I'm 65 and Working. Should I Enroll in Medicare?

It depends on how good your employer’s health insurance is. Meet with an independent health insurance broker to get the best value.

You have reached the Medicare qualifying age of 65. But what if you are still working and have employer-sponsored insurance? What should you do?

Unfortunately, there is no easy answer. For the average person, understanding how your variables can affect what you purchase is confusing and challenging without expert help. There are, however, a range of options that didn't exist for our parents.

Take Mark L. Clark of Mooresville, North Carolina. He retired early as a human resource professional four years ago. He carried health insurance for his wife, Cindy, a market research contractor without benefits. Mark has a part-time job that offers benefits, but his employer's health insurance is expensive.

Catastrophic Coverage, to Start

At his retirement from full-time work, the couple sought a marketplace plan to cover catastrophic care they could fund without an employer subsidy. They found one for $950 monthly, with a $10,000 deductible.

Two years ago, the couple learned they qualified for a government subsidy even with income from their investments and part-time work. The subsidy brought their premium costs down by two-thirds.

Three months before he turned 65, Clark started talking with an agent about his Medicare options.

"A Medicare Advantage (MA) plan sounded like it would be a good option for me because I'm not having any health issues," he said. However, after hearing acquaintances express coverage and financial concerns about their MA plan, "at the last minute, I decided to go with original Medicare, a supplement, and a Part D drug card," Clark said. He takes no medication; his drug card costs $11 a month.

"No wonder the American public is confused."

Cindy, 64, is still on the marketplace plan; her rates doubled when he left the plan.

Clark mentioned that in the months before he turned 65, their mailbox would fill up with brochures about Medicare Advantage plans. "No wonder the American public is confused," he said. He added that before he started the process, he "believed that when you go on Medicare, the government takes care of all health care needs."

Of course, it doesn't, but that is a common misconception. In fact, patients also have skin in the game.

An Abundance of Choices

As illustrated by the Clarks, no path to Medicare is a straight line. Next Avenue attended a seminar sponsored by Allsup and the Disability Management Employer Coalition (DMEC) to understand the choices available for a 65-year-old still working full-time and eligible for Medicare.

(Allsup, a St. Louis-based company, helps people apply for disability benefits and file appeals if they are denied benefits. DMEC is a coalition of employers, insurers, and service providers interested in Medicare.)

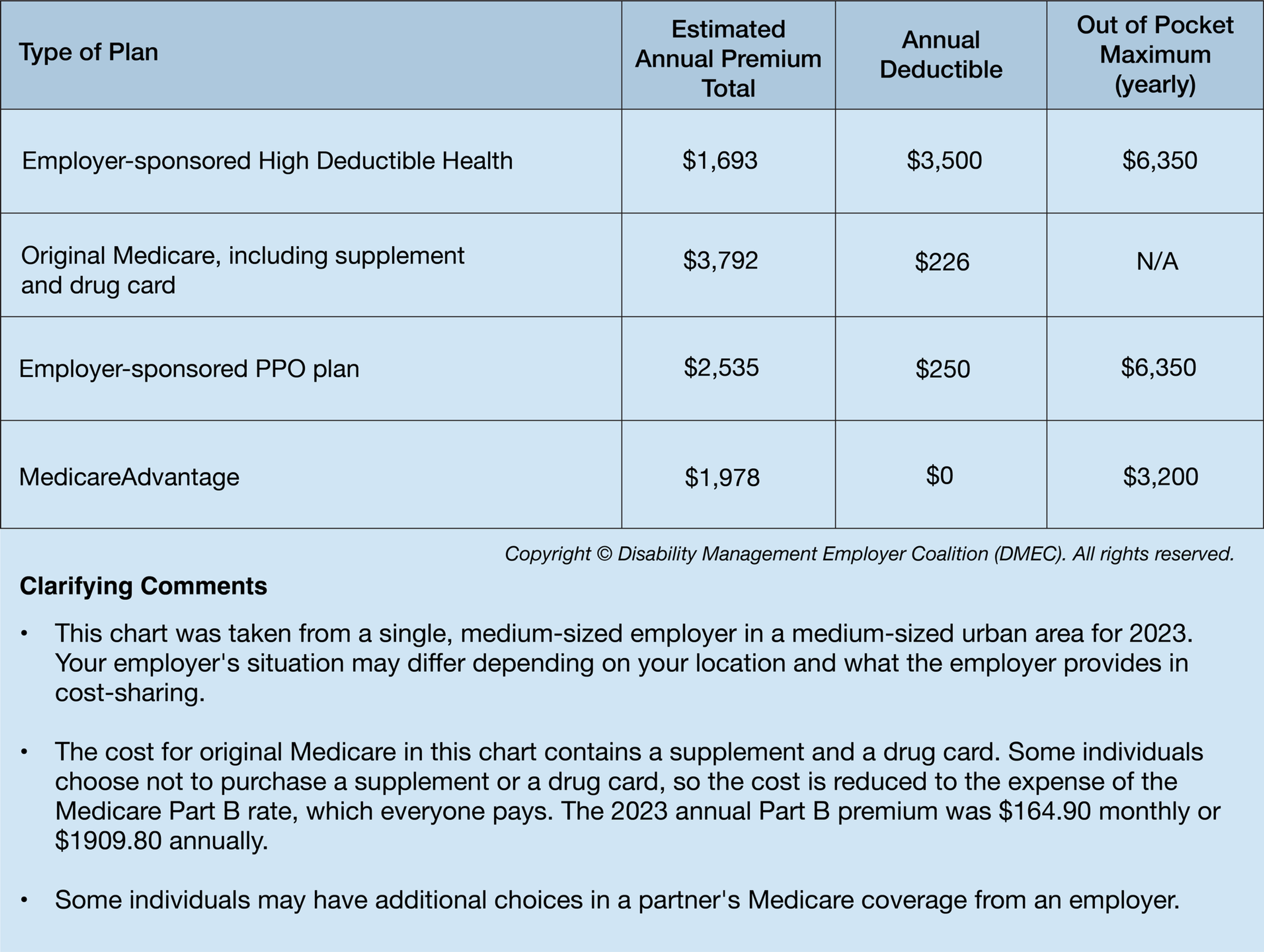

Next Avenue obtained DMEC data from 2023 plans of businesses in the St. Louis metropolitan area, comparing four options available for individuals still employed at 65, including an employer-sponsored high-deductible health plan, original Medicare with Medigap supplement, an employer-sponsored PPO plan and a private Medical Advantage PPO.

Should I Keep My Employer's Plan?

This question is easier for some, like Sue Verba, 66, a Fort Wayne, Indiana paralegal. Verba has long service with her firm, which provides full coverage health insurance and pays 100% of the premium.

"My wellness visits are all free," Verba said. "I don't go to the doctor very often, just once a year for my annual checkup (and screenings)."

For others paying a large monthly premium and having a large deductible, the other options may appeal to their budget.

Sitting down with an unbiased expert can help you clarify all your options.

Different Plans for Partners

My partner and I consulted an expert three months before he and I turned 65, a month apart. His former employer offered a Medicare Advantage plan for retirees. Our expert couldn't find an equal coverage or cost, so he chose the employer-sponsored plan. I chose original Medicare because its charge for my monthly supplemental oxygen cost was small, which cost hundreds of dollars on my other plan.

These anecdotes are specific to us, two individuals born a month apart, living in the same place. But our needs differ. While I can go anywhere with original Medicare, my husband's coverage steers him to another hospital and network, so we do not use the same systems.

What to Consider When Deciding

Seek the advice of an insurance expert, preferably one representing a range of health care insurers and plans, to help you find the best value in coverage for your unique situation. If you choose to stay on your employer's plan, it is not a decision that is fixed forever. You will be retiring in the next few years.

"My advice as someone who worked on the business side of health care for 35 years: consult with a Medicare expert."

No matter an individual's career and financial situation, checking with an expert is key. The DMEC reports that 47% of those seeking clarity on Medicare talk to their friends; about 70% consulted Medicare's website or read printed material from Medicare.

Please take my advice as someone who worked on the business side of health care for 35 years: consult with a Medicare expert who represents multiple insurers and will review options for your situation, a situation different from anyone else.

Even if you choose to stay on your employer's plan and it's the best for you today, unless your employer offers a special retiree plan, your choices when you retire will likely be different. You cannot foresee the future without a special crystal ball, and life surprises us.

When Should I Enroll in Medicare?

DMEC notes three different enrollment periods for Medicare, each applying to a different set of needs in enrollees.

- Initial Enrollment Period. This period runs from three months before to three months after the 65th birthday.

- Special Enrollment Period. For those who have lost credible group health coverage, i.e., retirement, there is an eight-month window to enroll in Medicare Parts A and B, and 60 days for Part D. If the Special Enrollment Period is missed, the enrollee may incur a late penalty that will continue throughout the insurance period.

- General Enrollment Period. The General Enrollment Period runs from the first day of January to the last day of March every year. This period is for individuals who missed their initial Medicare Part A and B enrollment.

Translating the Jargon

These issues may take you back to a chalkboard in high school calculus class, but they are important to know.

Guaranteed Issue (GI) means an individual cannot be turned down for any Medicare plan on initial enrollment. If you, for example, go on a plan but later want to change to another type, plans may require a medical history review. Pre-existing conditions may cause your application to be turned down or have high premiums.

Continuous GI means no medical underwriting is needed to switch between types of plans in three states: New York, Connecticut and Massachusetts. Other states have rules specific to their citizens, such as Oregon, which allows people to change plans only on their birthday. Check with your state's insurance commissioner to learn of your state's rules.

Part B is Medicare jargon for non-hospital medical coverage — doctor visits, tests, outpatient care, home health care and medical equipment such as CPAP machines. Hospital costs are covered by Part A, which is free. Every enrollee pays a monthly Part B premium. Medicare notifies enrollees of the cost of premiums for Part B annually for the upcoming year. While final costs have not been agreed upon for 2024, the estimate is $174.80, about a $10-a-month increase.

Enrollees in original Medicare who do not buy supplemental insurance, often called Medigap insurance, are on the hook for 20% of costs.

What confuses many enrollees in comparing plans is that certain Medicare Advantage plans participate in the Medicare Giveback Plan. The insurer pays some or all of the Part B premium for enrollees.

Original Medicare is coverage managed by the federal government. For people with compromised health at 65 or pre-existing conditions, it may be the best choice. While premiums may be higher than those of private Medicare Advantage plans, deductibles and out-of-pocket costs may be lower under original Medicare.

Enrollees in original Medicare who do not buy supplemental insurance, often called Medigap insurance, are on the hook for 20% of costs. Buy a supplemental policy and a Part D drug card for the most complete coverage under original Medicare.

Under original Medicare, there are usually no co-payments and no referrals needed to see a specialist. Most doctors take Medicare, and you are not limited to private insurers' networks. Routine tests do not need prior authorization; you have coverage for some skilled nursing days and home health care. But costs will rise annually, and if you have health problems, the supplement and drug card premiums can be pricey.

However, my five-day hospital stay for double pneumonia in January cost me around $200 and fulfilled my original Medicare deductible for the year.

Medicare Advantage (also called Part C) is coverage managed by private insurance companies. Enrollees may receive coverage for things not included in original Medicare, such as hearing, vision and dental benefits. My husband recently received his annual notification of benefits for 2024, and his company has added compression socks.

Advantage plans are required to pay for all services, tests and supplies that original Medicare pays for (without a supplemental insurance or a drug card). MA plans cap out-of-pocket expenses. After the cap, they will pay 100% of covered expenses. You may prefer an MA plan because it may be similar to your former employer-sponsored plans.

You will have co-payments for office visits, tests, Emergency Department visits, or in-patient stays. Your primary care physician directs your care; referrals are needed to see specialists within your provider network. Often, you will need prior authorization for certain tests.

Educate Yourself About Medicare

No one knows how their health situation will change or decline. It is important to do your research, talk to an expert, and understand your situation as much as possible when it is time to decide. Even if you have no health problems at 65, you can't know what lightning bolts may strike in the future.

- If you are still working and your current employer plan works for you, that may be the best choice today.

- If you are the type of person who likes knowing exactly how much things will cost from a budget, original Medicare may be your choice.

- If you are the type of person who prefers to pay-as-you-go, a Medicare Advantage plan may be for you.

Regardless of your choice, the most important takeaway is that you must consult an expert who can review your options for your situation.

Editor’s note: Next Avenue and the author do not offer this article as medical or financial advice. A patient or advocate should always discuss clinical issues with a medical provider and insurance issues with an unbiased expert.