons.

Know Your Adviser's Conflicts of Interest

Knowing how their investment professional is paid is one of the most important things for a retirement saver to know.

"We would encourage any retirement saver who's considering any provider to ask questions . . ."

Some advisers earn a commission on the stocks, funds and other products they sell to their clients, others share in the growth of clients' portfolios and many of the rest charge a flat fee for the year or by the hour. Knowing whether your adviser is making a profit from recommending a certain retirement product can help you infer if there's a conflict of interest at play.

Rubin recommends having a straightforward conversation with the financial adviser to ask about how he or she will make money from your business and if there could be any conflicts of interest.

"We would encourage any retirement saver who's considering any provider to ask questions that would allow them to understand, 'Are they going to get the lowest cost and the best possible products and does my adviser or broker . . . have an incentive to do anything other than that?' " Rubin said.