Older Women Flunk Financial Literacy Quiz

Here's why and four ways women can get smarter about money

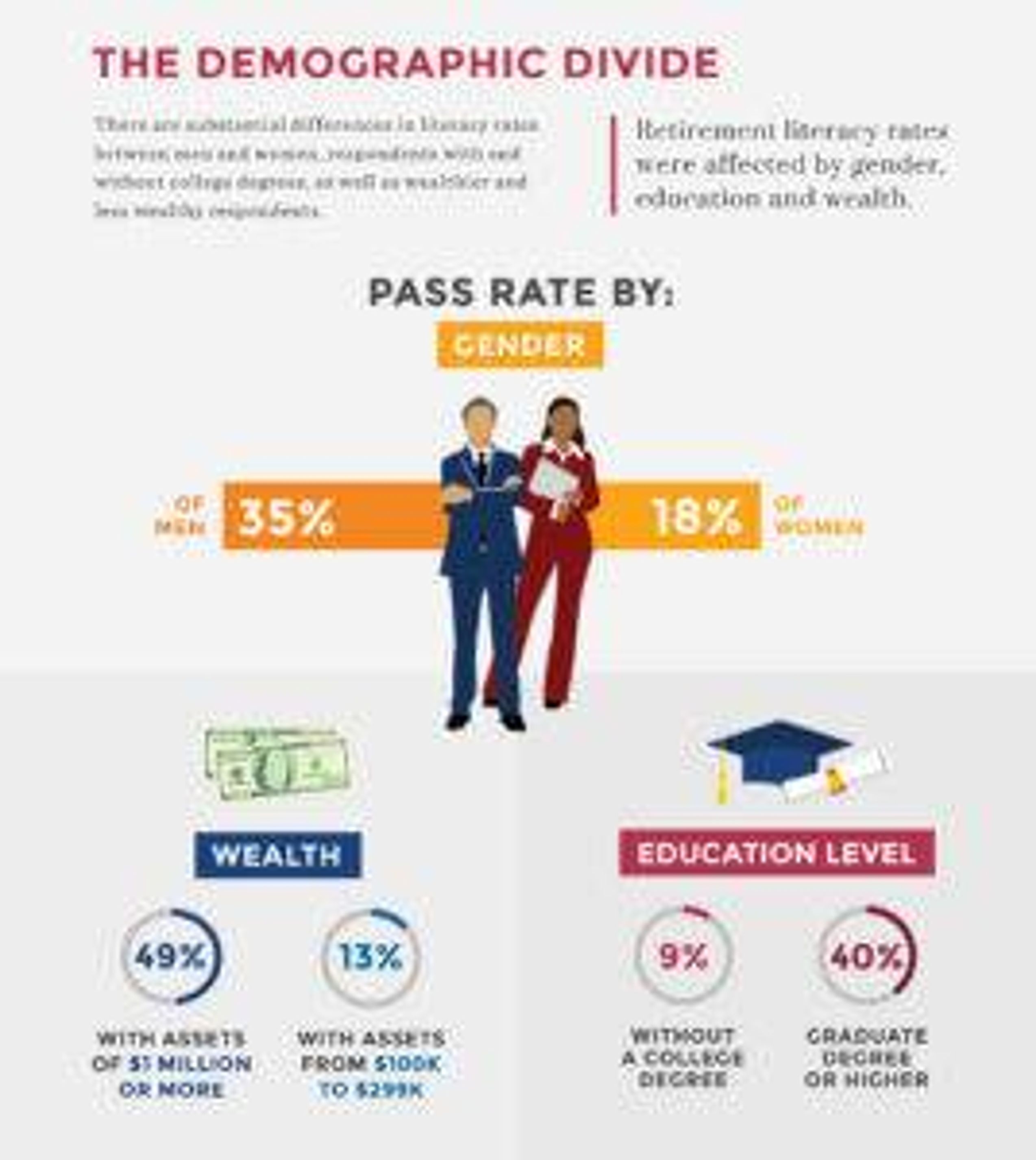

News flash: Retired women and women nearing retirement have a financial literacy problem. In a survey released recently, the 2017 RICP Retirement Income Literacy Gender Differences Report, from The American College of Financial Services, only 18 percent of women age 60 to 75 passed. By contrast, 35 percent of men did (also pretty shabby, if you ask me).

“I would expect a gap,” said Jamie Hopkins, Retirement Income Program co-director at The American College of Financial Services. “But it was actually double. That shocked me.”

The quiz featured a sweep of questions about annuities, company retirement plans, strategies for keeping an income stream in retirement, paying for long-term care expenses and Medicare planning. You can take it yourself here.

Financial Literacy Gaps on Investing, Saving and Retirement Planning

I found particularly significant the yawning gap between women and men when it comes to having a grip on investing, saving and retirement planning.

There was also a striking disconnect among women between their confidence level of their finances and their knowledge about personal finances. Most of the women surveyed (55 percent) said they were extremely confident they would have enough money to live comfortably in retirement. Only a quarter of those women passed the financial literacy quiz, however.

Another disconnect: What married women and men said about who makes the financial decisions in their households. “Most of the women said ‘We share the responsibility,’” Hopkins said. “And almost all of the men who were married said ‘I am the primary decision maker.’” Added Hopkins: “They’re not correctly communicating. That shouldn’t be happening.” Specifically, 80 percent of the married women said that they shared the decision making while only 35 percent of married men said they did.

Women, Men and Financial Advisers

Here’s a head-scratcher from the survey: Women and men who have financial advisers had lower levels of financial literacy than those who don’t use these money pros.

Hopkins’ explanation: “People who go to advisers are the types who want to delegate. They tend to rely on adviser and are not ‘do it yourselfers.’”

Maybe so, but it’s a huge mistake to be in the dark about the basics of personal finance, whether you have an adviser or not.

The Encouraging News About Older Women and Money

Not everything in the survey was discouraging, though, regarding older women and money.

For starters, the women were more likely to identify themselves as cautious or risk-averse investors than the men surveyed. At their age, this is the time to be conservative about your investment choices. “There’s a benefit to the group right around retirement to having some restraint and to be more protected,” said Hopkins.

The women surveyed were also far more concerned about retirement risks than men, especially cuts to Social Security. And they were more worried about the cost of health care in retirement as well as paying for long-term care. My take: Since women are more likely to live longer than men, on average, and to be solo at the end of their lives, they’re smart to be concerned about Social Security cuts, the cost of health care and paying for long-term care.

Also, the women surveyed were less likely than the men to get financial advice and information from friends: only 27 percent of women consulted friends vs. 39 percent of men. “In some respects, it’s good that women don't take advice from friends,” said Jocelyn Wright, State Farm chair in women and financial services and assistant professor of women's studies at The American College of Financial Services. “You don't want to get misinformation and make mistakes.”

To get financial information, the women were just as likely as men to consult an adviser or a financial services firm. And most of the women surveyed understood the value of a financial adviser. In fact, I’d argue that they understood this better than men.

Some 55 percent of women with advisers said it is extremely important that their money pro educate them about the risks of running out of money in retirement; just 42 percent of men felt this way. And 60 percent of women said it’s important to receive education from an adviser about investment management, as opposed to only 47 percent of men.

A willingness to be open to learning about money and retirement income is essential when it comes to long-term financial security.

4 Retirement Planning Tips for Women

Here are four ways older women can ramp up their literacy and be financially fit in retirement:

1. Craft a balanced investing strategy. The years right before, or in, retirement should be your most conservative as an investor, said Hopkins. That said, he added, “If you are a woman and expecting to live to 95, you have to invest in equities” to get enough growth in your retirement portfolio.

When you retire, you might create income for the next three to five years through an annuity or a bond ladder (where bonds mature at different times), so you won't have to worry about where your money will be coming from, Hopkins advised. Stocks or mutual funds that buy them can fund the latter half of your retirement, he added.

A traditional rule of thumb for the percentage of your portfolio to keep in stocks: 100 minus your age. In other words, if you’re 60, you’d have 40 percent in stocks. But given the anticipation for longer lifespans, I suggest fine-tuning that rule slightly to 110 minus your age.

2. Build into your schedule opportunities to learn more about personal finances and investing. “Women are willing to learn together, so make it a group activity,” said Wright. Many employers offer workplace seminars and planning tools; if yours does, take advantage of this.

You might also consider starting a money book club with friends and colleagues to read up on investing and retirement planning. If possible, invite a local financial author or financial journalist to make a presentation.

3. Create a long-term care strategy. For a discussion of the pros and cons of buying a long-term care policy, check out Next Avenue Money & Security Editor Richard Eisenberg’s column: Should I Buy Long-Term Care Insurance?

4. If you’re married or have a partner, have regular money talks with him or her. Yes, these can be nerve-wracking, but do it anyway. “Make sure you are having those open communications, so you know what is going on,” said Wright. “That way, if your husband predeceases you, you can step right in and are fully aware of the financial situation.”

When it comes to long-term financial security, regardless of gender, the best investment advice I can give is this: Knowledge really is the secret sauce.