Why Workplace Financial Wellness Programs Aren't Well

There's a big disconnect between what employees need and what employers offer

Doctor! We have a situation at America’s employers. Some of them are offering financial wellness programs to employees, which is great. But, according to a new Bank of America Merrill Lynch report, there’s a huge disconnect between the kind of financial information and advice they’re offering and what employees really want. Help is needed. Stat!

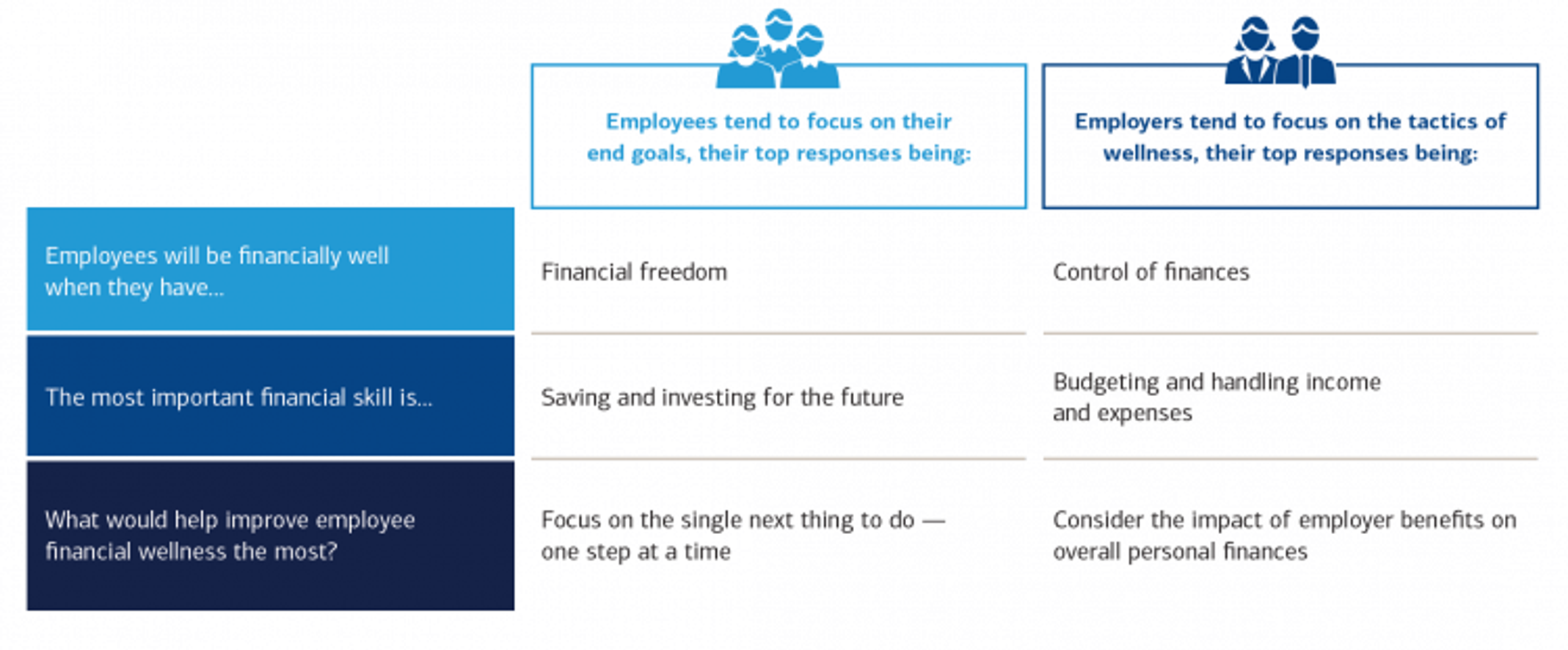

The 2018 Bank of America Merrill Lynch Workplace Benefits Report surveyed 657 employees who participate in 401(k) plans and 667 employers who offer a 401(k) and a financial wellness program. Employers, the survey found, tend to focus on actions to manage workers’ immediate financial needs, like budgeting and handling expenses. But employees prioritize long-term financial goals, such as ways to help them save and invest for the future.

The Disconnect in Workplace Financial Wellness Programs

When both groups were asked what would help improve employee financial wellness the most, employees wanted practical guidance that would “focus on the single next thing to do — one step at a time.” By contrast, employers said: “considering the impact of employer benefits on overall personal finances.”

Employees also said they want personalized advice from a professional, with the ability to track their progress and accomplishments, factoring in their goals. Similarly, in the International Foundation of Employee Benefit Plans (IFEBP) 2018 survey of employers, in-person, one-on-one meetings were rated as the most effective meeting approach, with the highest participation rates. But financial wellness programs tend to offer group sessions and one-size-fits-all budgeting calculators.

Little wonder, then, that Bank of America Merrill Lynch also found that although 48 percent of the employees surveyed were offered workplace financial wellness plans, only 31 percent participate in them. One reason employees said they demur: “Don’t offer services of interest to me.”

What’s going on here?

Employees Could Use Financial Advice

After all, many workers would like help managing their finances. The PwC 2017 Employee Financial Wellness Survey found that 57 percent of employees are stressed about their finances. And the IFEBP survey found that more than one in three respondents believe participants “face more financial challenges today compared with two years ago.” As Andrew Sullivan, head of the Workplace Solutions Group for Prudential Financial, said at a 2017 Aspen Institute panel on employee financial well-being that my colleague Kerry Hannon covered: “Employers have the responsibility and the opportunity to solve this.”

Lisa Margeson, head of retirement client experience and communications for Bank of America Merrill Lynch, said the disconnect between employer financial wellness offerings and what employees wanted was one of the “ahas” in the firm’s workplace benefit report. Employers, she said the survey found, are focused on “tactical answers,” while employees are “more aspirational” for help reaching good financial health.

Margeson’s takeaway: “Employers need to be sure they’re speaking the language of their employees.”

Agreed.

Why Aren't Wellness Programs Measured for Effectiveness?

And here’s a real head-scratcher that helps explain the disconnect: 70 percent of employers with financial wellness programs don’t have formal measurements to assess their value, the researchers found. “I was surprised by that,” Margeson told me.

It’s weird. Companies measure just about everything they do, from employee performance to their return on investment. But not their financial wellness programs.

Margeson and other financial wellness analysts say that there’s no common formula to measure financial wellness programs. Partly that’s because, as a U.S. Consumer Financial Protection Bureau report said, there’s no agreed-on definition of what a financial wellness program is.

But maybe if more employers surveyed employees about the kind of financial wellness help they’d like, the programs could be tweaked appropriately. That could then lead to less-stressed, more focused workers, which would be good for employers and employees.

“Where [employers] can focus on advancing the dial is working on teeing up metrics to help give individuals the right information and action plan that’s personalized for them, along with a digital experience,” said Margeson. “Then, when appropriate, have a professional available to them on location or over the phone.”

Targeting Financial Wellness Advice

Another way financial wellness programs could be improved: target offerings to particular groups of employees — boomers and Gen Xers; millennials; women.

Bank of America Merrill Lynch found that 44 percent of the under-40 employees it surveyed (millennials) said they are doing “less than financially well,” but 38 percent of those 40 to 59 said that (Gen Xers and younger boomers) and 23 percent of those 60+ said so (older boomers).

The researchers also found a huge gender disparity regarding financial wellness, which Margeson attributes to “the difference in their financial journey.” For example, women are more likely than men to leave the paid workforce for caregiving, which then leads to fewer years to contribute to retirement savings plans and earn Social Security benefits.

Nearly half the women (47 percent) surveyed said they are “less than financially well,” while just 29 percent of the men felt that way. Women were also 14 percent more likely to indicate they felt stress from their financial situation than men and 13 percent less likely to be very optimistic about their financial outlook.

The Bank of America Merrill Lynch report said “employers need to make a concerted effort to understand the unique challenges women face.”

Men, too.