What Could Help Address the Racial Wealth Gap

Ideas to narrow financial disparities between Black and white people in America

Sam Kearse, a 70-year-old Black retiree in Hartford, Conn., is a former entrepreneur who has been on disability since an accident 15 years ago. He receives about $2,000 a month in disability benefits. He uses it to pay for food, rent, and auto insurance on a 16-year-old car and utilities.

"I'm struggling," Kearse said.

Kearse is a prime example of the racial wealth gap in America, which is having a staggering impact on the retirement readiness of African Americans.

Just 34% of African Americans participate in retirement savings plans, while 60% of whites do.

Although Black people make up 13% of the U.S. population, they only have 2.5% of the nation's wealth, said William Darity, professor of public policy at Duke University and co-author of "From Here to Equality: Reparations for Black Americans in the Twenty-First Century."

According to the Brookings Institution, the net worth of a typical white family ($171,000) is roughly 10 times greater than for a Black family ($17,150).

Examples of America's Racial Wealth Gap

The nation's racial wealth gap is evident in numerous ways:

- Home ownership is the chief source of wealth for many Americans, but only 43% of Black people own homes, compared with 72% of white people.

- Just 34% of African Americans participate in retirement savings plans, while 60% of whites do, according to the Federal Reserve.

- Only 33% of Black households owned stocks in 2019, while nearly 61% of white households did.

- Less than half of people of color who responded to an Allianz Life survey said they own investments and other accounts that can help with retirement security, including life insurance, Individual Retirement Accounts and annuities.

Laurel Williams, a 64-year-old Queens, N.Y. Realtor and real estate investor, owns her home, but has no pension, no 401(k) and no retirement account of any kind. Her Social Security will be virtually nothing — "probably $500 a month," Williams said.

She wishes she had done a better job planning for retirement and building her own wealth.

"Wisdom is something we acquire as we get older," she said. "If I had only known about things that transpired, I would have done a lot of things differently."

Williams accumulated retirement savings while working for 13 years at the FDIC (the federal agency insuring bank deposits), but after quitting, ended up spending the money.

The Challenges Faced by People of Color

"Statistics show the challenges people of color are experiencing when it comes to wealth," said Rene Nourse, founder of Urban Wealth Management in El Segundo, Calif. and vice-chair of the Association of African American Financial Advisors. "We are using all of our money to maintain life. Some of us don't have extra money to build up worth."

Cecilia Stanton Adams, Allianz's chief diversity and inclusion officer, said: "Everyone is struggling to be ready for retirement. But we do see people of color in particular — there is definitely a gap."

Nourse says Black women are especially hurt by the wealth inequities.

"Many times, we have to put a profession on hold when we start a family," she said. "We're raising kids and tend to be responsible for taking care of our elders. And because of income inequality, we are not making enough money to focus on our future."

How the Pandemic Has Hurt

The pandemic has only made many Black Americans more strapped.

An August 2020 survey from the Prosperity Now research and low-income Americans advocacy nonprofit found that 35% of Black people say their household's financial situation is now worse due to COVID-19.

And the nonprofit Financial Health Network consultancy's August 2020 U.S. Financial Health Pulse survey showed that only 15% of Black adults were financial healthy vs 39% of white adults.

A significant factor in the retirement readiness of many older Black Americans may be a lack of professional advice and knowledge about personal finances.

"Growing up, that's not something we talked about at the kitchen table," said Dawn Kelly, a former executive at Prudential who now owns the Nourish Spot, a Queens, N.Y. health store and juice bar. "I'm not sure my mother or my father had anybody like that. They had a doctor and a lawyer, but not anyone in financial services."

The Paltry Number of Minority Certified Financial Planners

According to the CFP Board, there were only 1,355 Black Certified Financial Planners in 2019, up 8% from 2018. D.A. Abrams, managing director of the CFP Board's Center for Financial Planning, said while Black people and Latino people represent about 30% of the U.S. population, they make up only 3.8% of CFPs.

"We can't build wealth with each generation starting from scratch."

Williams has never sought the advice of a financial planner, something she regrets. "It would be nice to have some type of savings plan," she said. "I have insurance policies. I'm worth more dead than I am alive." And, she added, "Whatever God chooses for me is what he chooses."

Kelly had a 401(k) from her 16 years at Prudential but spent it down for living expenses and her business' start-up expenses after her unexpected, involuntary separation from the company.

"Honestly, my retirement plan is my business," said Kelly.

Ideas to Close the Racial Wealth Gap

What could be done to help close America's racial wealth gap? Experts offer these suggestions:

Financial advisers could encourage Black Americans to invest in the stock market and buy life insurance. Many African American people, they say, don't trust the financial system and aren't willing to risk the assets they have by purchasing stocks, stock mutual funds or exchange-traded funds (ETFs).

Black adults "developed a lack of trust in the system early on, along with us not having financial education in the community," said Eric Bailey, CEO of Bailey Wealth Advisors in Silver Spring, Md.

Nick Abrams, a Black Certified Financial Planner in Baltimore, advised: "Stop buying $25,000 in life insurance, just enough to put you in the ground. Leave some money to your family they can take it and grow it and leave money to following generation. We can't build wealth with each generation starting from scratch."

Find ways to grow minority representation of financial planners and boost financial literacy among Black Americans. It's starting to happen. "We are focusing on increasing the number of African American financial professionals," said Nourse, who is vice chair of the Association of African American Financial Advisors.

But, Nourse adds, "It's not just creating assets to manage, but getting people to make better decisions about what kind of employee benefits they should take advantage of."

Bailey recalls a Black client who was making a six-figure income with an employer who matched up to 11% of her retirement contributions. She was only contributing 2%. "She didn't get it," he said. "She said never thought about it. She was leaving $27,000 on the table. Assuming it earns six percent, you're talking about $400,000 that's not available in retirement age that she could have had."

Pay reparations to Black Americans for slavery and generations of discriminatory policies against African Americans. Darity estimates the cost of reparations would be $10 to $12 trillion.

"At least bring the Black share of wealth in proportion with the Black share of the population," said Darity. The cost would include a $200,000 to $250,000 cash transfer to each eligible participant, probably in the form of trust accounts or endowments, he noted.

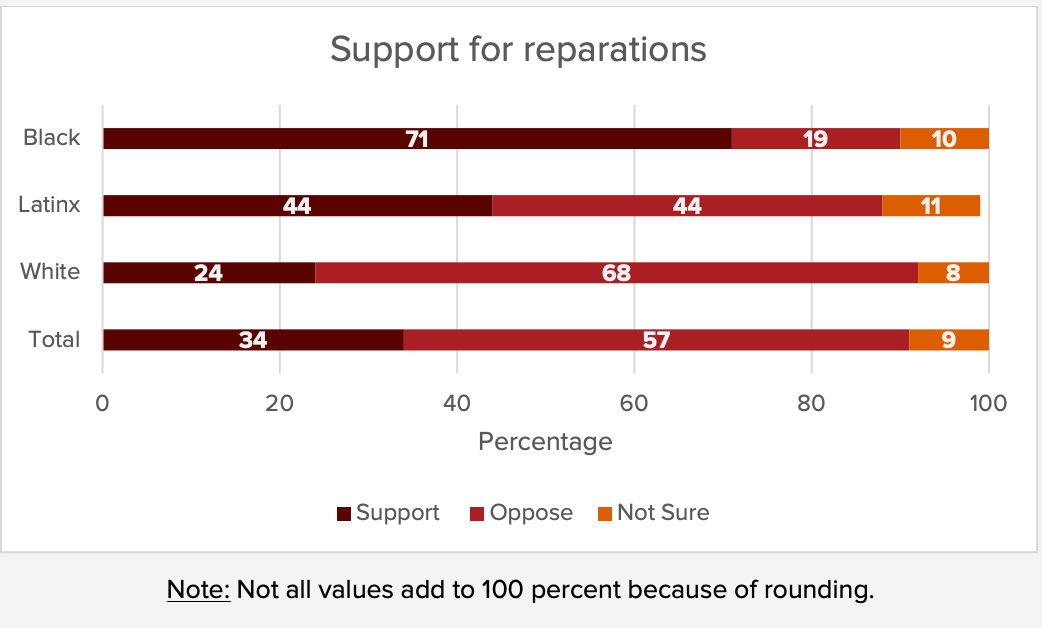

In a recent Prosperity Now survey, 71% of Black respondents supported reparations payments; 24% of white respondents did.

A host of municipalities and states, including California and Asheville, N.C., have approved reparation resolutions, though they don't call for direct payments to African Americans.

The U.S. House of Representatives is also expected to pass a bill to create a commission to study reparations; it has the endorsement of Democratic presidential candidate Joe Biden, but not President Trump or Senate Republicans.

The federal government could create and provide what are known as Baby Bonds. The idea, proposed in a report by Darity and Ohio State University's Darrick Hamilton and similarly by financial adviser Ric Edelman (founder of Edelman Financial Engines and — full disclosure — a Next Avenue sponsor), would be to give every child a savings account at birth. The Darity/Hamilton plan calls for $1,000; Edelman favors $7,500.

An analysis of the Darity/Hamilton baby bonds plan by the Morningstar financial services firm concluded that they'd cut America's racial wealth gap in half.

"Baby bonds would not be a panacea, but they hold promise for addressing the racial wealth gap," Morningstar's Aron Szapiro recently wrote. "We believe policymakers should explore ways to make them a reality."

Sen. Cory Booker (D-N.J.) has sponsored baby bonds legislation modeled after the Darity/Hamilton proposal. The U.S. government would put the $1,000 in an interest-bearing account and then contribute up to $2,000 every year until the child turned 18, but lower-income children would receive the largest payments. The money could only be tapped, starting at 18, for things like a down payment on a home, college tuition or other "wealth-building" activities.

According to Booker's office, by age 18, the poorest children would have about $46,200; children of the wealthiest parents would have roughly $1,700.

In Edelman's plan, the baby bonds funding would come from corporations, pensions and other investors, and the money would go into something like the U.S. Treasury's Series EE bonds.

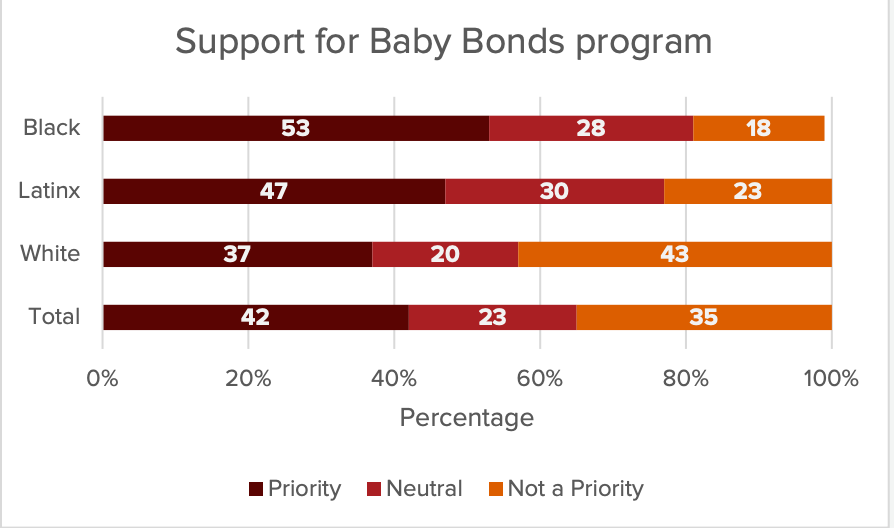

The idea of baby bonds idea is favored by 42% of Americans, according to a Prosperity Now survey — 53% of Black people and 37% of white people.

Some African Americans could change their spending habits. Ted Daniels, the Black founder of the Society for Financial Education & Professional Development, says if African Americans want to close the racial wealth gap, they need to stop spending on personal-use assets that rapidly decrease in value.

"As long as you stay away from wealth-building components, the wealth gap will never close," Daniels said.

He urges African American people to work on building wealth through home ownership and by acquiring financial assets, including employer-sponsored retirement plans and homes.

"There is a fork in the road," Daniels said. "To the right, you can add to consumer spending. Or, go to the left and start creating wealth for yourself and your community."