Is the Swelling in Retirement Confidence Believable?

Why the upbeat views of America's workers and retirees may be suspect

A new landmark study of America’s workers and retirees shows they’re significantly more confident than a year ago in their ability to live comfortably throughout retirement. I wish I could believe them.

But based on actual retirement savings trends, retirement health costs and long-term care expenses, I sadly think many of the workers and retirees are kidding themselves. I hope I’m wrong.

According to the 2019 Retirement Confidence Survey of 2,700 Americans 25 and older from the Employee Benefit Research Institute (EBRI) — the nonpartisan nonprofit’s 29 report:

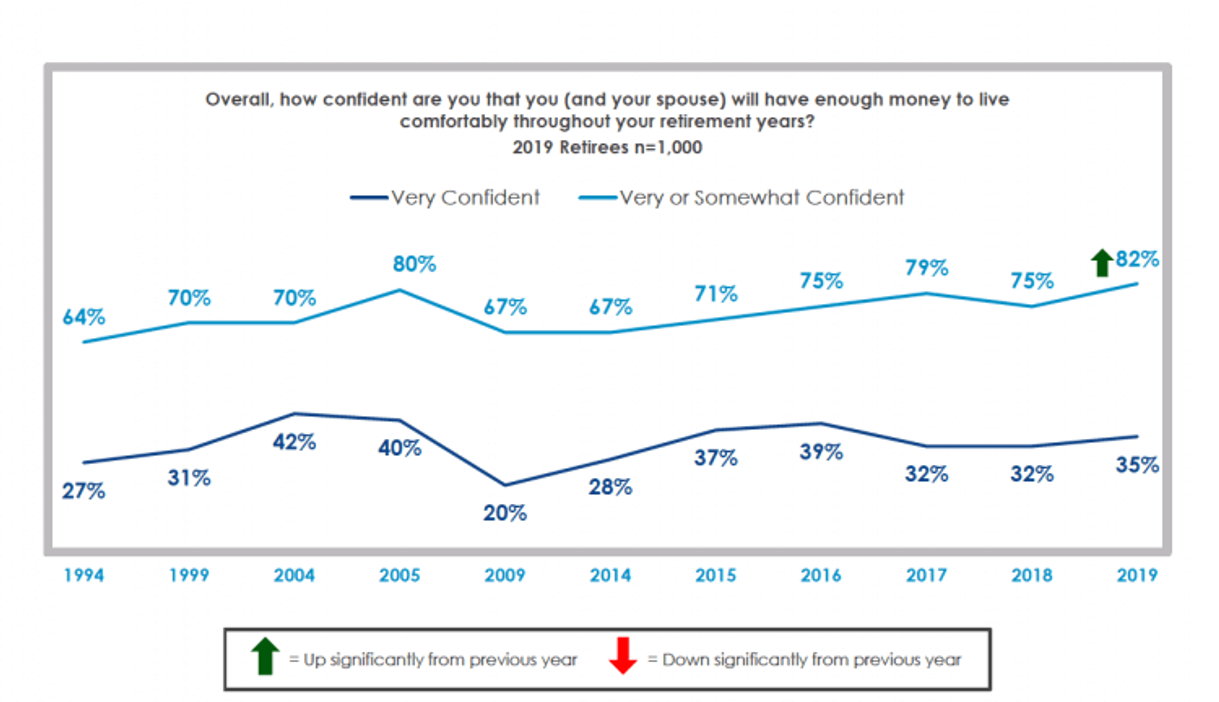

- 82% of retirees are confident they (and their spouse) will have enough money to live comfortably throughout retirement. That’s a sharp rise from 75% a year ago and comparable to the highs in 2005 and 2017.

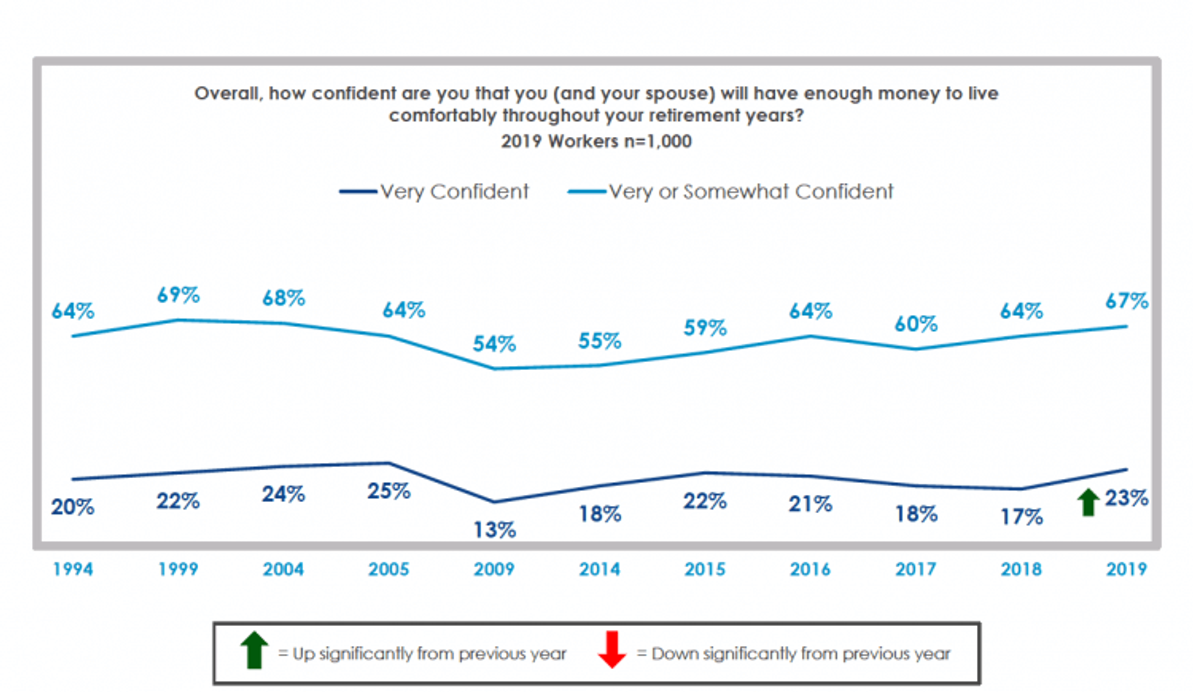

- 67% of workers are confident they (and their spouse) will have enough money to live comfortably throughout retirement, up from 64% a year ago and 60% in 2017. It’s near the peaks of 1999 and 2004.

Skeptical About the Retirement Confidence Numbers

And here’s why I’m dubious:

The EBRI survey also found that 40% of workers said they have less than $25,000 in savings and investments, not counting their home and any traditional pension plans. Another 9% had $25,000 to $49,999 and another 9% had $50,000 to $99,000. That brings us to 58% having under $100,000 saved. (A recent Transamerica survey found that boomers have saved a median of $152,000 and Gen Xers have saved $66,000.)

Similarly, a March 2019 U.S. Government Accountability Office report to Congress found that 48% of U.S. households aged 55 and over have no retirement savings.

And I think retirees and workers are wildly optimistic about their ability to pay for health and long-term care costs in retirement.

In the survey, 80% of retirees said they’re confident they (and their spouse) will have enough money to take care of their medical expenses during retirement; 59% felt the same way about long-term care, such as nursing home or home care. And those percentages are way up from a year ago, too (70% and 51%). A striking 59% of workers said they’re confident in having enough money for medical expenses in retirement and 52% felt that way about long-term care costs.

This despite the recent Fidelity Investments estimate that a healthy couple retiring at 65 this year can expect to spend $285,000 in health care costs in retirement, not including long-term care. And the new Senior Living Cost Index from A Place for Mom, a national senior-living referral service, said it now costs about $47,000 a year to live in an assisted-living facility and about $60,000 annually for a memory-care unit. Those figures will almost certainly increase in coming years.

Surprised About the Big Rise in Retirement Confidence

Craig Copeland, EBRI’s senior research associate, told me he was surprised how confident workers and retirees have become about their retirement finances.

“I was certainly expecting [the retirement confidence] numbers to go up from a year ago, with what’s going on in the economy and the job market. People have been seeing raises and inflation is under control. There are a lot of good things going on,” Copeland said. “But the magnitude is a little larger than I expected.”

Copeland seemed skeptical about whether the strong confidence numbers were warranted. “If you look at what people have saved, they’re not at the numbers people say in the survey that they should be saving at,” he said.

And, he added ominously: “I hope this isn’t a precursor to what we saw just before 2008 with the level of numbers we had back then.” As you no doubt remember, the stock market and housing market came crashing down soon after.

Taking the Temperature of Health Costs

Copeland was also surprised, as I was, about the respondents’ confidence in their ability to pay for health and long-term care costs in retirement. He attributed it to the current low rate of medical inflation. “They think that will continue,” Copeland said. “That may be a false hope, because if people get hit with long-term care expenses, they typically aren’t going to have enough money for them.”

I asked Copeland why workers and retirees have grown more confident about their retirement prospects when the stock market fell about 6% last year. “Middle America people are more likely to have money in bank accounts than in the stock market,” he said. And interest rates rose throughout much of 2018, providing heftier returns.

Considering all of this, it’s important to point out that just 23% of workers say they are “very confident” about having enough money to live comfortably through retirement. That’s also up substantially from last year, though, when 17% said so.

Working in Retirement: Perception vs. Reality

There also seems to be a large disconnect between perception and reality when it comes to working part-time in retirement.

Once again this year, a preponderance of workers (80%) said they think they‘ll work for pay after they retire. Yet only 28% of retirees have actually done so, and that percentage fell from 34% in 2018.

“We’ve seen this gap for a number of years,” said Copeland. “We also see people ending up retiring earlier than they had planned due to illness or disability or a loss of their job. It can be very difficult to get back to work.”

Copeland expects the percentage of retirees working part-time to increase, but doesn’t expect much of a narrowing in the chasm between the percentage planning to work and those actually working.

Investing, Caregiving and Retirement Confidence

Two more intriguing findings from the EBRI study relate to investments and family caregiving.

A sizable majority of workers (74%) and retirees (65%) said income stability was more important to them in retirement than maintaining wealth. Put another way, they favored knowing they’d have a set amount of income for life over preserving the money they had.

However, not many Americans are giving their savings to an insurance company or other financial firm to turn the money into a guaranteed income annuity when they retire. “Pulling the trigger on that really seems to be hard,” Copeland said.

And in a sign of the times, family caregiving has become a stumbling block for saving for retirement.

In the survey, about a quarter of the workers who’ve provided unpaid care to a relative or a friend said the caregiving prevented them from saving or investing for the future or caused them to stop contributing to, or reduce contributions to, a workplace retirement plan. “Only 28% of workers have been caregivers, but for them, it does have a huge impact” on saving for retirement, said Copeland.

The Key to Confidence: A Workplace Retirement Plan

As in previous years, the EBRI survey found that having a workplace retirement plan was a key factor in whether Americans are saving for retirement. Some 79% with a plan have saved for retirement while only 17% without a plan have done so. “And this comes through in the confidence numbers,” said Copeland. While 74% of workers with retirement plans are confident about living comfortably in retirement, just 39% without a plan are.

Legislation moving through Congress might help the ones lacking access to plans — often small business employees and the 27 million Americans who are part-time workers. The SECURE bill would make it easier for both to contribute to workplace retirement plans.

But, Copeland said, “I expect it would be four or five years down the road before that law would let people have enough to accumulate for retirement to see if this shows up in the retirement confidence numbers."