Why This Year-End Is Different

Substantial changes in tax laws are taking effect; here are four financial steps to confirm you are secure

If your retirement savings plan is on autopilot, right now is the time to make a change. The Secure Act 2.0, which President Biden signed into law a year ago, raised the annual limits on how much you can add to your retirement savings.

That means you can sock away more in your plan in 2024 — but first be sure you have saved as much as you can in 2023. Then, read about other ways this change in the retirement rules may impact you.

Max Out Your 2023 Contributions

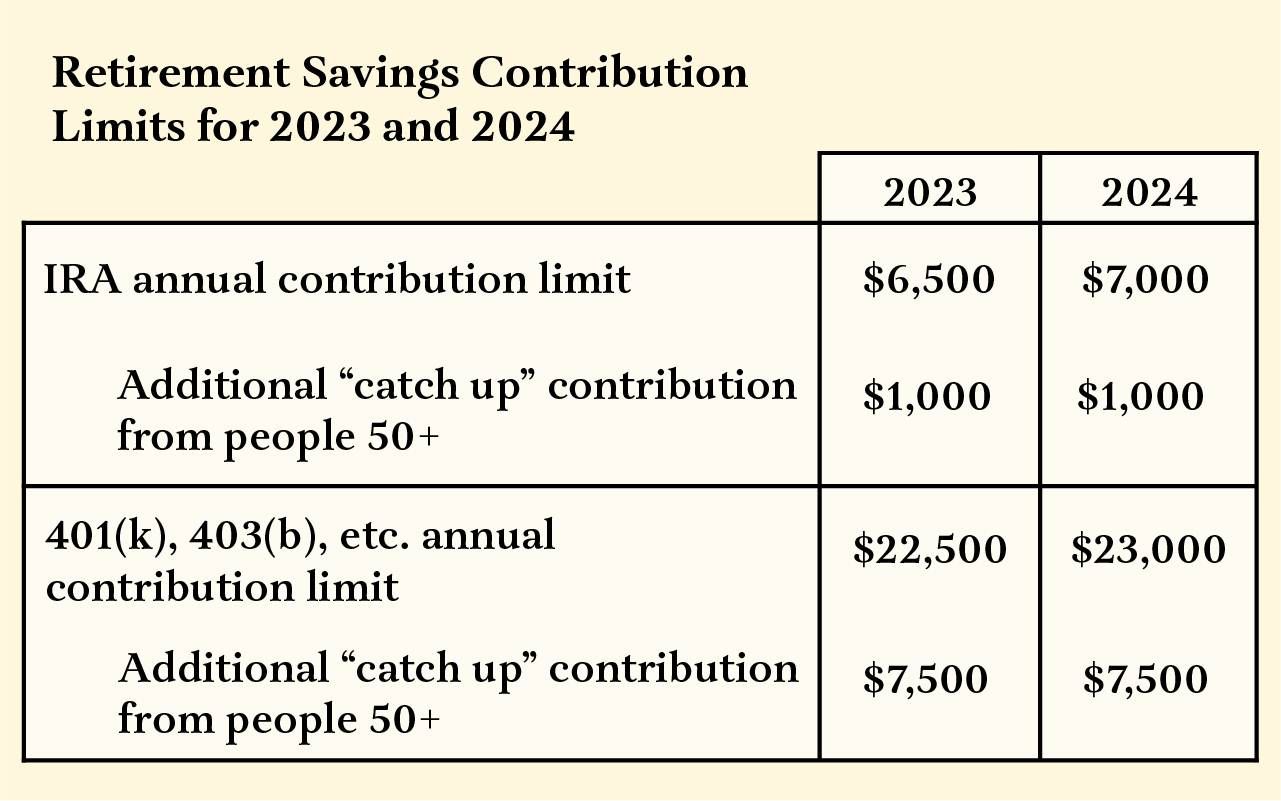

People enrolled in employer-sponsored, tax-deferred retirement savings programs — 401(k), 403(b) and most 457 plans, as well as the federal government's Thrift Savings Plan — can contribute as much as $22,500 in 2023.

As soon as you know how much you can afford to save, ask your company's payroll department to deduct as much from your paychecks for the rest of the year.

People aged 50 and over may contribute an additional $7,500 to help them achieve otherwise unachievable savings goals before they retire. If you turned 50 in 2023 or never increased your contributions over your working life, act now.

Start by considering how much you can reasonably set aside for retirement in the rest of this year. Keep in mind that you can deduct that amount from your income in tax filings, which may reduce the amount you owe or increase the amount you will be refunded.

As soon as you know how much you can afford to save, ask your company's payroll department to deduct as much from your paychecks for the rest of the year. If you get a bonus, deposit all of it — or at least a significant portion of it — in your retirement account.

Prepare Now to Save In 2024

In 2024, the contributions cap on 401(k), 403(b) or other employer-backed retirement plans will rise to $23,000. So even if you saved the maximum in 2023, you'll need to ask your employer to increase the retirement-savings deduction to fully fund your plan to the 2024 limits. Most payroll changes take at least a couple of weeks to institute. The sooner you make the change the less impact you will feel in your paycheck.

A $500 increase in the maximum annual contribution means a change of less than $42 a month in your pay—and that's before considering the savings from deferring taxes on the income you are investing.

The Secure Act 2.0 includes other changes around retirement planning for you or those you love. Consider just some of the options listed below:

- Savers Credit is turning into savers cash. A tax credit meant to encourage low and moderate-income workers to save for their retirement will be swapped out for cash contributions starting in 2027.

Launched in 2002, the Savers Credit allows qualified taxpayers to reduce their income taxes by $200 to $2,000 if they contributed to an IRA, 401(k) or other retirement-savings plan. The reward came in the form of a tax credit equal to between 10% and 50% of the first $2,000 that individual taxpayers (or $4,000 that joint filers) save for retirement.

Three years from now, the Secure Act 2.0 will replace the tax credit with cash that will be wired directly into the retirement accounts of low- and moderate-income people.

Encouraging People to Save

- College savings become retirement savings. Money languishing in a 529 Plan college savings account can now be rolled into a Roth IRA. The transfers will be tax- and penalty-free, but cannot exceed Roth IRA annual contribution limits (in 2024, they will be $7,000 for most people and $7,500 for individuals aged 50 and over). Each beneficiary is limited to a lifetime total of $35,000 in 529 rollovers.

- Part-time employee eligibility. Even if you did not qualify in the past for your company's 401k or other retirement plan, rules have been adjusted for part-time workers to participate in employer's plans.

- Expanding automatic enrollment. Unless new employees opt out, The Secure Act 2.0 requires employers that offer 401(k), 403(b) and SIMPLE IRA plans to automatically enroll all newly eligible employees. At first, companies would divert 3% of new employees' pay to their personal accounts and raise it by one percentage point annually until it reaches 10%.

Easing the Student-Loan Burden

- Student loan payments get a match: Many young people cannot afford to save for retirement while still paying on their student loans. That has meant they could not qualify for employers' offers to match some or all of that early retirement savings—a pair of missed opportunities that were hard to make up.

Starting January 1, The Secure Act 2.0 will enable businesses to fully deduct the "matching" funds they give to employees' retirement savings plans based on each worker's "qualified student loan payments" as well as their contributions to retirement plans.

The law broadly defines student loans as any debt incurred by the employee solely to pay qualified higher education expenses of the employee. No parent loan payments qualify for the option.

- Penalty exemption for the terminally ill. Terminally ill employees will no longer have to pay a penalty to make early withdrawals from their retirement savings.

- Help for federal disaster victims. The Secure Act 2.0 includes special rules for using retirement funds by people affected by qualified federally declared disasters.

There were a host of other rule changes around early withdrawals and repayment for adoptions, births, domestic violence victims and long-term care contract premium payments. This allows more options and flexibility with your retirement plan.

Congress also has rewritten the rules for other retirement plans, like SIMPLE or Simplified Employee Pension (SEP) plans, so check with your employer or your financial adviser to see if any of those changes affect you.

Postponing Withdrawals

Thanks to the first Secure Act, in 2019, we can forget about rules that required people to routinely withdraw funds from their tax-deferred retirement accounts when they turned 70½ — unless they had already started making withdrawals.

The Secure Act 2.0 raised the age for requiring minimum distributions to 73 starting on January 1, 2023 — and will increase it further to age 75 on January 1, 2033. Those who turned 72 after December 31, 2022, are affected by this new rule.

This means your retirement money can remain in your plan, growing tax-free for a longer period of time. Planning well means reducing income taxes and pursuing more options to strategically plan income payouts in retirement.

The act also reduced the penalty for failure to take the RMD from 50% to 25% — and paring the penalty to just 10% if the failure to take an RMD is corrected in a timely manner, as defined in the law.

Other Benefits of Secure 2.0

The Secure Act 2.0 also tied many retirement contribution limits to inflation, meaning employees can save more if they fear accelerating price increases. The final numbers will be calculated before the new year, so watch for them this time next year.

The bottom line is never to believe your retirement contributions or planning are set in stone — or should be. Laws and tax codes change often. That is why it is important to meet with your accountant, Certified Financial Planner or investment adviser at least once a year to review where you stand and where you want to go.

Otherwise, when financial rules change, you may unknowingly leave money on the table.

C.D. Moriarty, CFP, is a Vermont-based financial speaker, writer and coach. She can be found at MoneyPeace.com. Read More